Symbol supply: Getty Photographs

The dividend forecast is necessary for any investor. It tells us how a lot we will be able to be expecting to obtain within the type of in most cases biannual bills if we acquire stocks within the corporate.

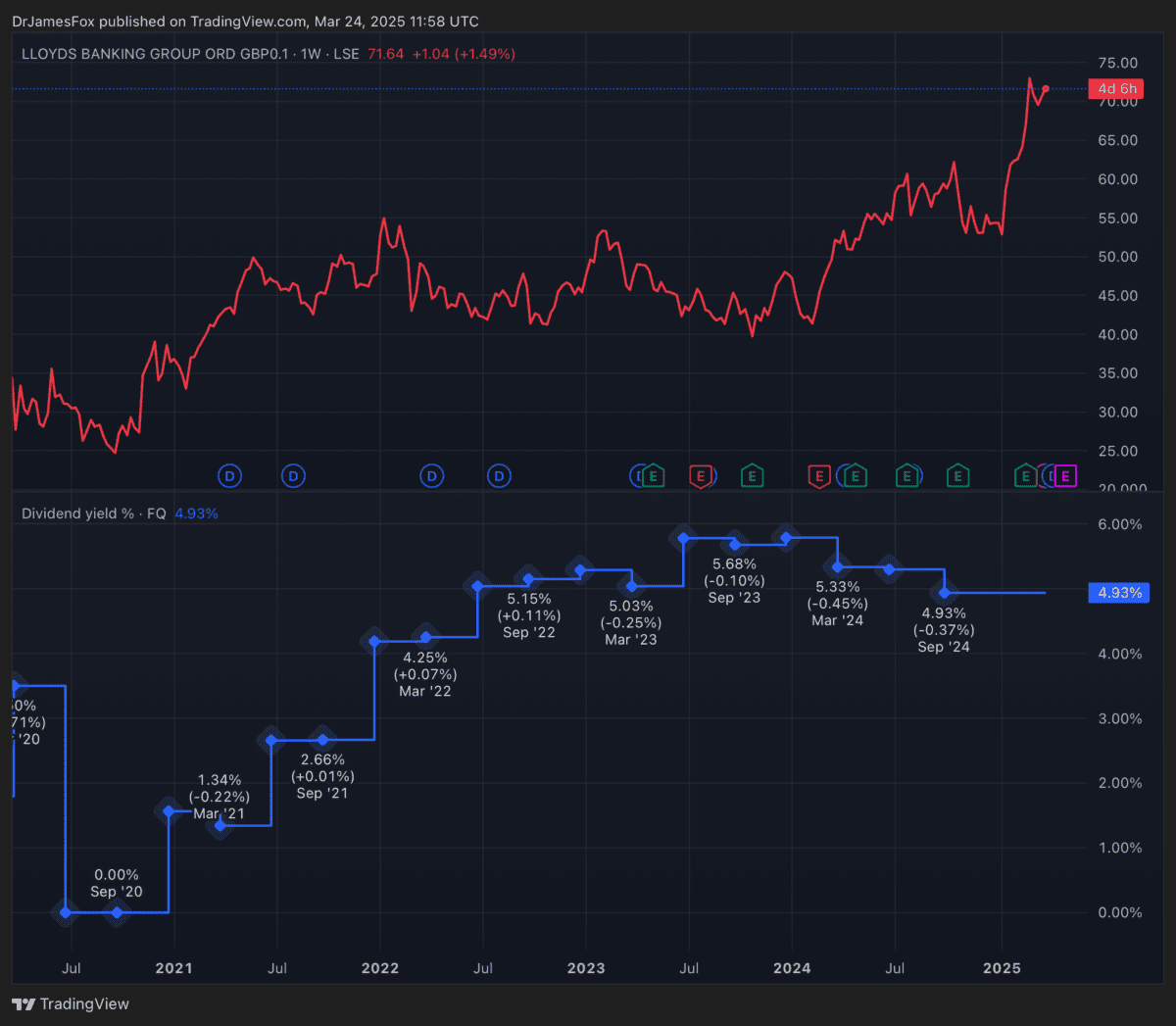

So, as of late I’m taking a look at Lloyds. The inventory has surged over the last one year, and in consequence, the dividend yield has fallen relatively. Taking a look on the ahead yield — the dividend yield an investor may just be expecting to obtain in accordance with forecasts over the following one year — is 4.9%.

That’s rather robust in comparison to the FTSE 100 reasonable, nevertheless it’s if truth be told not up to the 6% yield I gained in my first 12 months after I entered the inventory round 24 months in the past.

The place’s it going subsequent?

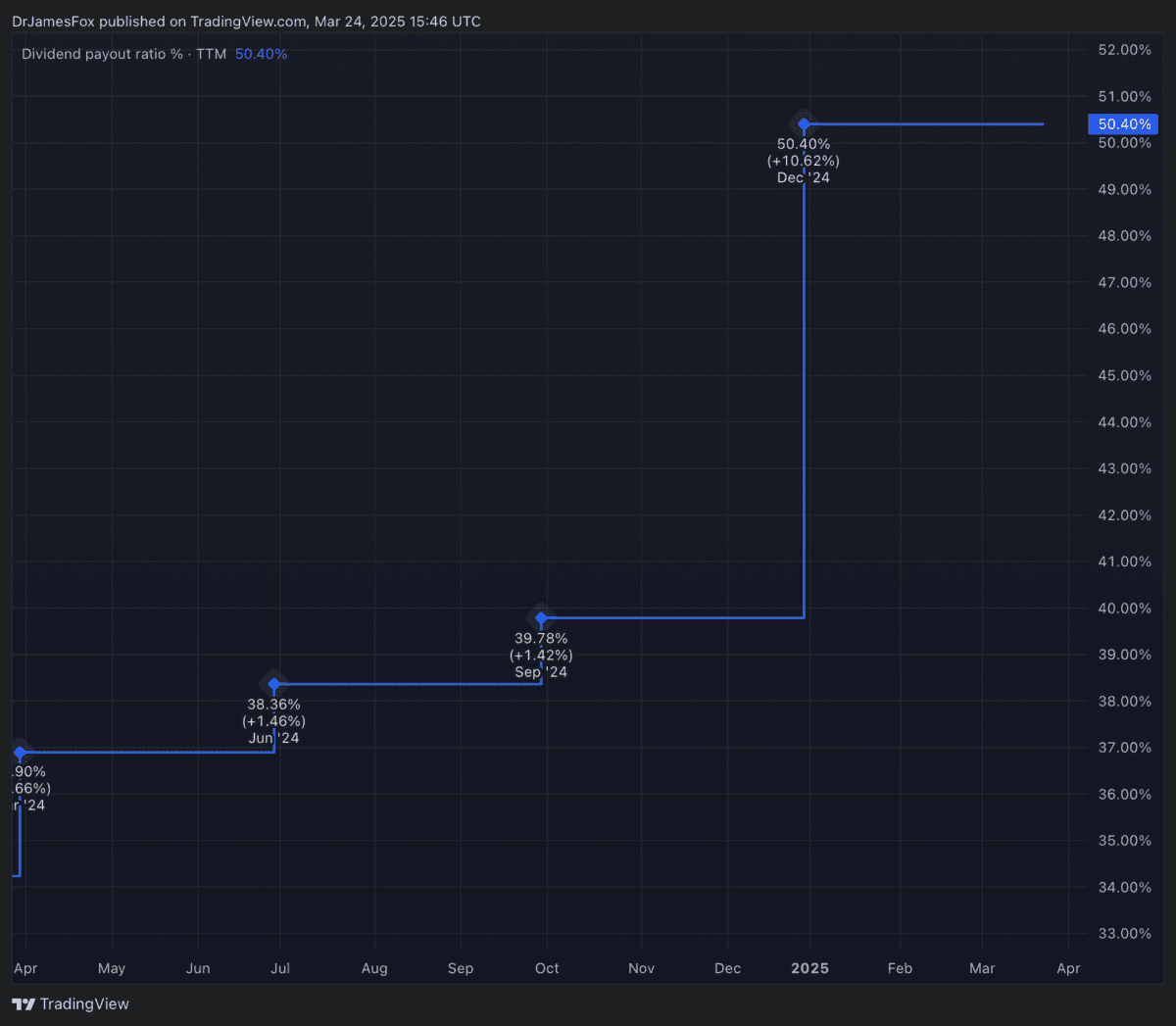

Apparently, the information means that Lloyds is a lot more beneficiant than a few of its friends. It’s making a gift of greater than part of profits to shareholders. The these days protection ratio of 2025 — that is primarily based of profits projections and dividend forecasts — is 1.95. It’s robust, however can be a little more potent.

Fortunately, each profits and dividends are anticipated to support right through the medium time period. In reality, profits are anticipated to leap from round 6.6p consistent with percentage in 2025 to eight.8p in 2026, after which to ten.6p in 2027. This isn’t purely natural, as 2025 will most likely see massive impairments associated with motor finance mis-selling.

Nevertheless, this profits enlargement is just right for dividends and their sustainability. The dividend bills are anticipated to extend from 3.4p in 2025 to 4p in 2026, after which to 4.6p in 2027. This equates to a 5.8% yield for 2026 and a 6.6% yield for 2027 if an investor purchased the inventory as of late.

Rising profits may even see the dividend protection ratio upward thrust to round 2.2 through 2027. That’s a just right signal.

Issues to imagine

Whilst the financial institution’s dividend forecast appears promising, attainable dangers loom. The have an effect on of motor finance mis-selling might be extra vital than expected, with Lloyds already environment apart £1.2bn for repayment. This factor would possibly proceed to impact profitability.

Moreover, the United Kingdom financial system faces enlargement demanding situations underneath the Labour executive, with GDP enlargement forecasts for 2025 starting from 1.2% to at least one.5% — not up to it’s been. Those financial problems may just have an effect on Lloyds’ efficiency, harmful call for for loans and lengthening unhealthy debt. Traders will have to track those traits carefully when comparing Lloyds as a dividend inventory.

A lesson for later

No longer each and every inventory is going up in worth and no longer each and every dividend rises. On the other hand, I, and my fellow Idiot analysts, particularly John Choong, had numerous conviction when Lloyds stocks had been buying and selling round 40p. And with my weighted price round 40p, my ahead dividend yield is round 8% for this 12 months. That jumps to ten% in 2026 and 12% in 2027. Whilst this isn’t a Warren Buffett and Coca Cola tale — his preliminary funding now yields over 50% — it’s a very powerful lesson in making an investment. In my opinion, having already constructed a sizeable place in Lloyds, I’m no longer purchasing extra at this time.