- The survey used to be performed in January on the top of Bitcoin’s all-time prime of $109,000

- 59% of institutional buyers are making plans on allocating over 5% of belongings underneath control to virtual belongings

- An extra 75% mentioned they intend to spend money on some type of tokenization by means of 2026

Institutional buyers stay bullish on crypto with 83% making plans to amplify their crypto publicity in 2025.

The analysis, which polled 352 institutional decision-makers in January, used to be performed by means of Coinbase and EY-Parthenon.

It discovered that “greater than three-quarters of surveyed buyers be expecting to extend their allocations to virtual belongings in 2025, with 59% making plans to allocate over 5% of belongings underneath control to virtual belongings or comparable merchandise.”

The survey, which used to be performed on the top of Bitcoin’s all-time prime of $109,000, discovered that almost 80% of buyers be expecting crypto costs to upward push. Round 70% see crypto as the most important alternative to create horny risk-adjusted returns.

Stablecoins and DeFi

Passion in stablecoins could also be emerging. 84% of establishments are already the usage of or making plans to make use of stablecoins this yr, and 75% indicated that they intend to spend money on some type of tokenization by means of 2026.

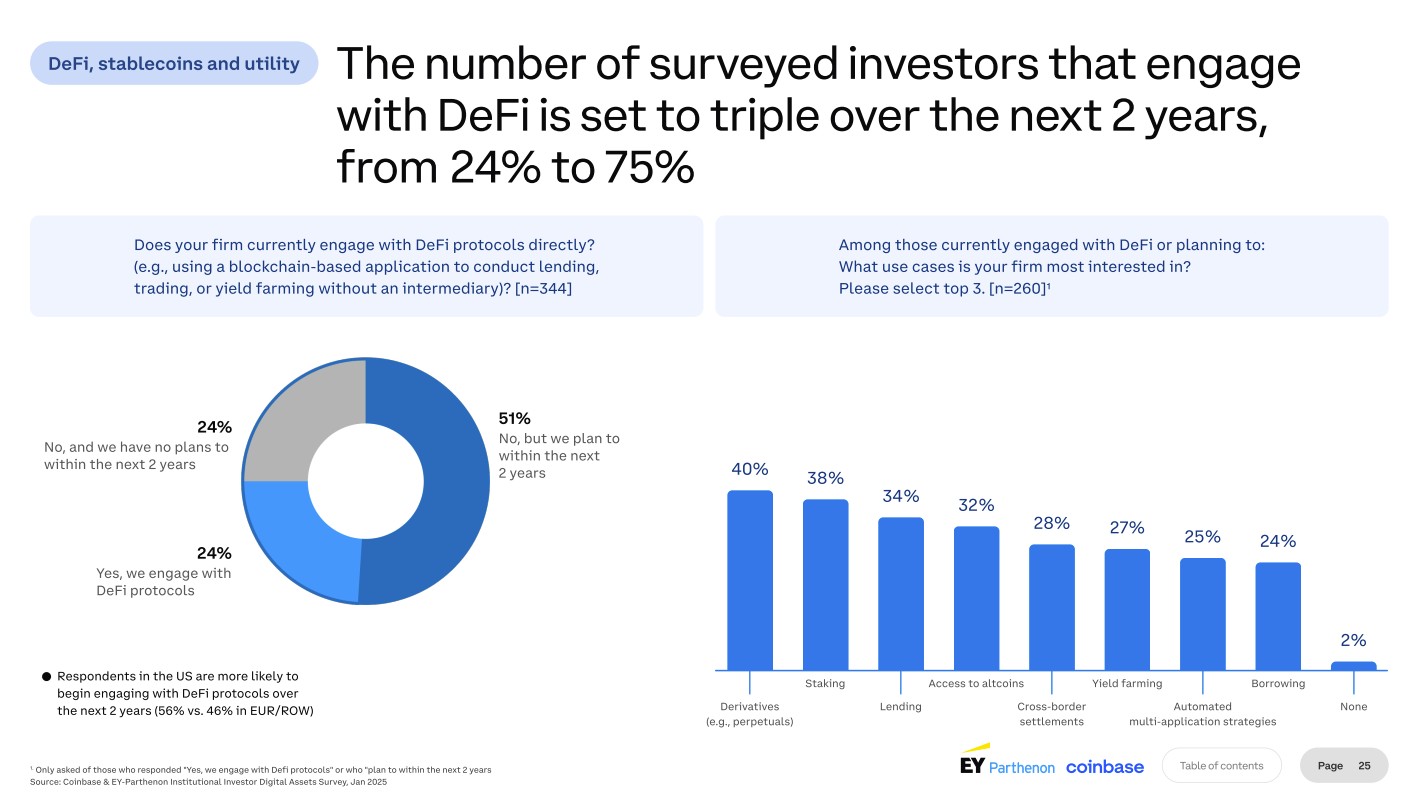

With decentralized finance (DeFi), the choice of buyers anticipated to interact with it’s set to upward push from 24% to 75% over the following two years. But, regardless of the optimism the sphere is projected to revel in, boundaries to DeFi come with regulatory (57%) and compliance (55%) issues, along with a loss of inner wisdom (51%), consistent with the survey.

Amongst the ones recently engaged in DeFi or plan to, derivatives (40%), staking (38%), and lending (34%) are the highest 3 use instances corporations are considering.

Bringing regulatory readability

Institutional buyers see law as the most important alternative and the most important menace for the crypto marketplace in 2025.

In line with the survey, bringing extra regulatory readability round custody, tax remedy, and the usage of stablecoins will have to introduce new marketplace contributors and higher job.

“We think the sure tone and motion from each the brand new US management and regulatory our bodies globally to boost up an already increasing hobby in virtual belongings,” the survey’s researchers mentioned.

For the reason that survey used to be performed, crypto costs have declined. On the time of publishing, Bitcoin is buying and selling round $83,000. Previous this month, Bitcoin fell to $76,000 after US President Donald Trump did not rule out a conceivable recession.

The put up Coinbase survey: 83% of institutional buyers are making plans to amplify crypto publicity in 2025 gave the impression first on CoinJournal.