Symbol supply: Getty Photographs

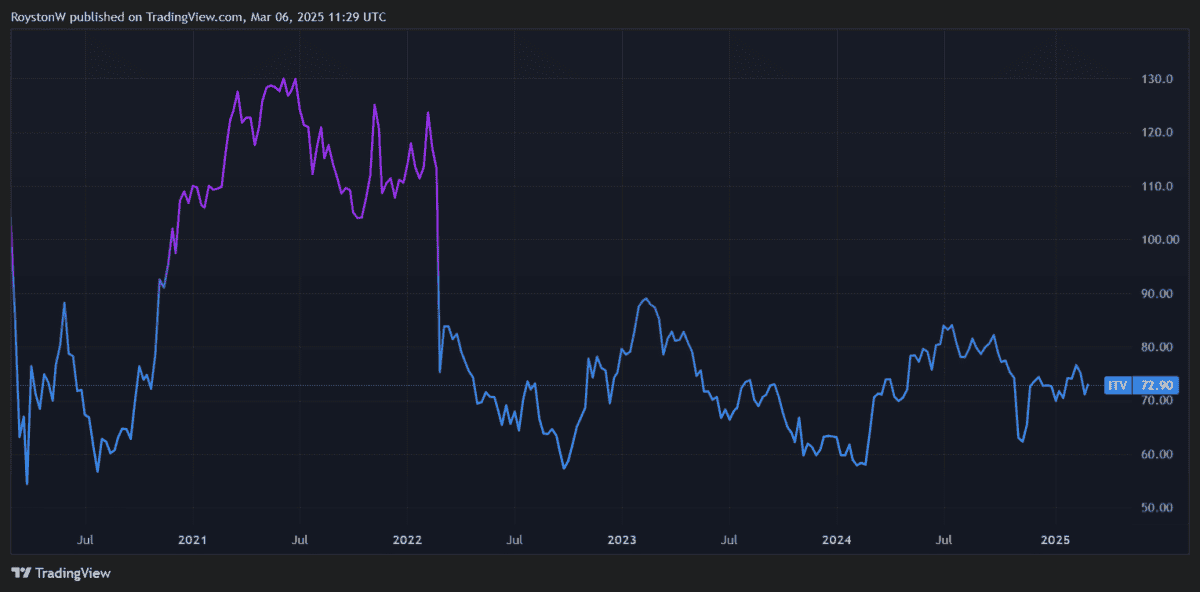

ITV (LSE:ITV) stocks are emerging strongly once more following a bumpy few months. Issues on the broadcaster’s manufacturing department, combined with issues over the well being of the United Kingdom financial system and path of rates of interest, weighed on investor sentiment past due ultimate yr.

But it surely’s at the entrance foot once more Thursday (6 March) after a cast set of buying and selling numbers for 2024. Those confirmed adjusted pre-tax income up 19%, at £472m.

At 72.90p according to proportion, ITV’s proportion charge used to be ultimate round 5% upper at the day. And if dealer forecasts end up right kind, it’s going to proceed to upward push all through the following one year. However how sensible are the Town’s estimates?

Any other 17% upward push?

As with all proportion, a variety of reviews exist the place ITV’s proportion charge is heading. One specifically bleak forecast has the industrial broadcaster slumping 18% from present ranges, to 60p according to proportion. On the different finish of the dimensions, probably the most bullish estimate has the FTSE 250 corporate jumping 58% to 115p.

General, Town analysts are overwhelmingly sure on ITV stocks for the following yr. The typical charge goal amongst 8 agents with rankings at the inventory is 85.57p according to proportion, marking a 17% top class to nowadays’s charge.

Nonetheless affordable

What suggests vital charge upward push doable from present ranges? When blended with predicted dividends, a lump sum funding nowadays may just yield an important overall investor go back. Town analysts expect a 5.1p according to proportion money praise in 2025, leading to an enormous 6.9% dividend yield.

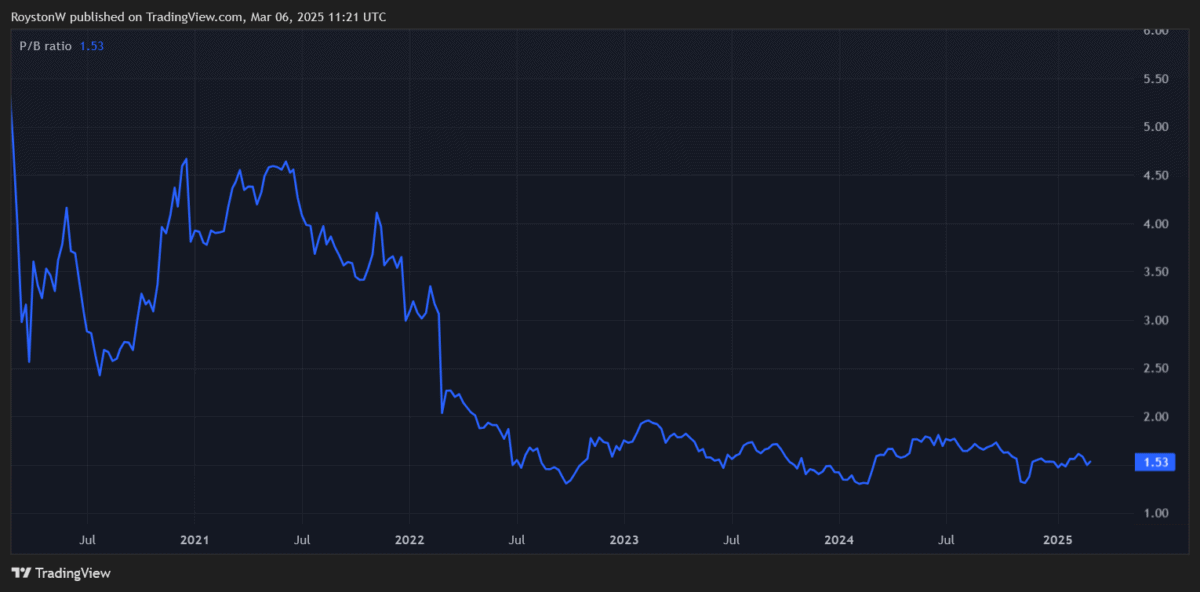

Encouragingly, ITV stocks proceed to industry at a tight cut price to their long-term moderate. This theoretically supplies added scope for the broadcaster to upward push in worth.

Town analysts suppose annual income will building up 4% in 2025, to eight.99p according to proportion. This leaves the company with a price-to-earnings (P/E) ratio of 8.1 instances, a way underneath the 10-year moderate of 9.9 instances.

ITV’s price-to-book (P/B) ratio of one.5 in the meantime, could also be smartly underneath the long-term moderate (because the chart presentations).

With its ahead dividend yield additionally above the 5.5% moderate for the previous decade, I believe the industry may just proceed attracting passion from worth hunters.

Quietly assured?

But an additional upward push in ITV stocks is certainly not a accomplished deal. Promoting revenues may just fall apart once more if financial prerequisites irritate. Tighter advertising and marketing restrictions on unhealthier meals from October might also hit advert gross sales laborious.

Intense pageant from different broadcasters, to not point out US streaming giants like Netflix and Amazon‘s High provider, may just additionally weigh on efficiency.

However at the complete, I’m positive that ITV’s proportion charge may just proceed emerging. With call for for content material often emerging, and inventive moves in the USA over, I consider ITV Studios can stay shining (income right here reached document highs in 2024).

I’m additionally inspired through the breakneck momentum of ITVX. It’s been Britain’s quickest rising streaming platform all through the previous two years and drove ITV’s virtual advert revenues 15% upper ultimate yr.

In spite of everything, the company’s cost-cutting programme additionally continues to surpass expectancies. It delivered £60m of financial savings in 2024, beating estimates through a groovy £10m. I believe ITV stocks are price critical attention nowadays.