The Bitcoin (BTC) marketplace has been extremely risky within the final week and below a powerful bearish affect. On this length, Bitcoin has crashed by way of over 15% falling as little as $80,000. Apparently, blockchain analytics company Glassnode has supplied an in-depth research of traders’ habits amidst this worth decline highlighting the cohort with the biggest discovered losses.

BTC 1-Day To at least one-Week Holders Lead Marketplace Liquidation Drive

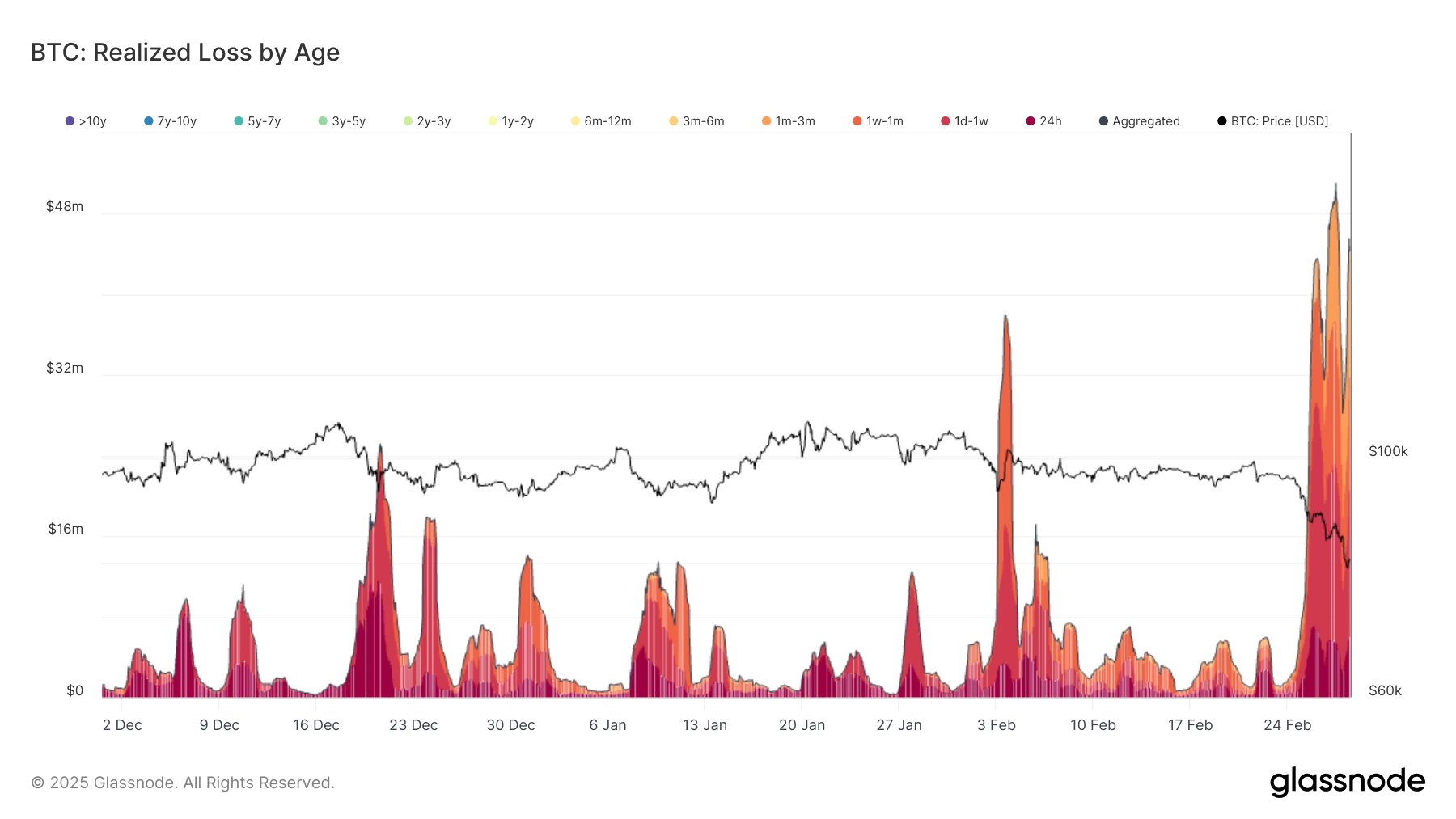

On Friday, February 28, Bitcoin dipped under $80,000 attaining a value stage final observed in November 2024. In reaction, the BTC marketplace recorded $685 million in discovered losses along with the preliminary $2.16 billion between February 25-27. In a up to date X put up, Glassnode analysts dived into the marketplace sell-off on Friday, indicating that this fresh capitulation is basically concentrated amongst momentary holders (STH) who’re understanding losses at a miles upper charge than long-term holders.

From Glassnode’s file, probably the most affected cohort of STH has been new marketplace entrants during the last week as indicated within the following information: 1-day to 1-week holders with $238.8 million in losses,1-week to 1-month holders ($187.6 million), 1-month to 3-month holders ($132.4 million) and 24-hour patrons ($104.9 million). Alternatively, it’s price noting that holders from the previous 3-6 months additionally skilled a vital spike in discovered losses. This crew recorded $ 12.7 million in discovered losses on Friday, representing a 95.4% acquire from the day prior to this.

Having a look additional, Glassnode’s file additionally discovered the associated fee dip on Friday additionally driven the Bitcoin loss realization moderate charge to $57.1 million consistent with hour. The conclusion pace consistent with cohort of the STH – who account for almost all of the marketplace losses is as follows: 1-day to 1-week holders with $19.9 million/hour, 1-week to 1-month holders ($13.9 million/hour), 1-month to 3-month holders ($14.2 million/hour) and 24-hour patrons ($8.04 million/hour).

As anticipated, the 1-day to 1-week cohort is the dominant drive in using liquidity drive with a loss realization charge nearly double the following biggest crew.

Bitcoin Lengthy-Time period Holders Keep Resolute

In step with extra information from Glassnode’s file, Bitcoin long-term holders from the final 6-Three hundred and sixty five days have proven minimum, negligible loss realization in spite of a in style marketplace capitulation.

This building signifies that the longer-term traders are in large part unbothered by way of the new sell-off and value correction with sturdy self assurance for a marketplace rebound. At press time, Bitcoin trades at $85,200 following some worth restoration on Friday. Alternatively, its weekly losses stay at 11.34% indicating the present bearish transfer available in the market.

Featured symbol from Getty Photographs, chart from Tradingview