Symbol supply: Getty Pictures

Out of interest, I really like to test in at the best buys over at AJ Bell and Hargreaves Lansdown. Frequently their lists are made up of the standard UK inventory suspects like Rolls-Royce, or Large Tech names equivalent to Nvidia, Tesla, and Palantir.

Alternatively, you do get the strange exception. One who stood out just lately was once Hims & Hers Well being (NYSE: HIMS). On 24 February, this was once the 6th most-bought proportion amongst AJ Bell shoppers.

Now, I think for a few of these invested as a result of Hims and Hers inventory plummeted 26% the day prior to this (25 February)! But in spite of this drop, it’s nonetheless up 270% previously 12 months.

Right here, I need to dig into this this under-the-radar US inventory to look if it’s value me purchasing.

Virtual healthcare

Hims and Hers is an internet healthcare corporate. It provides prescription medicines, over the counter wellness merchandise, and digital consultations for stipulations equivalent to hair loss, psychological well being, and skin care.

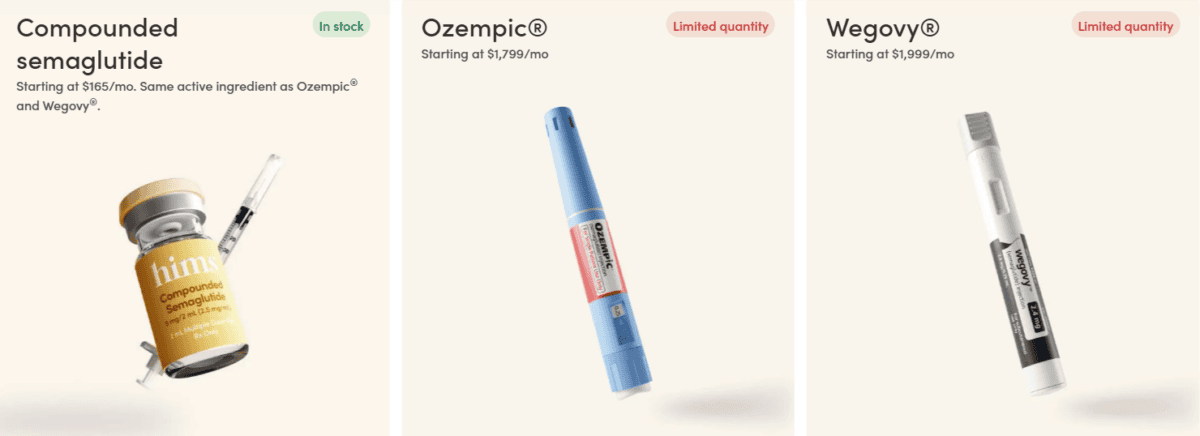

Alternatively, it’s been compounded semaglutide merchandise that experience put rocket boosters beneath the percentage payment. Semaglutide’s the lively factor in Novo Nordisk’s blockbuster GLP-1 medicines Ozempic and Wegovy. Compounded medicine are customized possible choices to branded variations.

In Might, the corporate was once allowed to start out prescribing those copycat weight-loss merchandise as a result of there was once a GLP-1 drug scarcity because of huge call for. It’s been providing compounded variations of semaglutide at costs beginning round $165 a month. In contrast, the listing costs for Ozempic and Wegovy with out insurance coverage are manner upper.

Unsurprisingly, this has pushed massive expansion on the virtual well being company. Alternatively, regulators introduced closing week that the lack in semaglutide injection merchandise is over. In consequence, compounding pharmacies like Hims and Hers must forestall promoting them in the following couple of weeks.

Nonetheless robust expansion

On 24 February, the corporate posted its This fall effects. Income surged 95% 12 months on 12 months to $481m, whilst profits in keeping with proportion skyrocketed to 11 cents from 1 cent. Alternatively, gross margin fell from 83% to 77% because of the upper prices and GLP-1 merchandise that have been “strategically priced to draw new shoppers“.

Co-founder and CEO Andrew Dudum stated: “We proceed to construct a platform that leverages personalisation and era in contrast to any conventional healthcare device. Over 2 million subscribers now entrust Hims & Hers to assist them of their adventure to raised well being.”

The underlying platform’s rising properly. With the exception of GLP-1 medicine, full-year earnings higher 43% to over $1.2bn. This noticed the company succeed in its earlier 2025 earnings goal a 12 months early!

In the meantime, the corporate’s pursuing vertical integration. To this finish, it just lately bought a peptide facility in California and blood-testing industry Trybe Labs. This latter acquisition permits it to provide at-home blood trying out services and products, offering shoppers with insights into more than a few well being markers.

Price observing

For 2025, control expects earnings of $2.3bn-$2.4bn (more or less 60% year-on-year expansion) and altered EBITDA of $270m-$320m. That places the inventory on a cheap price-to-sales (P/S) more than one of about 3.5.

However, the worry this is that profits expansion will drop sharply as soon as compounded semaglutide merchandise disappear. There’s additionally numerous pageant within the virtual healthcare area.

I feel it could be too dangerous to take a look at and catch this falling knife presently. However this can be a very attention-grabbing $8bn expansion corporate. So I’ve put the inventory on my watchlist.