- The Bollinger Bands indicator on Chainlink (LINK) is contracting predicting a significant volatility section might be drawing close.

- Top correlation with Bitcoin suggests LINK may just decline additional ahead of a bullish transfer.

- Chainlink has witnessed a robust enlargement in spite of value drop with 22 new integrations.

Chainlink (LINK) has been a point of interest for buyers and analysts alike since its surprising drop in the beginning of February.

Since February 3, LINK has been oscillating between $17 and $22 with signs signaling a conceivable breakout amid weeks of consolidation.

Bollinger Bands squeeze signaling a conceivable breakout

Probably the most telling indicators of an forthcoming value shift for Chainlink has been the squeeze in its Bollinger Bands at the 12-hour chart.

The Bollinger Bands technical indicator, which measures volatility, has tightened considerably round LINK’s value, a development that traditionally precedes primary marketplace actions.

As famous through distinguished analyst Ali Martinez, this squeeze may just imply that LINK is at the cusp of both a pointy rally or an important drop, relying available on the market’s subsequent transfer.

The Bollinger Bands are squeezing at the #Chainlink $LINK 12-hour chart, signaling {that a} high-volatility transfer might be drawing close! %.twitter.com/nP4yjvAnyK

— Ali (@ali_charts) February 17, 2025

A surge in Chainlink (LINK) buying and selling process

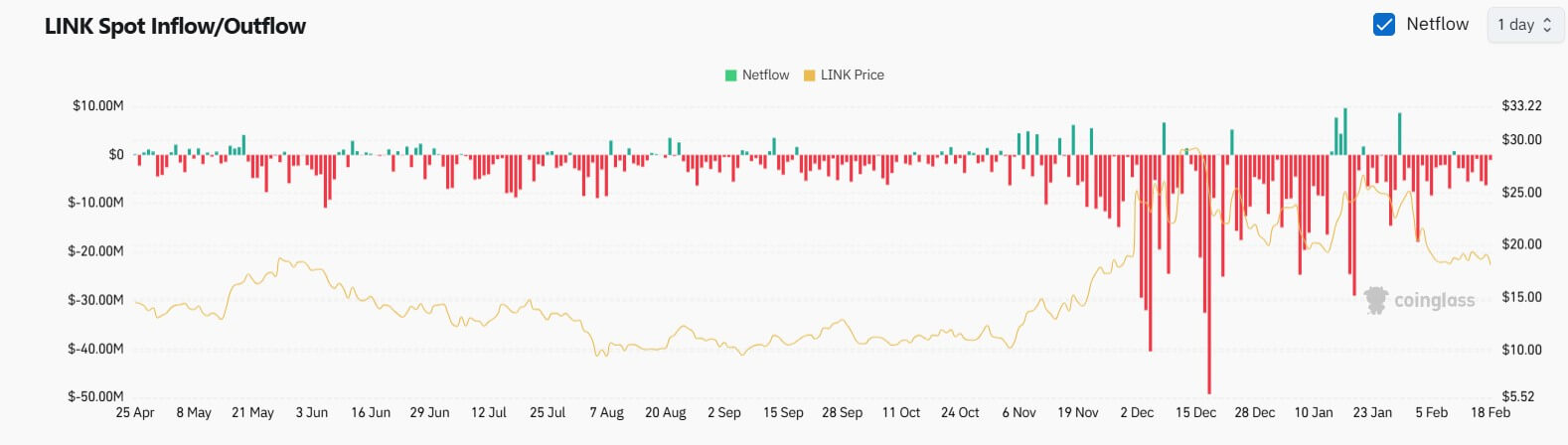

The marketplace has additionally witnessed a surge in LINK buying and selling process, with spot inflows and outflows appearing lively engagement from each bullish and bearish buyers.

Information from Coinglass finds fluctuations in LINK’s internet inflows and outflows, pointing to an building up in marketplace process.

This lively buying and selling, coupled with the Bollinger Bands squeeze, means that buyers are positioning themselves for what they imagine is usually a important marketplace shift.

Whilst there’s a surge in marketplace process, on-chain metrics from Santiment point out a 78% drop in whale transactions since November, with those massive holders controlling 67% of LINK’s provide. This aid in process through important gamers suggests a cooling off of shopping for power, which might exacerbate the downward value motion within the quick time period.

Alternatively, with 59% of holders nonetheless in benefit, there’s underlying self assurance in LINK’s basics.

Chainlink’s correlation with Bitcoin

Apparently, Chainlink maintains a nil.97 correlation with Bitcoin’s value actions, in step with IntoTheBlock’s research.

Given Bitcoin’s present trajectory, which hints at an additional correction in opposition to the $92k reinforce degree, LINK is predicted to practice go well with, probably experiencing every other 30% decline ahead of any rally in opposition to its all-time excessive.

This correlation underscores the interconnectedness of the crypto marketplace, the place primary property like Bitcoin can considerably affect the efficiency of others like LINK.

Chainlink community enlargement in spite of value drop

In spite of the associated fee correction section, the Chainlink community has observed really extensive enlargement with 22 new integrations throughout more than a few blockchains like Arbitrum and Base. This growth solidifies Chainlink’s position as a pacesetter in offering real-world asset tokenization via its dependable oracle products and services.

The dedication to interoperability and sensible use instances via merchandise like Information Feeds and Pass-Chain Interoperability Protocol (CCIP) suggests a strong basis for long run enlargement.

As well as, the re-election of Donald Trump, dubbed the primary pro-crypto president, may just in the end push Chainlink (LINK) again on a bullish pattern particularly with its persevered community growth.