Symbol supply: Getty Photographs

The ISA is a wonderful car for development wealth after which producing a tax-free passive source of revenue. And that is one thing I plan to make use of to the fullest extent.

However the usage of an ISA to generate £10,000 monthly or £120,000 a 12 months sounds arduous, proper? Within the present marketplace — for the reason that a mean 5% dividend yield could be very achievable — this passive source of revenue goal may well be reached with £2.4m invested in shares and stocks.

That’s some huge cash. However it’ll marvel many traders to understand that it’s additionally achievable. If truth be told, with 4,850 ISA millionaires in the United Kingdom in 2023, 1000’s of Britons may just already be producing the kind of passive source of revenue we’re speaking about.

Please be aware that tax remedy will depend on the person cases of every shopper and could also be matter to switch in long term. The content material on this article is equipped for info functions most effective. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for wearing out their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Inventory markets beat financial savings accounts time after time

Inventory markets have persistently outperformed financial savings accounts over the longer term, with a number of main indexes demonstrating this development. The S&P 500, a benchmark for america inventory marketplace, has delivered a mean annual go back of 10.13% since 1957. Even if adjusted for inflation, the actual go back stays spectacular at 6.37%. This important distinction in returns may end up in considerable wealth accumulation through the years.

Even supposing the FTSE 100 hasn’t carried out that smartly over the last decade, long-term general returns are relatively encouraging. Within the twenty years from 2003 to 2023, FTSE 100 general shareholder returns got here in at 241%, whilst the FTSE 250 has outperformed that — nearly 600%.

Briefly, even if making an investment in somewhat unexciting index-tracking budget, shares and stocks hugely outperform financial savings over the long term (even if financial savings accounts are more secure). And whilst previous efficiency is not any ensure of long term luck, the monitor file of inventory markets in advanced economies — particularly america and UK — could be very sturdy.

How the mathematics provides up

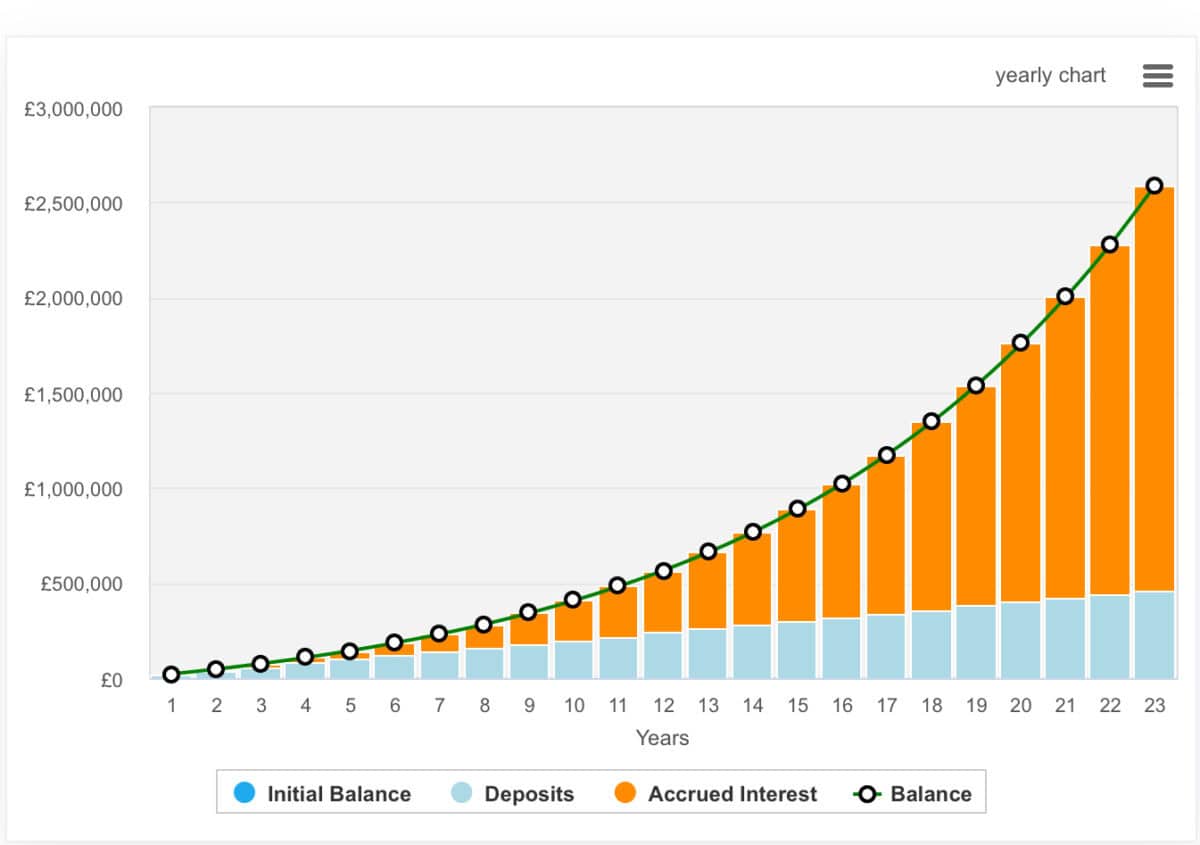

There are more than a few tactics to make the mathematics paintings and hit £2.4m. A method, as proven beneath, can be to max out the ISA contribution — £20,000 in line with 12 months — for 23 years, and moderate 12% annualised returns. Some other folks might say 12% is bold they usually’re proper. But it surely’s nonetheless a long way beneath the Nasdaq’s general returns for the decade — round 20%.

One inventory for the expansion section

Buyers might wish to take a look at a few of my favorite shares, together with Celestica, Credo, and DXP Undertaking. Alternatively, amateur traders might like to imagine budget or trusts like Scottish Loan Funding Believe (LSE:SMT) for simple diversification.

The FTSE 100-listed funding believe most often invests in growth-oriented firms with Elon Musk’s SpaceX now representing the biggest keeping at 7.5%. That is adopted through Amazon and MercadoLibre, amongst different giant tech firms.

What’s extra, the Baillie Gifford-managed fund has a name for choosing those tech winners earlier than they change into family names. It’s a super monitor file and it’s one who has noticed them ship roughly 333% proportion worth development over the last decade.

Issues to fret about? Neatly, a few of its largest holdings are Magnificent Seven shares, which might underperform the marketplace this 12 months and past following terrific development in earlier years. That might, alternatively, be mitigated through more potent appearing mid-caps decrease down within the portfolio. It’s a inventory I hang, and I latterly purchased extra for my daughter’s SIPP.