Symbol supply: Getty Photographs

In comparison to in a foreign country equities, the returns on UK stocks have widely underwhelmed over the last decade. A mix of low financial enlargement and excessive political turbulence have restricted proportion charge positive aspects as traders have prioritised purchasing international shares.

But there were some impressive performances from specific British stocks over this time. Take those two FTSE 100 blue-chips, as an example:

| Inventory | Reasonable annual go back since 2014 |

|---|---|

| JD Sports activities (LSE:JD.) | 17.5% |

| Scottish Loan Funding Agree with (LSE:SMT) | 14.9% |

To place their powerful performances into context, the once a year returns of FTSE 100 and S&P 500 over the similar time-frame sit down long ago, at 6.1% and 12.7%, respectively.

I’m positive that they are going to proceed to outperform those heavyweight indexes for the following decade too. Right here’s why.

Tech accept as true with

Surging call for for tech shares has underpinned the S&P‘s robust positive aspects of the previous decade. So it’s no longer tricky to look why Scottish Loan Funding Agree with — which supplies centered publicity to on-line shops, tool builders and the like — has delivered awesome returns.

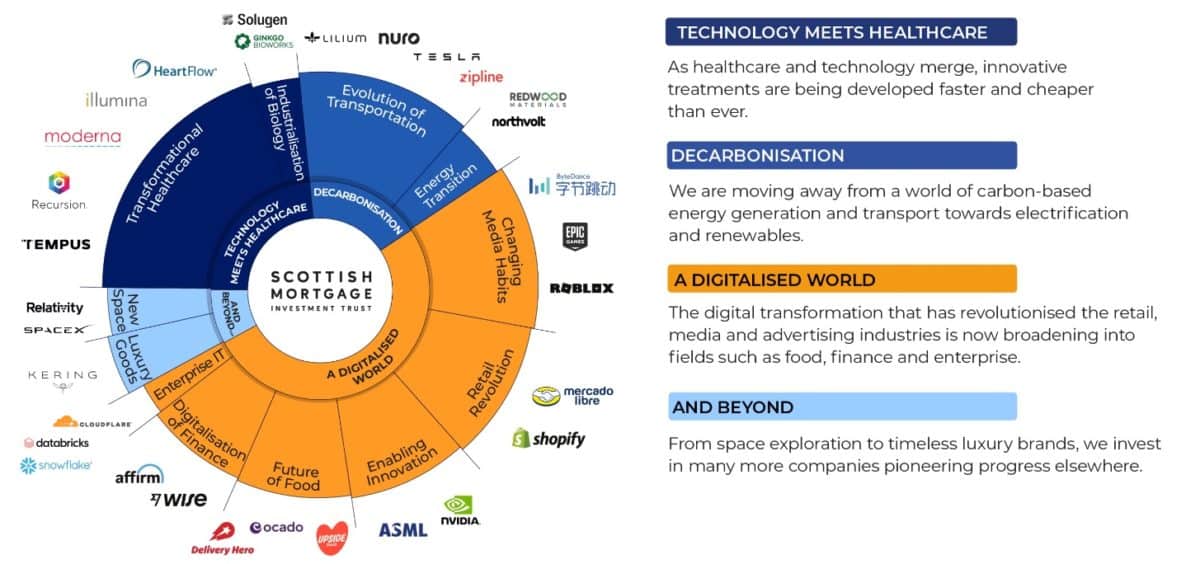

Holdings like Amazon, Tesla and Apple imply the accept as true with has capitalised on sizzling tendencies like e-commerce enlargement, electrical car (EV) adoption and hovering smartphone gross sales. Lately it has stakes in 95 other firms, giving it publicity to a mess of white-hot enlargement sectors for the following decade.

All this being stated, the hazards of proudly owning Scottish Loan are rising. I’m frightened that an escalating tech industry conflict between america and China may just hose down annual returns over the following 10 years.

In December, america slapped recent restrictions on complex microchip shipments to China. Inside of days, Beijing stated it used to be investigating Nvidia at the grounds of breaking native anti-monopoly regulations.

Those tit-for-tat movements may just accentuate additional as soon as tariff fan and China critic Donald Trump returns to the White Space this month. However regardless of this, there’s an excellent chance in my view that Scottish Loan will ship any other decade of market-beating returns.

International digitalisation is poised to proceed at speedy tempo, offering the accept as true with with terrific benefit possible. Fields like synthetic intelligence (AI) and robotics particularly have vital scope for enlargement.

Sports activities big name

JD Sports activities had a deficient 2024 as inflationary pressures and better rates of interest squeezed client spending. Those stay risks around the sports wear store’s US, UK and Eu markets within the New 12 months and doubtlessly past.

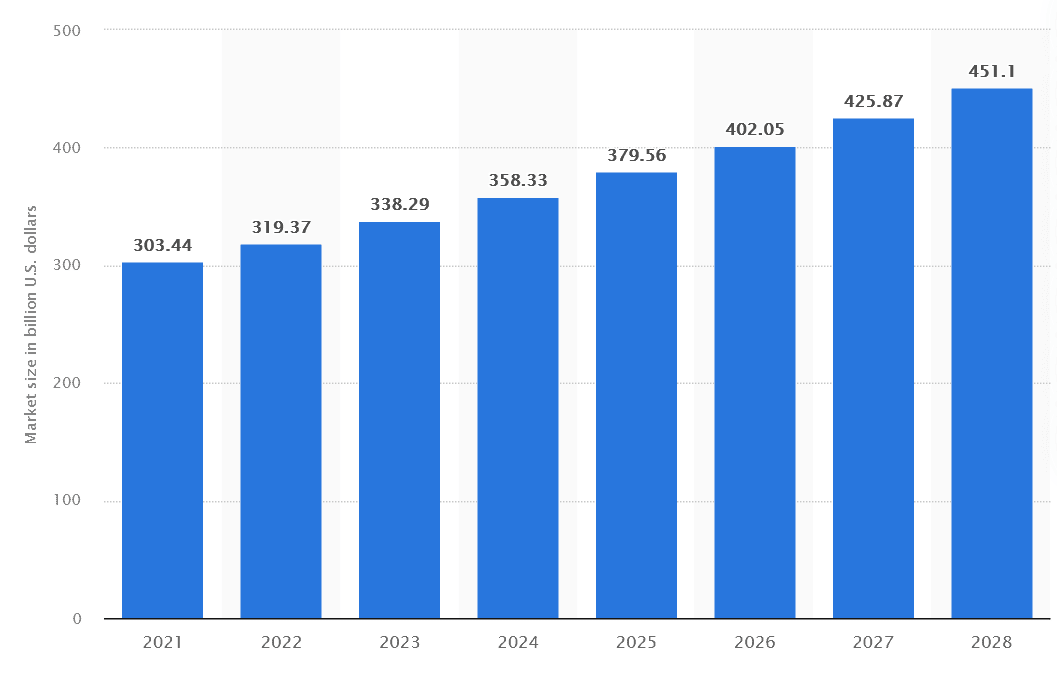

However as with Scottish Loan, I feel the prospective long-term rewards right here make it worthy of attention. The worldwide activewear (or athleisure) marketplace is tipped to proceed setting out, because the chart from Statista beneath presentations.

As we noticed all the way through the decade, JD must be in excellent form to capitalise in this alternative. Beneath its long-running enlargement scheme, it plans to open between 250 and 350 shops each and every 12 months via to round 2028.

A robust steadiness sheet additionally provides the Footsie company scope to make extra earnings-boosting acquisitions. Its most up-to-date acquisition used to be France’s Courir, whose of completion in December boosts JD’s presence in Europe’s greatest sneaker marketplace.

I additionally like JD’s main place within the top rate athleisure marketplace the place enlargement is particularly robust. Given its low price-to-earnings (P/E) ratio of seven.5 instances, I feel it has vital room for a proportion charge restoration.