Symbol supply: Rolls-Royce plc

The most productive-performing percentage of the entire FTSE 100 index closing yr was once aeronautical engineer Rolls-Royce (LSE: RR). Speedy-forward to 2025 and has that massive expansion within the worth of Rolls-Royce stocks long gone into opposite?

As though.

In reality, the Rolls-Royce percentage charge has soared Thus far this yr, it’s up 93%. In comparison to 5% for the FTSE 100 as an entire, this is exceptional efficiency – once more.

What’s using the proportion charge achieve

To unpick the explanations at the back of this hovering charge, I believe it turns out to be useful to believe a couple of various factors.

One is buyer call for. After an excessively tricky time because of government-imposed trip restrictions and vulnerable shopper call for all the way through the pandemic years, airways had been suffering to satisfy hovering call for, which means they’ve been servicing planes and ordering new ones.

Making plane engines is a hard and expensive industry, so there are top boundaries to access. That provides the few dominant gamers, corresponding to Rolls-Royce, pricing energy.

Any other issue has been efficiency past the core civil aviation department. Ecu governments have higher army budgets, serving to Rolls’ defence department. In the meantime its nuclear energy technology experience is coming increasingly more into call for.

However there were inside elements at play too. Because the get started of closing yr, new control has set very competitive expansion objectives. Thus far, industry efficiency has been sturdy. I believe that, if Rolls-Royce continues to appear not off course to satisfy and even beat the ones objectives, its percentage charge may just transfer up additional even from right here.

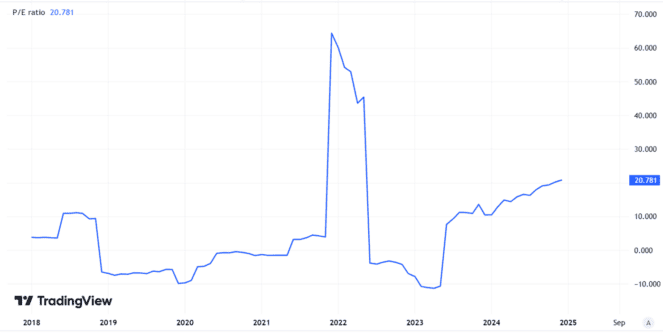

The present price-to-earnings (P/E) ratio of 21 might glance top these days (for my tastes, no less than). Then again, if income develop strongly — as the corporate’s technique suggests they may — the possible P/E ratio appears to be like to me as though it’ll in truth nonetheless be probably affordable from a long-term investor’s viewpoint.

Created the usage of TradingView

Doable for additional positive factors – however no promises

The object that places me off making an investment in Rolls-Royce – and I haven’t any plans these days to shop for the stocks – is what else would possibly occur.

As an example, what if the formidable expansion plan fails?

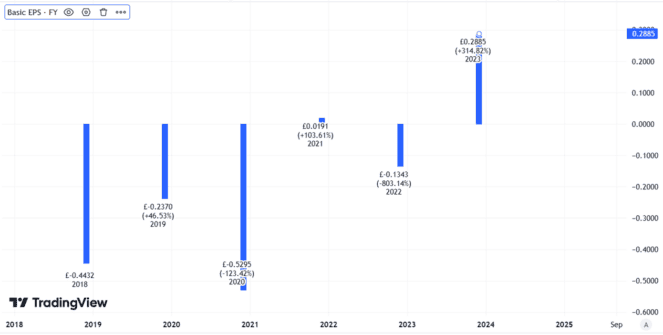

Rolls has a historical past stretching again a long time of combined efficiency. Have a look at its roller-coaster income consistent with percentage, for instance.

Created the usage of TradingView

Its industry comes to huge mounted prices and initiatives with timelines that may shift dramatically because of exterior elements like airframe producers pushing again release dates.

I believe the present charge of Rolls-Royce stocks displays investor hopes that the corporate will ship on its plans. So if that doesn’t occur, I be expecting the proportion charge may just fall.

Any other vital however exterior issue that, once more, Rolls has struggled with for many years is civil aviation call for shocks outdoor its keep an eye on. The pandemic was once simply the most recent in a protracted line of such shocks, from the 2001 US terrorist assaults to volcanic mud clouds grounding Ecu aviation.

I see a chance of a few such match throttling call for once more at some unknown long term level.

The present Rolls-Royce percentage charge does now not be offering me sufficient margin of protection to catch up on such dangers, so far as I’m involved.