Symbol supply: Getty Photographs

The Santa Rally of early December now turns out an extended, very long time in the past. Lately, inventory markets are awash with a sea of crimson, with some predicting {that a} US inventory marketplace crash might be across the nook.

So what’s happening? And what motion must traders like me take?

Right here’s what’s took place

Hopes of swingeing rate of interest cuts in 2024 and 2025 have boosted world percentage markets this yr. Base charge discounts supply an financial stimulus and convey down borrowing prices, boosting company profitability.

However stickier inflation extra lately suggests those excessive charge discounts is probably not at the horizon in spite of everything. Such suspicions have exploded following the United States Federal Reserve’s newest assembly the day past (18 December).

As anticipated, the central financial institution lower its benchmark charge once more, to 4.25% from 4.5%. However Fed chairman Jerome Powell warned that “from this level ahead, it’s suitable to transport cautiously and search for growth on inflation.”

By means of including that inflation may take “some other yr or two” to get to the financial institution’s 2% goal, upper rates of interest would possibly remaining for much longer than have been was hoping.

What subsequent?

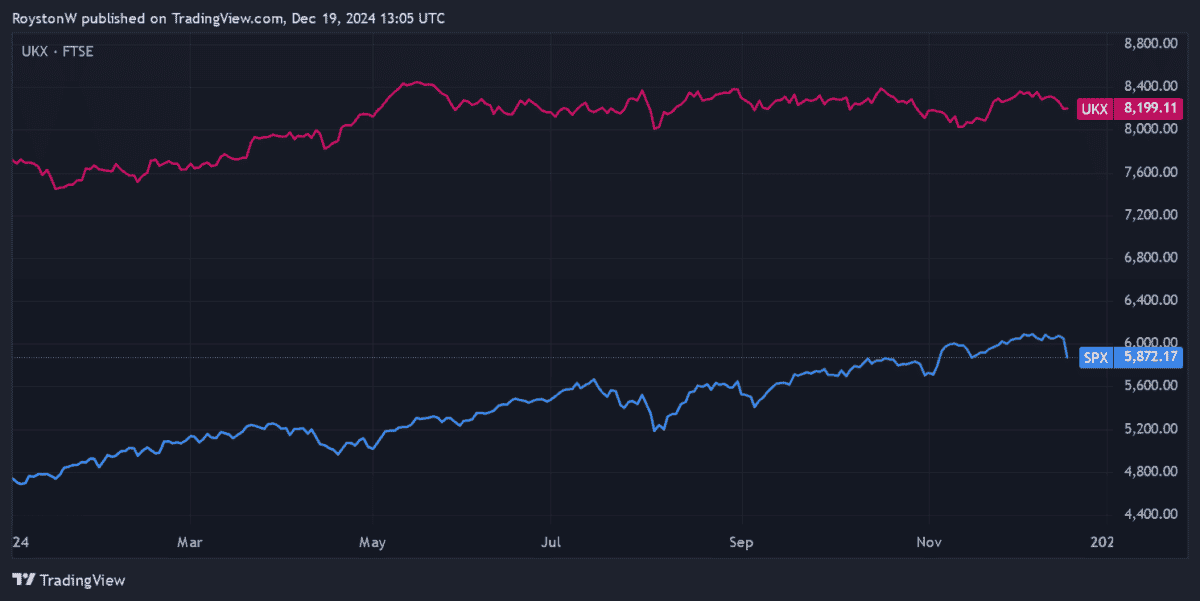

Inventory markets have plunged around the globe because of this. In London, the FTSE 100 slumped to one-month lows simply above 8,000 issues these days. The day past, the S&P 500 index of US stocks dropped to six-week troughs.

Since previous rallies had been constructed on expectancies of charge cuts, those retracements aren’t sudden. Even after the wipeout of the remaining 24 hours, the S&P 500 stays up 23% within the yr thus far.

May this be the start of a massacre? Many analysts say world shares are hyped up given issues like China’s suffering economic system, doable new business price lists, and the ones indicators of continual inflation.

On this context, additional falls might be across the nook.

That is my plan

As it should be guessing how percentage markets will behave within the close to time period is an excessively difficult activity. At any given time, inventory costs are suffering from a variety of macroeconomic and geopolitical elements. Surprises too can spring up that shake asset values, as we’ve simply observed.

My wager is {that a} marketplace crash is not likely. However as I say, I will in no way make sure that.

However whether or not the near-term outlook is dangerous or just right, my very own making an investment technique stays the similar. Marketplace turbulence is commonplace, but percentage making an investment nonetheless delivers spectacular long-term returns. So decreasing my percentage holdings makes little to no sense.

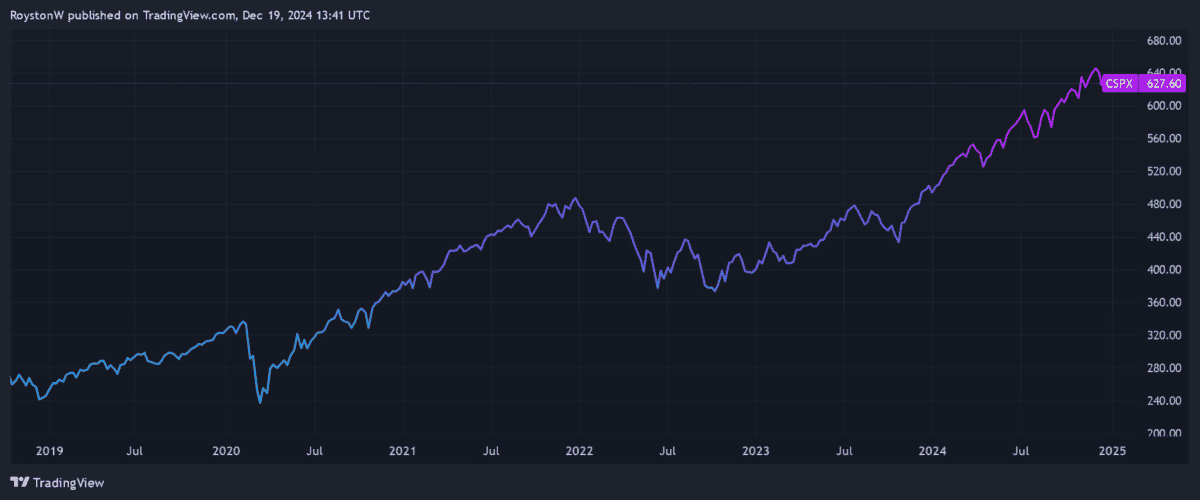

The S&P 500, as an example, has supplied a mean annual go back of 12.7% during the last decade. It’s delivered those whopping returns regardless of issues just like the Covid-19 pandemic, emerging geopolitical tensions and better rates of interest.

Every now and then like those, I subsequently search for beaten-down stocks, price range and trusts to shop for. And the iShares S&P 500 ETF (LSE:CSPX) is one I’m bearing in mind purchasing extra of following the index’s sharp drop.

Because the title implies, it provides me publicity to all of the S&P 500, which is helping me to unfold possibility. Having mentioned that, it additionally has substantial enlargement doable because of its prime weighting of tech shares together with Nvidia and Microsoft.

With an ongoing fee of 0.07%, it’s one of the cost-effective price range monitoring the United States index too.

Previous efficiency isn’t a competent information of long run returns. But when this iShares fund’s long-term go back stays unchanged, a £10k funding these days would greater than triple to £36,365 a decade from now.