Symbol supply: Getty Photographs

The newest FTSE 100 proportion I’ve purchased for my portfolio is JD Sports activities Style (LSE: JD.). It’s slumped 37% 12 months thus far and is now 55% not up to it used to be in November 2021.

Listed here are 3 causes I snapped up some stocks.

Nonetheless rising international

JD Sports activities has struggled because of susceptible client call for around the retail sector. In Q3, the corporate’s natural gross sales expansion used to be 5.4%, however like-for-like gross sales have been mainly flat.

As a result, control now expects full-year pre-tax earnings to be on the decrease finish of its earlier steerage (£955m-£1.03bn). That’s no longer nice, however similarly no longer disastrous, personally.

That mentioned, we don’t know when the restoration will kick in. A go back of inflation is a chance, whilst the present vacation season is essential for the gang. If Christmas buying and selling is deficient, the inventory may endure some other setback.

Taking a long term view, on the other hand, I feel there’s so much to love. The company has leveraged its sturdy logo to shape shut relationships with each adidas and Nike. Collaborations with those primary manufacturers for unique releases strengthens JD’s marketplace place and loyalty amongst customers looking for the most recent developments.

In the meantime, it opened 79 new JD shops in Q3, taking the full collection of openings to this point in FY25 to 181. So the corporate’s growth continues, whilst many smaller competition are not likely to continue to exist this difficult length.

After the hot acquisition of Hibbett in america, JD’s general international retailer depend now stands at 4,541.

Sexy valuation

The second one explanation why I’ve added the inventory to my portfolio is that it seems undervalued to me.

Occurring forecasts for FY26 (which begins in February), the ahead price-to-earnings (P/E) ratio is simply 7.2.

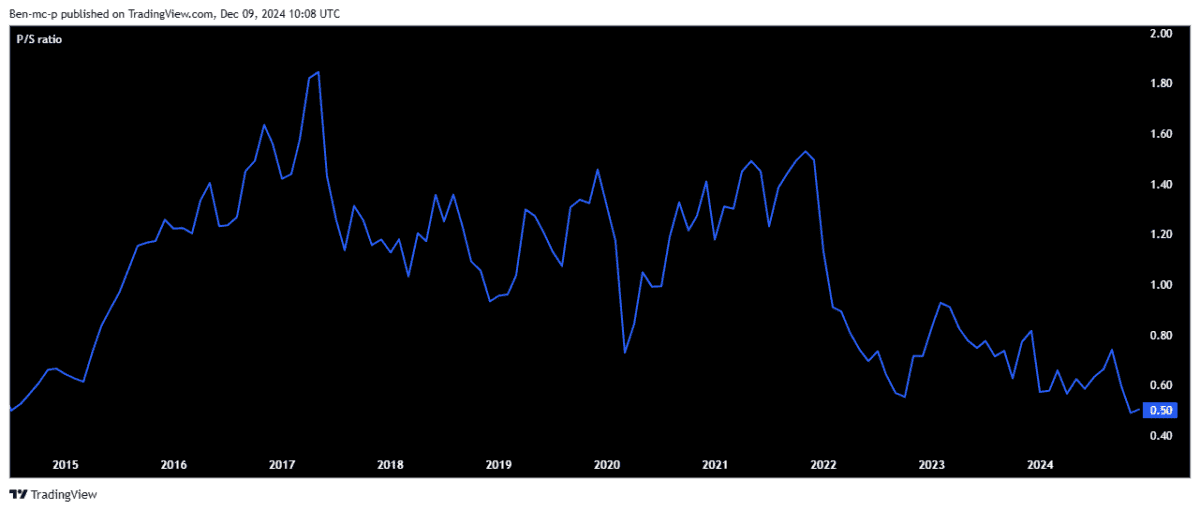

The cost-to-sales (P/S) a couple of is 0.5, which means that buyers are recently paying 50p for each and every £1 of JD’s gross sales. It’s the bottom the P/S ratio has been in over a decade!

At this kind of rock-bottom valuation, I’ve to consider many of the unhealthy information is already factored in for the sports activities type store. The percentage charge may get a pleasant rebound if and when issues get started to select up.

Maximum Town agents appear to agree. As an example, analysts at Shore Capital just lately wrote: “The stocks glance reasonable to us…we see this present weak point as a really perfect access charge with vital mid-term upside if the corporate can ship on its ex-UK expansion doable.”

A lot upper moderate charge goal

In spite of everything, the typical proportion charge goal from agents is encouraging right here. It stands at 157p, which is 50% upper than the present degree of 104p.

Certainly, some of the 15 analysts protecting the inventory has a most estimate of 250p — some 137% upper!

In fact, this doesn’t imply it’ll ever succeed in those costs. However it does spotlight how huge the disparity is.

Silly maintaining length

Having a look previous the present weak point, I reckon JD is working in an attractively huge expansion marketplace.

In step with Hargreaves Lansdown, the worldwide sports clothing marketplace is ready to develop to $544bn by way of 2028, up from $396bn in 2023. It must develop even upper past 2028 because the shift against extra informal and energetic existence continues.

As all the time, I’ve purchased the inventory with the aim of maintaining it for at least 5 years.