Information presentations the Bitcoin HODLer steadiness has registered a drop of round 9.8% this bull run. Right here’s how this determine appeared for earlier cycles.

Bitcoin HODLers Have Noticed Their Holdings Pass Down Lately

In step with knowledge from the marketplace intelligence platform IntoTheBlock, the Bitcoin long-term holders have steadily been lowering their overall steadiness not too long ago.

The “long-term holders” (LTHs) right here seek advice from the BTC buyers who’ve been maintaining onto their cash for a minimum of 365 days, with out shifting or promoting them a unmarried time.

Statistically, the longer a holder helps to keep their cash nonetheless, the fewer most probably they turn out to be to promote the tokens at any level. As such, the LTHs, who cling for important classes, may also be regarded as chronic entities. The facet of the marketplace with vulnerable arms is referred to as the “non permanent holders” (STHs).

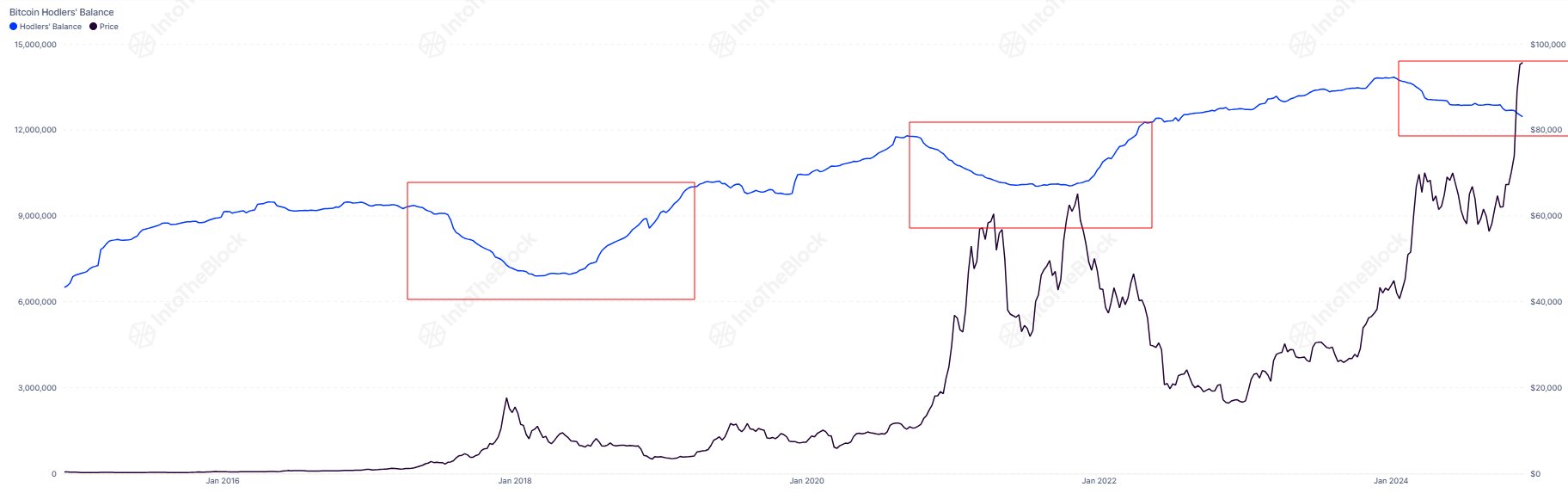

Now, this is the chart shared via IntoTheBlock that presentations the fad within the blended holdings of the Bitcoin LTHs during the last decade:

The price of the metric seems to had been at the decline in fresh months | Supply: IntoTheBlock on X

The above graph presentations that the Bitcoin LTHs had been decreasing their provide this yr. Extra particularly, the whole steadiness of those HOLDers has lowered via round 9.8% right through this downtrend.

The LTHs have made up our minds to wreck their dormancy on every occasion this metric registers a decline. Usually, this occurs as a result of they need to take part in some promoting.

One thing to notice is that whilst promoting is one thing that may right away seem at the indicator, the similar isn’t true for purchasing. LTH provide has a 1-year prolong connected in relation to this, as cash can handiest turn out to be part of the cohort after they have got been held for a minimum of a yr.

As discussed previous, LTHs have a tendency to be dedicated arms, in order that they don’t generally tend to promote too regularly. That stated, even those buyers are pressured into promoting when the income of a big Bitcoin bull run get started rolling in.

The analytics company has highlighted within the chart how this promoting appeared right through the former cycles. It could seem that the stage of the decline has been much less on this cycle thus far than within the remaining bull markets.

“Lengthy-term holder balances have fallen via 9.8% this cycle, in comparison to 15% in 2021 and 26% in 2017,” notes IntoTheBlock. Thus, it’s conceivable that the HODLer distribution can have extra space to proceed sooner than the Bitcoin rally ends.

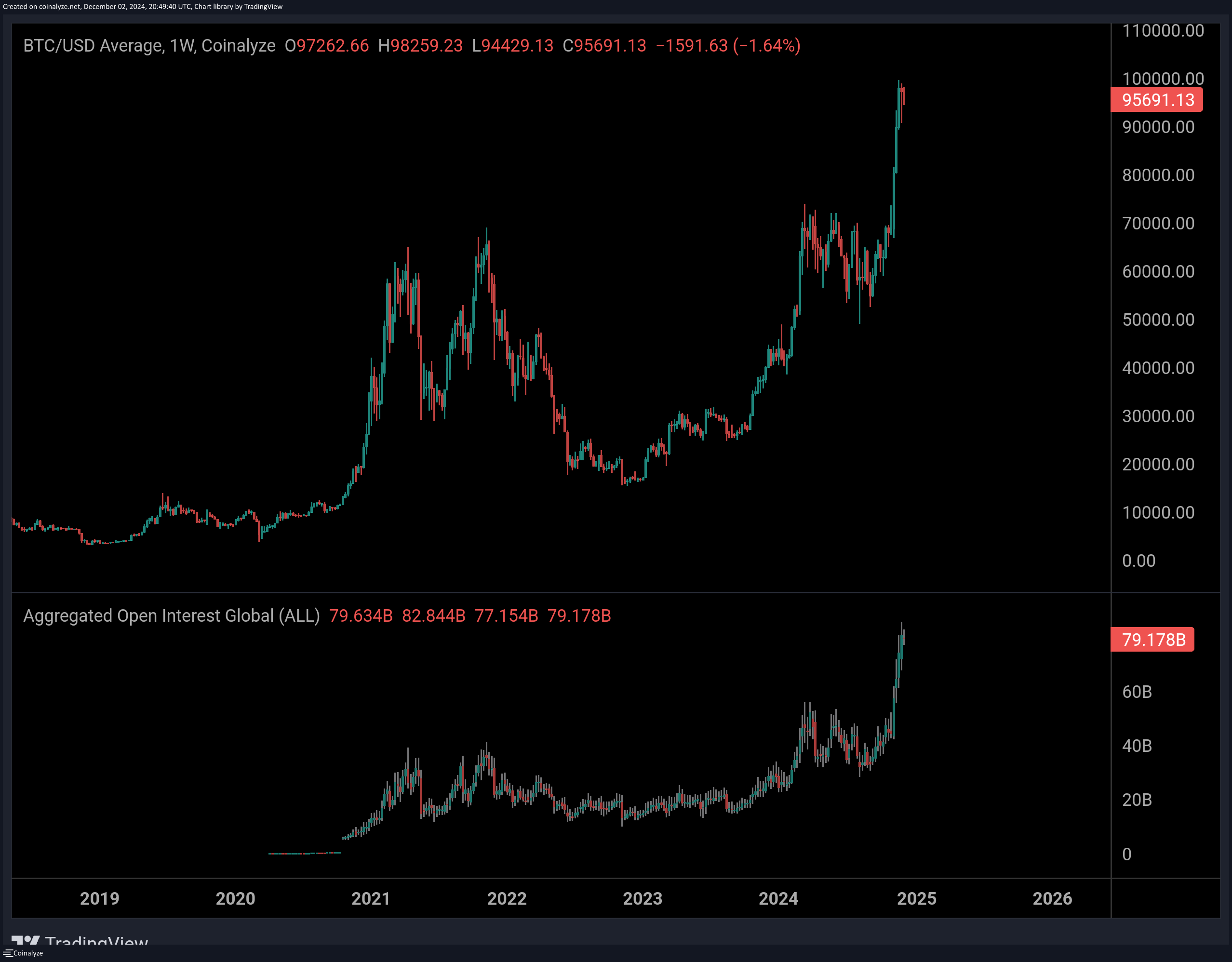

In another information, as CryptoQuant group analyst Maartunn has identified in an X put up, the whole Open Pastime for the cryptocurrency sector has shot as much as a brand new all-time prime of $79.2 billion.

Looks as if the worth of the metric has noticed a pointy surge not too long ago | Supply: @JA_Maartun on X

The “Open Pastime” refers to a measure of the choice of derivatives positions that customers have opened on all centralized exchanges. A spike on this indicator normally corresponds to raised volatility for the marketplace.

BTC Value

The Bitcoin rally has long past chilly as its value has been consolidating sideways across the $95,800 mark not too long ago.

The cost of the coin has been caught in sideways motion over the previous few weeks | Supply: BTCUSDT on TradingView

Featured symbol from Dall-E, IntoTheBlock.com, chart from TradingView.com