Symbol supply: Getty Photographs

Previous efficiency isn’t any ensure of long run returns. However new analysis from eToro means that now generally is a nice time for me to load up on FTSE 100 stocks.

The Footsie‘s up 1% to this point in December in what some say might be the beginning of a Santa Rally. Markets are emerging on hopes of impending rate of interest cuts through the Federal Reserve, in conjunction with tax discounts below the returning President Trump.

Historical past displays that December rallies are not any uncommon prevalence. In step with eToro, “inventory marketplace traders experience virtually 1 / 4 in their annual returns in December“. And UK traders particularly acquire probably the most from end-of-year fizziness on monetary markets.

The FTSE outperforms

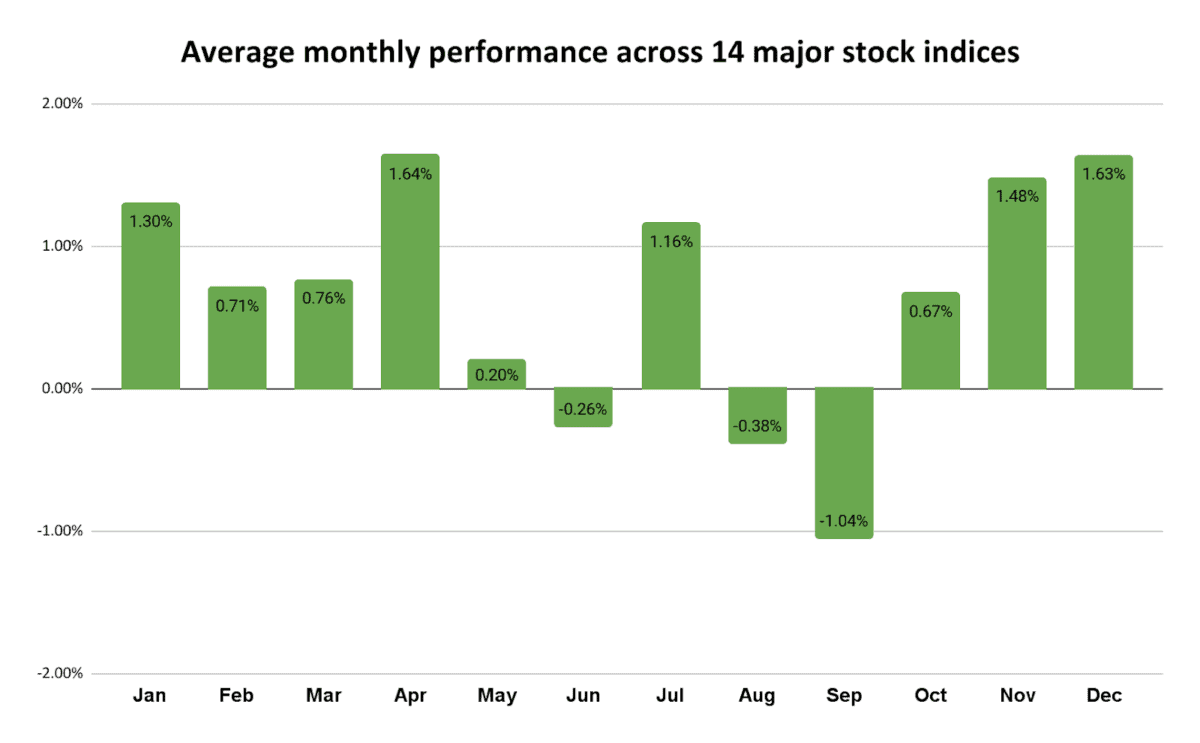

Dealer eToro seemed on the efficiency of 14 primary international indexes all the way through the previous 50 years. It confirmed that “returns in December moderate 1.63%, with ease outpacing the 0.57% moderate per thirty days go back from January to November“.

Encouragingly for UK traders, the FTSE 100 has left virtually all different primary indexes in its wake over previous festive classes, too.

It has delivered a median December go back of two.29% since its formation in 1984, outperforming the opposite months of the yr through a meaty 1.93%. On moderate, a whopping 36% of the Footsie’s annual returns had been made within the ultimate month of the yr.

December’s moderate go back is best than the 1.28% that the S&P 500 has supplied in contemporary many years. Best Hong Kong’s Cling Seng index has supplied a greater moderate ultimate month go back throughout primary international indexes, at 3.09%.

A best inventory I’m taking into account

As I stated on the best, previous efficiency isn’t a competent information to the long run. And presently, fears over US business price lists, China’s suffering financial system, and battle in Europe and the Heart East all pose a danger to this yr’s Santa Rally.

But in spite of macroeconomic and geopolitical dangers, I think that inventory making an investment is price severe attention, whether or not that be in December or another month of the yr.

This displays the awesome long-term returns traders experience as opposed to simply retaining cash in money. Somebody who purchased a FTSE 100 tracker fund in 2019, for example, would have loved a forged moderate annually go back of 6.2%.

Buying particular undervalued stocks this December may supply an even-better go back. Phoenix Staff (LSE:PHNX) is one dirt-cheap inventory I’m taking into account for my very own portfolio.

In 2025, annual income are anticipated to leap 22%. This leaves it buying and selling on a ahead price-to-earnings (P/E) ratio of 9.4 occasions.

Moreover, the FTSE corporate additionally has a price-to-earnings expansion (PEG) ratio of 0.4. Any sub-one studying signifies {that a} percentage is undervalued.

In any case, the dividend yield on Phoenix stocks is a marketplace busting 10.8%.

In spite of the specter of prime festival, income right here may just leap as falling rates of interest spice up shopper call for. Phoenix’s base line will have to additionally upward push as demographic adjustments force pension gross sales, now and over the long run.

It is a percentage I’m taking into account purchasing for my very own portfolio. I believe it might see severe percentage fee development in December and past.