Symbol supply: Unilever plc

I in point of fact just like the funding case for Unilever (LSE: ULVR). So too, it sort of feels, do different traders. The Unilever percentage payment has surged 23% this yr.

For a original blue-chip company in a mature business promoting on a regular basis staples, that turns out like a large bounce.

Why I just like the funding case

To begin, let me provide an explanation for why I just like the Unilever funding case typically.

It operates in a space this is more likely to see top and sustained call for for many years (dare I say, in all probability even centuries) to come back. Shampoo and laundry detergent will not be thrilling trade spaces, however I don’t see them going away any time quickly.

Such markets generally tend to draw a horde of businesses prepared for a slice of the pie. By way of spending a long time making an investment in build up top rate manufacturers akin to Dove and Marmite, Unilever has helped set itself excluding the group.

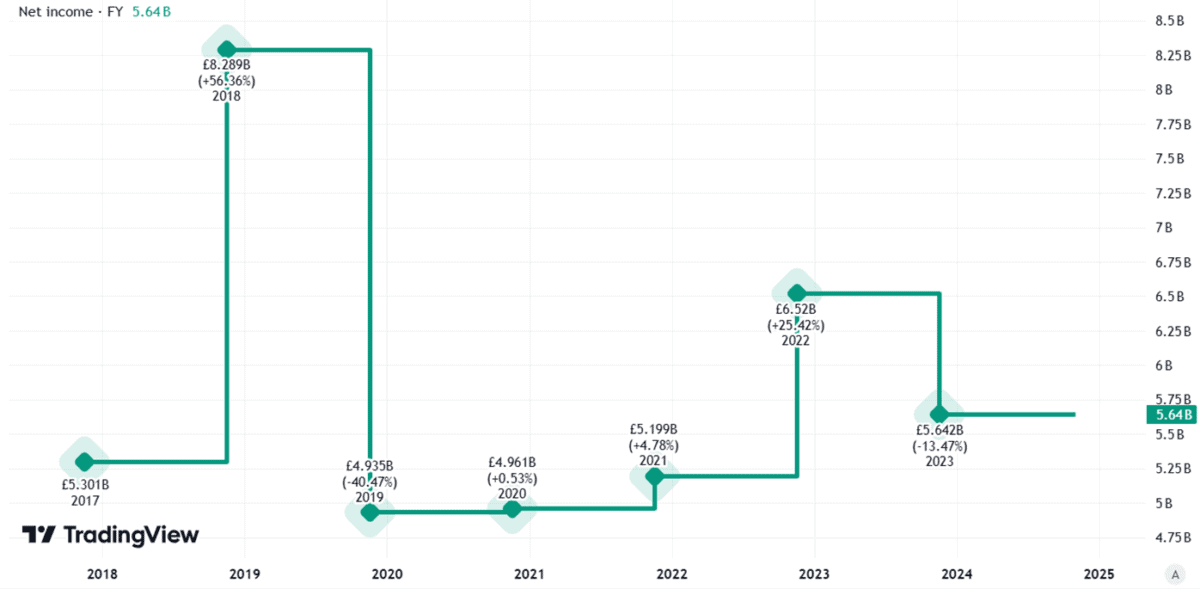

That provides it pricing energy, which in turns is helping become profitable. Sure, the corporate’s income have moved about lately. However they’ve persistently been within the billions of kilos.

Created the use of TradingView

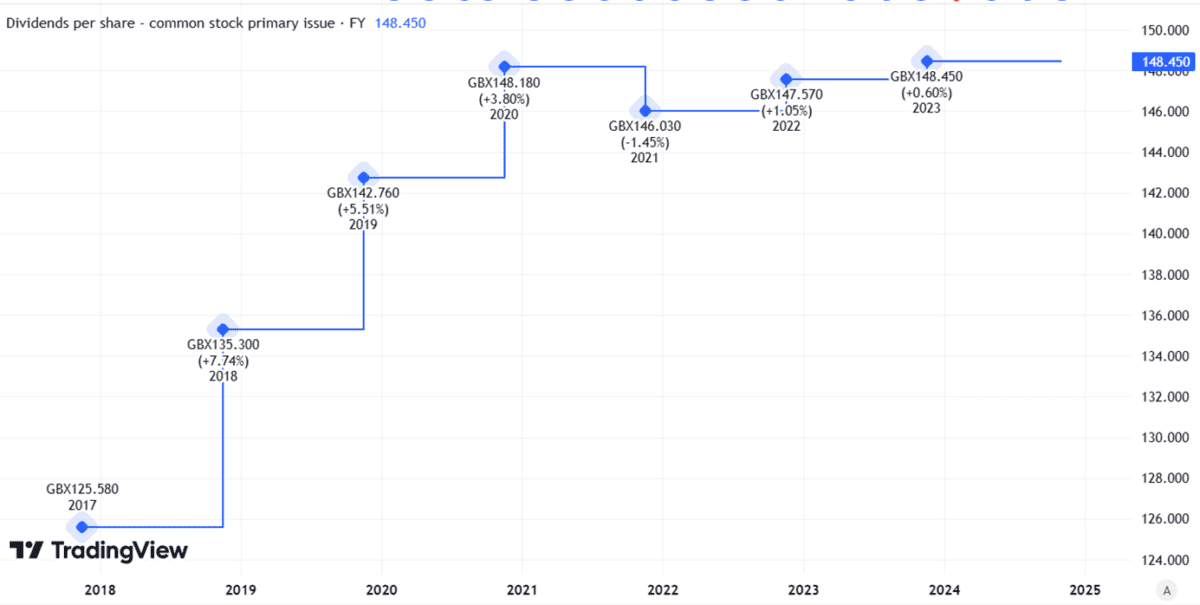

In flip, that is helping fund dividends.

Created the use of TradingView

Revisiting Warren Buffett’s takeover try

Is it a twist of fate, then, that Warren Buffett attempted to shop for Unilever – no longer some stocks in it, however the entire caboodle – in 2017?

I might say certainly not.

Unilever has all of the hallmarks of a vintage Buffett funding: a big, enduring marketplace, sturdy aggressive benefit and confirmed money technology doable.

Working out fresh payment strikes

Buffett failed. That was once at £40 consistent with percentage. However, within the years since, the Unilever percentage payment has time and again traded underneath (in truth, neatly underneath) that payment.

So, why has it surged this yr?

New control may well be a part of the reason. Plans to chop headcount on the large multinational hold the possibility of decrease prices, doubtlessly boosting benefit margins.

So too may just a plan to spin off the ice cream trade and concentrate on spaces like non-public good looks, with its sexy margins and little need for a tough refrigerated provide chain from Cornetto manufacturing unit to nook store.

An investor tournament final week showed that it’s on target to ship on its cost-cutting targets and the company additionally elaborated on its “Enlargement Motion Plan 2030”. The corporate stated it’s on target to split its ice cream trade from the remainder of the company by way of the top of subsequent yr.

Now not liking the percentage payment

Nonetheless, that seems like moderately sluggish growth to me. It suggests that consumers on the proper payment won’t had been chomping on the bit (or on the Ben & Jerry’s).

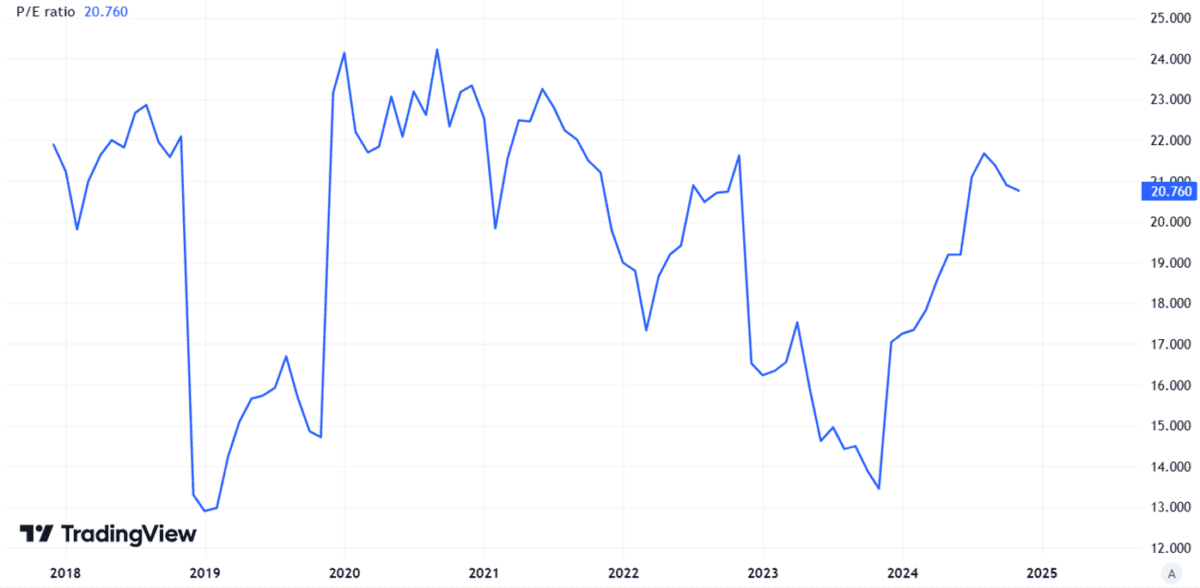

In the meantime, expansion plans are all neatly and excellent (even though may also be exhausting to ship in any such mature trade) however in line with present efficiency, the Unilever percentage price-to-earnings ratio is already 21.

Created the use of TradingView

I don’t suppose this is outrageous, however it’s upper than I’m ok with as a potential investor, even supposing I just like the Unilever funding case.

The corporate faces dangers, from promoting the ice cream trade at too low a value simply to eliminate it, to a susceptible financial system pushing down call for for branded merchandise. So for now, I haven’t any plans so as to add Unilever to my portfolio.