Symbol supply: Getty Pictures

On the lookout for dividend expansion shares? Those FTSE 100 shares are anticipated to ship robust payout expansion over the following couple of years no less than.

BAE Techniques

Dividend yield: 2.5% for 2024, 2.7% for 2025

The solid nature of hands spending manner defence has a tendency to be a rock-solid sector for dividends. That is particularly the case nowadays, as fractures within the international order power speedy rearmament within the West.

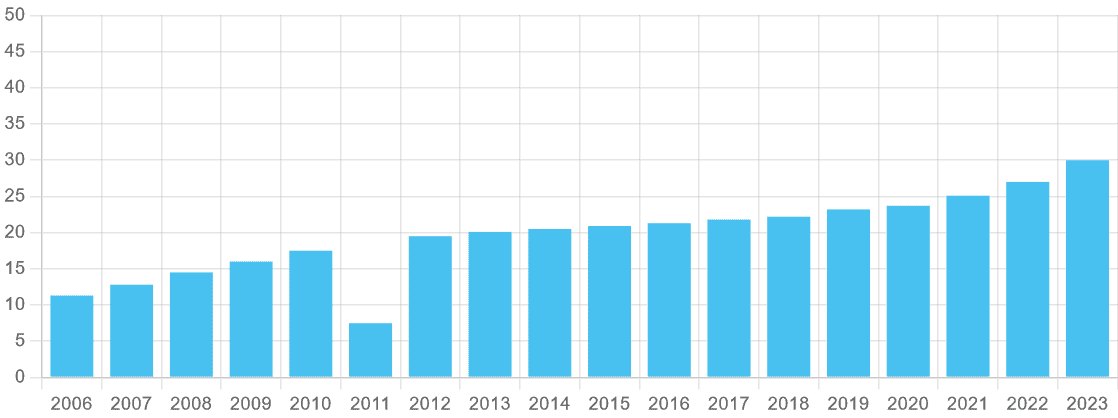

BAE Techniques (LSE:BA.) is one contractor with an extended document of prominent dividend expansion. It’s raised shareholder payouts once a year since 2011. It’s a pattern Town analysts be expecting to proceed, making it value a detailed glance personally.

Payouts are anticipated to upward thrust 8%, to 32.3p in step with proportion, this 12 months. Dividend expansion is anticipated to boost up to ten% in 2025, leading to a full-year payout of 35.5p.

Forecasts for subsequent 12 months are supported by means of anticipated earnings rises of seven% and 12% in 2024 and 2025 respectively. As a end result, estimated dividends for each years are coated 2.1 instances by means of predicted profits.

Each readings are above the security benchmark of two instances, offering dividends forecasts with further metal.

BAE additionally has robust monetary foundations to fund dividends in case profits disappoint. Income would possibly fall wanting estimates because of provide chain problems, as an example, an important risk to defence corporations’ annual profits nowadays.

The Footsie company had £2.8bn of money at the stability sheet as of June.

BAE Techniques’ order backlog is surging, and it hit a document £74.1bn on the midpoint of 2025. It appears set to stay emerging too, which bodes smartly for longer-term dividends.

Airtel Africa

Dividend yield: 5.4% for 2025, 5.5% for 2026

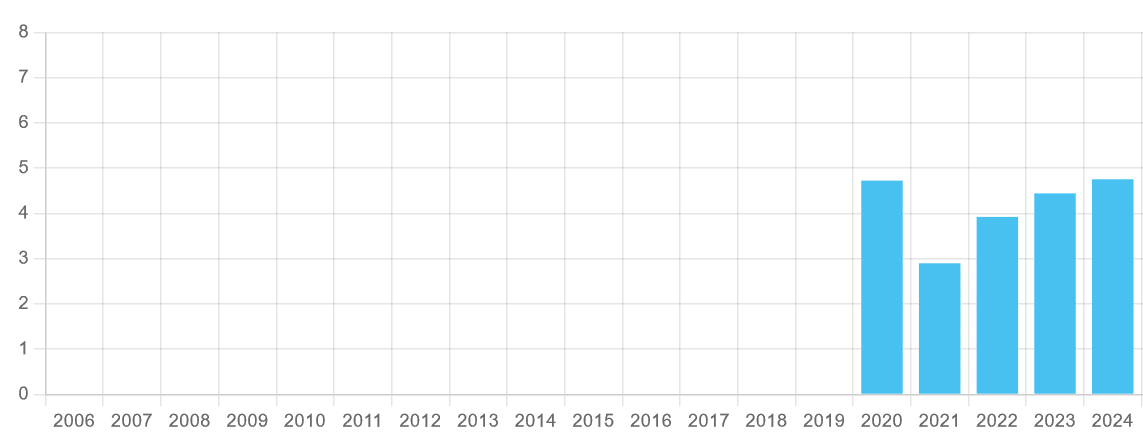

Telecoms supplier Airtel Africa (LSE:AAF) doesn’t have an extended document of dividend expansion like BAE. It’s handiest been indexed at the London Inventory Change for 5 years. It additionally lower the once a year payout in 2021 because it rebased dividends to chop debt.

On the other hand, money payouts have surged since then, and by means of greater than double-digit percentages on events. It’s a pattern that Town agents be expecting to hold on.

For this monetary 12 months (to March 2025), a complete dividend of 6.52 US cents in step with proportion is anticipated, up 10% 12 months on 12 months. An additional 3% upward thrust is predicted for monetary 2026, to six.70 cents.

On the other hand, I should warn that Airtel’s forecasts aren’t as powerful as I’d preferably like.

Income are skidding decrease because of hostile forex actions (EBITDA dropped 16.5% between April and September). And leverage ranges are sharply rising, with net-debt-to-EBITDA emerging to two.three times as of September.

Falling profits additionally imply dividend duvet turns adverse for this 12 months, with predicted profits of 46.7 US cents in step with proportion forecast. At the plus aspect, Town analysts be expecting earnings to rebound strongly in monetary 2026, leaving powerful dividend duvet of two.7 instances.

But regardless of the unsure near-term outlook, I nonetheless consider Airtel Africa stocks are value severe attention by means of risk-tolerant traders.

What’s extra, I consider the long-term image right here stays extremely horny. Telecoms call for for Africa continues to rocket, with Airtel’s buyer base emerging 6.1% 12 months on 12 months to 156.6m in September.