Information displays the Bitcoin Open Pastime to Marketplace Cap Ratio has surged along the most recent run within the asset’s value to the brand new all-time prime (ATH).

Bitcoin Open Pastime to Marketplace Cap Ratio Is Now At A 2-Yr Prime

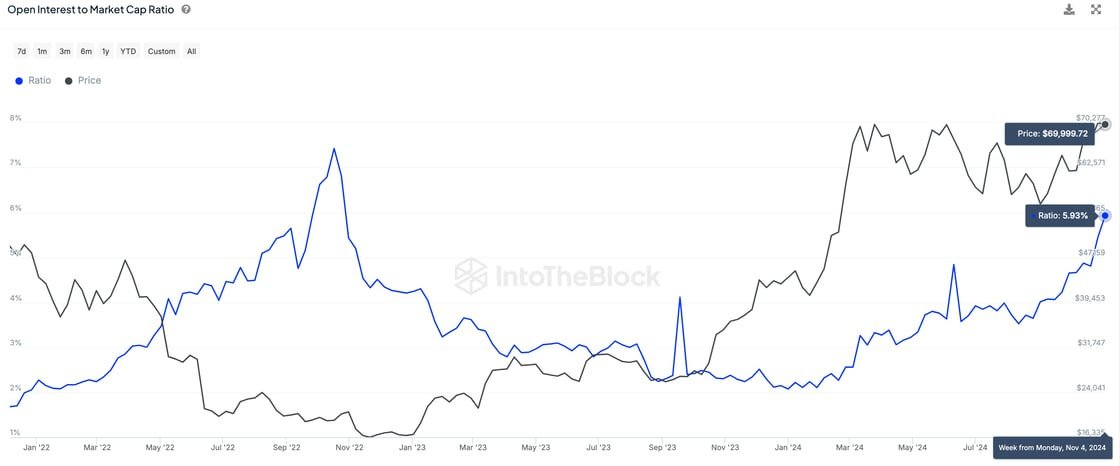

As defined via cryptocurrency information account Satoshi Membership in an X put up, the BTC Open Pastime has been overheating relative to the Marketplace Cap not too long ago. The metric of passion here’s the “Open Pastime to Marketplace Cap Ratio” from the marketplace intelligence platform IntoTheBlock.

As its identify suggests, this indicator tells us about how the Open Pastime of Bitcoin compares in opposition to its Marketplace Cap. The Open Pastime refers to a measure of the whole quantity of derivatives positions associated with BTC which can be these days open on all exchanges.

Derivatives contracts are monetary tools that permit traders to guess on BTC’s value actions with out essentially proudly owning any exact tokens. As a result of this reason why, the Open Pastime could also be often referred to as a measure of the ‘Paper’ BTC provide within the sector.

The Marketplace Cap is the whole valuation of the cryptocurrency’s circulating provide on the present alternate charge, so the Open Pastime to Marketplace Cap Ratio mainly tells us about how the quantity of Paper BTC compares in opposition to the asset’s spot price.

Now, here’s a chart that displays the rage on this indicator for Bitcoin over the previous few years:

The worth of the metric seems to were heading up in fresh days | Supply: @esatoshiclub on X

As displayed within the above graph, the Bitcoin Open Pastime to Marketplace Cap Ratio has observed a pointy surge along the most recent value rally that has taken the asset to a brand new all-time prime (ATH).

This is an engaging pattern, because the Marketplace Cap going up must imply the ratio would head down as an alternative because it’s within the denominator, so the truth that it has greater regardless implies paper BTC has merely been revealed at a charge quicker than the Marketplace Cap has risen.

The indicator has now approached the 6% mark, this means that there are actually sufficient derivatives positions open to make up for six% of the cryptocurrency’s general capitalization. This newest prime within the metric is the best that it’s been since November 2022, when the cave in of the FTX alternate befell.

Traditionally, the Open Pastime to Marketplace Cap Ratio being prime hasn’t been a favorable signal for BTC, because it implies there may be an far more than leverage provide within the sector.

The aforementioned prime of November 2022 had led right into a crash for the asset that might take it to the bottom level of the endure marketplace. A an identical cooldown had additionally befell previous on this yr.

It now continues to be observed whether or not the Marketplace Cap would have the ability to develop in spite of the overheated prerequisites brewing within the derivatives facet, or if some other mass leverage washout would apply for Bitcoin.

BTC Worth

Bitcoin is at the cusp of some other document prime as its value is floating round $76,300 at the moment.

Seems like the cost of the coin has been in ATH discovery mode not too long ago | Supply: BTCUSDT on TradingView

Featured symbol from Dall-E, IntoTheBlock.com, chart from TradingView.com