Symbol supply: Getty Pictures

One not unusual solution to price stocks is to take a look at their price-to-earnings (P/E) ratio. Most of the time of thumb, the decrease it’s, the less expensive the proportion is, despite the fact that there are a few necessary caveats to imagine: the sustainability of the revenue and the company’s debt each topic. This present day, one well known FTSE 250 proportion sells for pennies and has a P/E ratio of simply 8.

So, is it a discount I ought to shop for for my portfolio?

Well known client emblem

The percentage in query is Dr Martens (LSE: DOCS).

With an iconic shoes emblem, huge buyer base, and distinctive position out there, I feel there’s a lot to love in regards to the industry.

So, why is the FTSE 250 proportion promoting for pennies? (And why has it fallen 88% because it indexed at the London inventory marketplace simply 3 years in the past?)

The solution lies within the company’s susceptible efficiency in recent times.

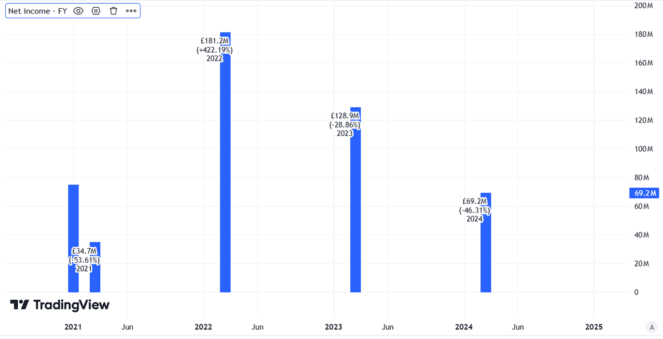

Take final 12 months for example. Revenues fell through 12%. Benefit after tax crashed through 46%.

Created the usage of TradingView

In the meantime, internet debt rose through 24%. As I stated above, debt issues on the subject of valuation as servicing and repaying it may well consume into revenue.

Doable for turnaround

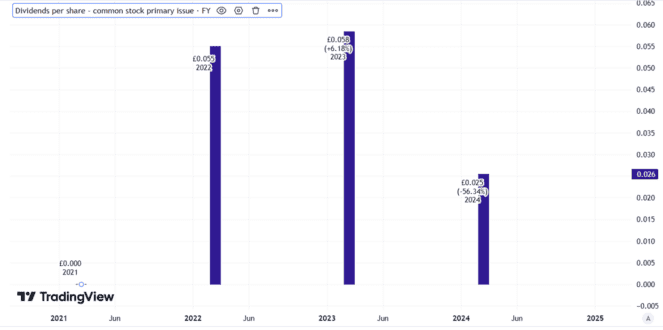

Nonetheless, whilst the corporate’s earnings after tax fell badly, it remained firmly within the black. It lower the dividend, however didn’t cancel it altogether.

Created the usage of TradingView

Susceptible US client call for was once given as a key explanation why for final 12 months’s deficient efficiency. However the industry introduced plans to handle that, together with expanding advertising spend within the a very powerful area.

The newest replace got here in July, when the corporate stated that buying and selling in its most up-to-date quarter were in step with expectancies. I feel a large take a look at will come this month, when Dr Martens is about to announce its period in-between effects.

In the event that they comprise certain information about gross sales traits and prices, I reckon the present proportion fee may just turn into a discount.

On the other hand, the opposite may just occur. If there are handiest susceptible indicators of a turnaround (or none in any respect), the proportion fee would possibly fall additional. Dr Martens footwear aren’t reasonable and US client spending stays rather susceptible.

I’m no longer purchasing

I’m in no rush to shop for right here. The corporate’s large proportion fee decline since record issues to numerous elements that worry me, from internet debt to the seeming fragility of the industry style.

At highest, I feel the industry can begin to display proof of a turnaround and notice the proportion fee climb. However this type of turnaround is not likely to occur in a single day. So there will probably be time for me to shop for when proof of it comes, although that suggests paying the next fee than as of late for the FTSE 250 proportion.

In the meantime, the dangers worry me. Dr Martens is a sturdy emblem however this can be a industry that has been combating sizeable demanding situations. The ones would possibly proceed.