Symbol supply: Getty Photographs

Passive source of revenue is the holy grail for many people. It’s one thing that might give us the chance to take extra day off paintings and spend extra time with our households. It’s additionally one thing that might merely assist us pay expenses and get through in existence.

Without reference to our causes, passive source of revenue can also be completed through making an investment in shares and stocks. When compared with the passive source of revenue ‘hacks’ I see driven on social media, making an investment permits us to succeed in our objectives in a somewhat low-risk setting.

So, what if I had £20,000 stashed apart? Whilst that may sound like a excellent chew of cash, may just I make investments that and switch it into £20,000 of annual passive source of revenue? Let’s have a look.

It can pay to be dull

It’s most effective come to my consideration lately that my proclivity to place cash apart and spend little or no on myself is just a little dull to a couple. Then again, it’s the foundation of a technique that has served many a success traders neatly.

So, let’s consider I come to a decision to speculate all of this £20,000 into shares and stocks thru an ISA — an ISA is just a wrapper that protects our funding from tax and is to be had on all main funding brokerages.

Please notice that tax remedy will depend on the person instances of every consumer and could also be matter to switch in long run. The content material on this article is equipped for info functions most effective. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for wearing out their very own due diligence and for acquiring skilled recommendation prior to making any funding selections.

I may just then glance to construct a portfolio the usage of my £20,000 as beginning capital and through making small per 30 days contributions.

Sound investments

Many beginner traders are drawn in through the possibilities of huge returns on unstable shares. However that regularly results in losses.

Then again, once we make funding selections in accordance with robust basics, quantitative research, and macroeconomic knowledge, we stand a a lot better likelihood of rising our portfolios.

Newbie traders would possibly glance to make excessive single-digit returns annually, whilst extra skilled traders would possibly purpose for double-digit returns.

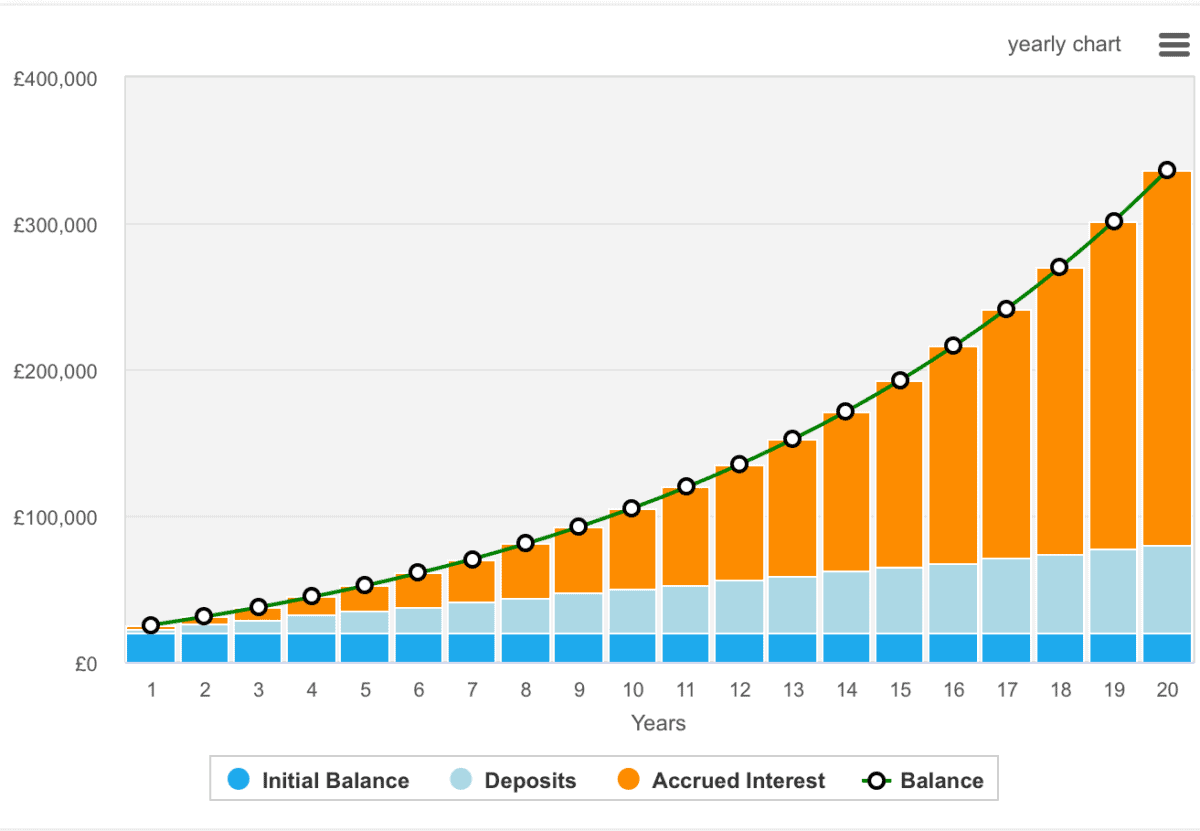

The above instance displays how £20,000 may just develop if I completed 10% annualised enlargement and contributed at further £250 per 30 days from my wage.

Briefly, in lower than two decades, my portfolio would develop through greater than 10 occasions. And against the top of this era, I’d recommend that through making an investment in high-yielding dividend shares, I may just earn greater than £20,000 once a year in passive source of revenue.

The place to speculate

Buyers with extra time on their arms may like to select all of their very own investments. And this can also be specifically time eating as diversification is all the time necessary.

Then again, for the ones people searching for a somewhat extra arms off manner, a fund or ETF, such because the iShares US Era ETF (NYSEMKT:IYW), may well be a excellent position to start out.

The fund invests in one of the most greatest US firms within the tech area, and it’s traded like every other inventory, that means we will purchase extra or promote at any time.

US tech shares have definitely observed numerous consideration during the last 365 days, and so they’re turning into costlier given enlargement expectancies. This gifts a point of menace, particularly with a big match like the United States election simply not far away.

Then again, let’s take into consideration the longer term. US tech has outperformed its international friends decade after decade, and those mega-cap firms like Meta and Nvidia are in pole place to dominate the bogus intelligence revolution.

Only a few other people guess in opposition to US tech and win.