Symbol supply: Getty Photographs

Transfer apart Rolls-Royce and Fresnillo — this small-cap biotech percentage is skyrocketing previous probably the most UK’s main enlargement shares. Up 100% this yr, OXB (LSE: OXB) is taking no prisoners because it fights to get better its losses from 2022.

Between November 2021 and October 2022, the percentage worth crashed 78%, falling from a prime of £16.78 to just about £3 in step with percentage. The cost endured to fall thru 2023 however has now recovered to £4.18 — the perfect it’s been in over a yr.

So what’s subsequent for the inventory?

State-of-the-art biotechnology

Up to now referred to as Oxford Biomedica, OXB is a somewhat small £442m inventory indexed at the FTSE All-Proportion index. The Oxford-based biopharmaceutical corporate specializes in mobile and gene treatment, specialising in viral vector production. It has over 25 years of revel in running with probably the most main pharmaceutical and biotech corporations globally.

Not too long ago it shifted to a pure-play contract building and production organisation (CDMO), aiming to put itself as a pace-setter in viral vector products and services, serving to different corporations increase and commercialise gene remedies.

During the last yr, its portfolio grew to incorporate 37 purchasers and 48 programmes, specializing in viral vector varieties like lentivirus and adeno-associated virus (AAV). The worth of those contracts is roughly £94m as of 31 August.

Shaky financials

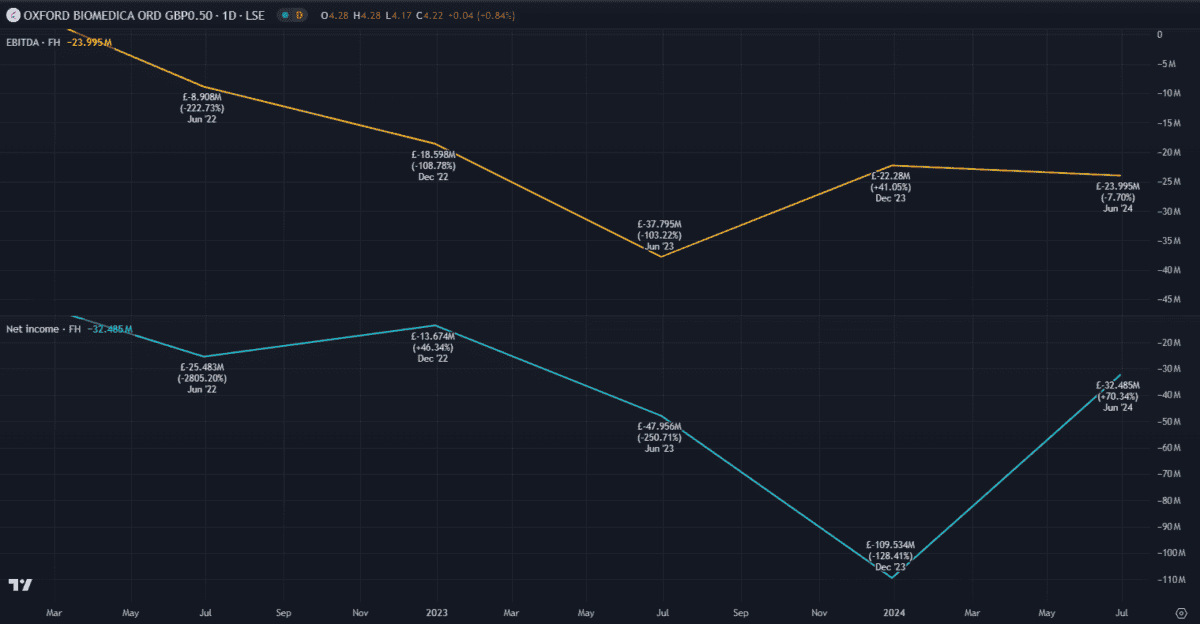

Final yr was once now not sort to OXB, with the percentage worth falling 50%. Within the first half of of 2023, it reported a 33% drop in revenues in comparison to the similar duration in 2022. The decline was once essentially because of the non-recurrence of AstraZeneca Covid vaccine production. It additionally posted an working EBITDA lack of £33.7m, upper than the £5.8m loss within the earlier yr. This was once attributed to inflation blended with upper bills associated with its new Oxford Biomedica Answers department.

Issues appear to be bettering in 2024, even supposing first-half income had been nonetheless moderately disappointing. Each income and income in step with percentage (EPS) overlooked analyst expectancies, via 4.7% and 110%, respectively. Despite the fact that it posted a internet lack of £32.5m, this was once a 32% growth on H1 2023.

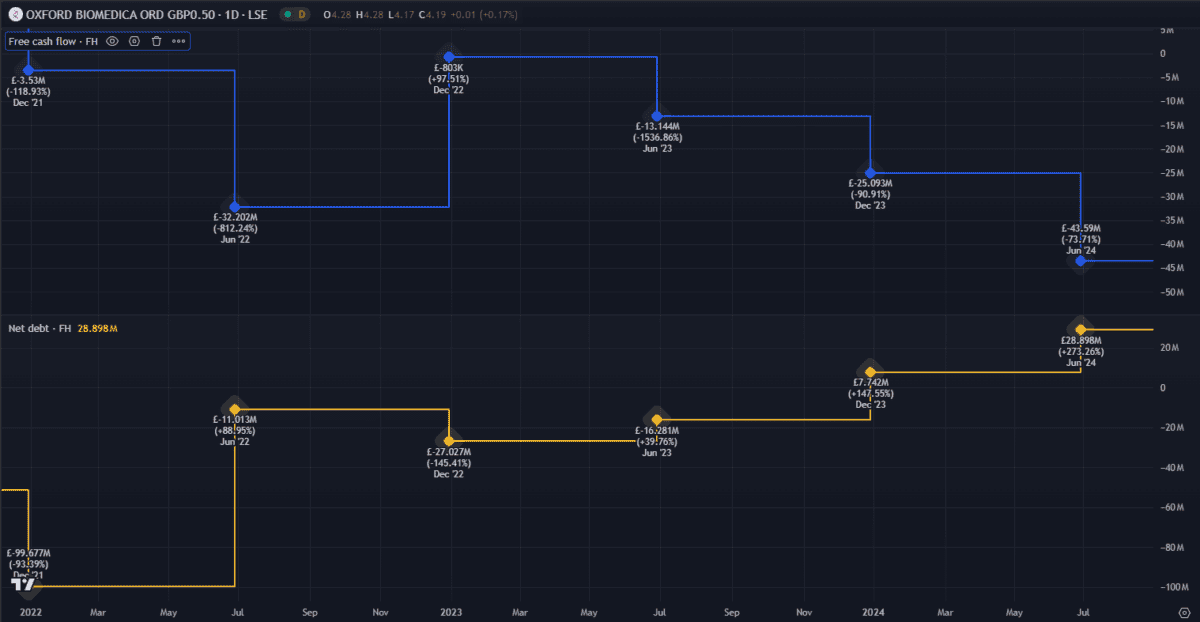

The stability sheet appears ok for now, with a debt-to-equity ratio of 55.8%. Alternatively, it’s burning thru money and piling on debt, most likely because of higher operational bills and emerging bioprocessing prices.

Money and liquidity are key spaces to look at as the corporate expects to wreck even in EBITDA via the top of 2024. In a statement made in September throughout the rebranding to OXB, new CEO Dr. Frank Mathias stated it goals to toughen its monetary status via specializing in its function as a CDMO.

It’s unclear how smartly the trade to a CDMO will repay, however the fee is already reacting undoubtedly. Alternatively, the loss of a giant shopper like Novartis may just simply flip issues round. It already faces tricky festival within the CDMO marketplace — any drop in efficiency may just lead to misplaced contracts.

If issues pass smartly, the transition must supply extra solid, long-term income versus the risky revenues from interior R&D. I be expecting it is going to proceed to do smartly so if I weren’t already a shareholder, I’d luckily purchase the inventory nowadays.