Bitcoin is experiencing important volatility and uncertainty after falling under the $60,000 mark. This dip has sparked combined reactions amongst traders. Some view it as a possible endure entice, indicating that the cost would possibly quickly rally, whilst others worry that the marketplace may well be headed for a deeper correction.

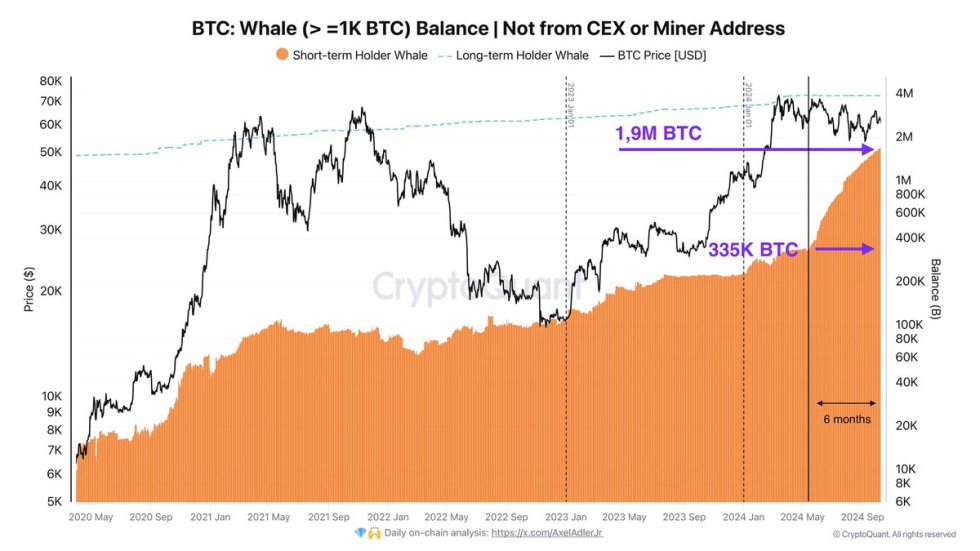

Regardless of the conflicting sentiments, essential information from CryptoQuant finds that Bitcoin whales have gathered BTC closely during the last six months.

As the cost hovers simply above the important thing $60,000 degree, many traders speculate concerning the present marketplace stipulations. May this extended accumulation length by means of massive holders sign a bullish outlook for the approaching months? Or is the marketplace nonetheless liable to additional drawback?

Analysts are divided, however the whale process means that there may well be extra energy available in the market than meets the attention. Figuring out this accumulation segment is a very powerful for buyers navigating Bitcoin’s unpredictable worth actions.

Bitcoin Rally In This fall?

Bitcoin has been in a 6-month accumulation segment, in step with on-chain information from CryptoQuant. After achieving new all-time highs of round $73,000 in March, the cost entered a falling vary that has endured, leaving many questioning if BTC’s decline used to be a part of a bigger technique.

Some analysts counsel that the downward motion used to be influenced by means of worth manipulation and accumulation techniques hired by means of Bitcoin whales and marketplace makers. Those massive holders had been purchasing closely during the last a number of months.

Crypto analyst and investor Axel Adler has highlighted this pattern, sharing a chart appearing whales’ competitive accumulation. Consistent with his research, whales with balances of over 1,000 BTC have added a staggering 1.5 million BTC to their holdings prior to now six months.

This purchasing process generally precedes a significant bullish motion, as massive holders gather all over sessions of uncertainty, anticipating an important worth surge in a while.

For traders intently looking at Bitcoin, this knowledge paints a promising image. Many imagine this accumulation segment may cause a rally within the ultimate quarter of 2024, pushing BTC to new highs. As whales proceed to shop for, the opportunity of a pointy upward transfer grows, growing a good outlook for long-term holders who stay bullish on Bitcoin’s long term trajectory.

BTC Retaining Above Key Call for Degree

Bitcoin is recently buying and selling at $61,000, simply 1% clear of the 4-hour 200 transferring reasonable (MA) and 200 exponential transferring reasonable (EMA). Those ranges are essential for figuring out the momentary worth motion. The important thing degree to observe is $62,000 for bullish momentum to proceed.

If BTC can reclaim the 4-hour MA and EMA and spoil above the $62,000 resistance, a bullish continuation towards $66,000 is most probably.

Then again, the marketplace stays unsure, and if Bitcoin fails to carry above the $60,000 beef up degree and does no longer push upper towards $62,000, buyers may see a deeper correction. In one of these state of affairs, BTC would possibly fall to check decrease beef up ranges, with a possible retracement to $57,500.

Buyers are intently looking at those key ranges as the cost motion within the coming days will most probably set the tone for Bitcoin’s subsequent primary pattern. Whether or not Bitcoin rallies previous $62,000 or dips under $60,000 will resolve whether or not bulls or bears will dominate the marketplace within the brief time period.

Featured symbol from Dall-E, chart from TradingView