Symbol supply: Getty Photographs

The selection of other people the usage of an Particular person Financial savings Account (ISA) has jumped just lately. I’m no longer stunned. Those nice merchandise permit folks to spend money on a variety of belongings whilst saving them a boatload of cash on tax.

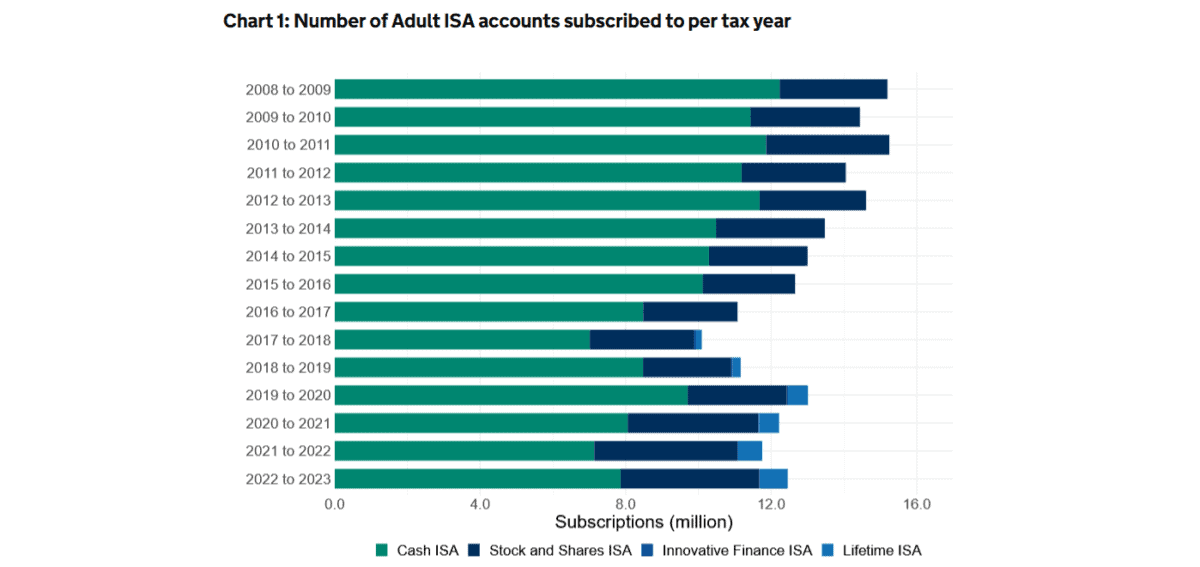

Within the 2022/23 length, there have been 12.5m grownup subscribers to the ISA, in step with HM Earnings and Customs. This was once up from 11.8m within the prior yr, and was once pushed by means of a 722,000 upward thrust in Money ISA subscriptions as other people capitalised on sturdy financial savings charges.

I personal different types of ISAs to focus on a life-changing passive source of revenue after I in the end retire. Right here’s how they may lend a hand me are living a lifetime of luxurious in my later years.

Please observe that tax remedy depends upon the person instances of every shopper and could also be matter to modify in long term. The content material on this article is equipped for info functions handiest. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for wearing out their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

A £44,000 saving

Any capital positive factors and dividends a person receives in an ISA are safe from tax. And over the years, this may upload as much as a substantial sum of money.

In a 2024 Monetary Instances article, asset supervisor Netwealth calculated that “an extra fee taxpayer making an investment £100,000 in a Shares and Stocks ISA would save £44,000 in taxes over 10 years“. That is in accordance with a mean every year go back of five.9% and excludes buying and selling prices.

One problem with the ISA is that there’s a restrict on how a lot a person can make investments every tax yr. This places it an evident drawback to a normal funding account (GIA). That’s in principle, no less than. In fact, lower than one in 10 other people in truth use their complete £20,000 allowance every tax yr, me integrated.

I these days personal a Money ISA along a Shares and Stocks ISA. I’m additionally one in all a smaller quantity of people that spend money on a Lifetime ISA every yr.

With the latter product, the federal government supplies a 25% bonus on best of any contributions I make. The utmost annual allowance this is £4,000, and I will be able to’t draw on my cash till I hit 60. However that tasty bonus is just too just right for me to forget about.

Concentrated on 1,000,000

In a Shares and Stocks ISA and Lifetime ISA, I will be able to spend money on a variety of monetary tools. This comprises exchange-traded finances (ETFs), one in all which I’m making an allowance for is the iShares Core S&P 500 UCITS ETF (LSE:CSPX).

As its title implies, the fund invests within the 500 biggest US-listed corporations. This provides me as an investor publicity to critical high quality, in addition to superb diversification throughout other sectors and areas of the sector.

I additionally love it as it has vital capital tied up within the knowledge generation sector. Holdings like Nvidia, Apple and Microsoft may just disappoint if the worldwide economic system stagnates or contracts. However they may additionally ship considerable returns because the virtual revolution rolls on.

Since its inception in 2018, the ETF’s delivered a mean annual go back of 12.36%. If this continues, a £300 per month funding may just turn out to be £1,136,102 after 30 years.

This in flip, would give me a £45,444 passive source of revenue in accordance with a 4% every year drawdown. Added to the State Pension, this is able to permit me to revel in an excessively relaxed way of life in retirement.