Bitcoin has not too long ago noticed a notable decline, shedding from a worth above $64,000 on Monday to as little as $58,000 the day past, marking a ten% lower over two days.

This sharp downturn seems to have initiated worry a few of the crypto neighborhood, prompting more than a few interpretations of the marketplace’s conduct.

A up to date document by way of CryptoQuant, an on-chain information supplier platform, has illuminated the 5 key components that would possibly have contributed to this decline.

Brief-Time period Holders And Marketplace Fragility

CryptoQuant’s research highlights 5 important charts illustrating the marketplace prerequisites prior to and all through the new value drop.

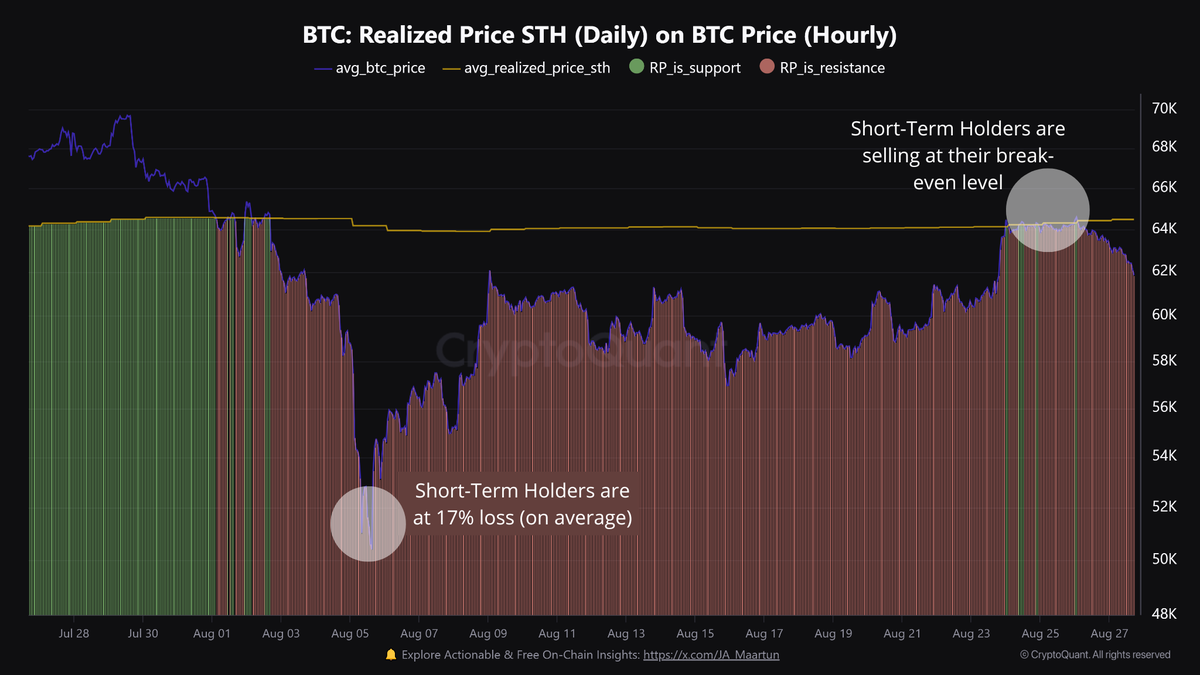

One of the crucial number one components recognized by way of CryptoQuant is the position of momentary holders in making a resistance degree at their break-even value.

Previous this month, Bitcoin’s value skilled every other sharp drop, which left many momentary holders with a mean lack of 17%. When the fee recovered to its break-even level, those holders took the chance to promote, growing resistance that avoided additional upward motion.

Along with the conduct of momentary holders, the document additionally highlights the delicate atmosphere created by way of buyers speculating on upper costs. The open passion in Bitcoin futures rose from $13.5 billion to $17.9 billion, a 31% building up since August fifth.

Significantly, sure investment charges indicated a top rate on perpetual contracts, reflecting buyers’ expectancies of persevered value will increase. Alternatively, CryptoQuant published that this optimism created a precarious scenario the place any adverse value motion may just cause vital instability in buyers’ positions.

Spot Inflows And Marketplace Liquidations

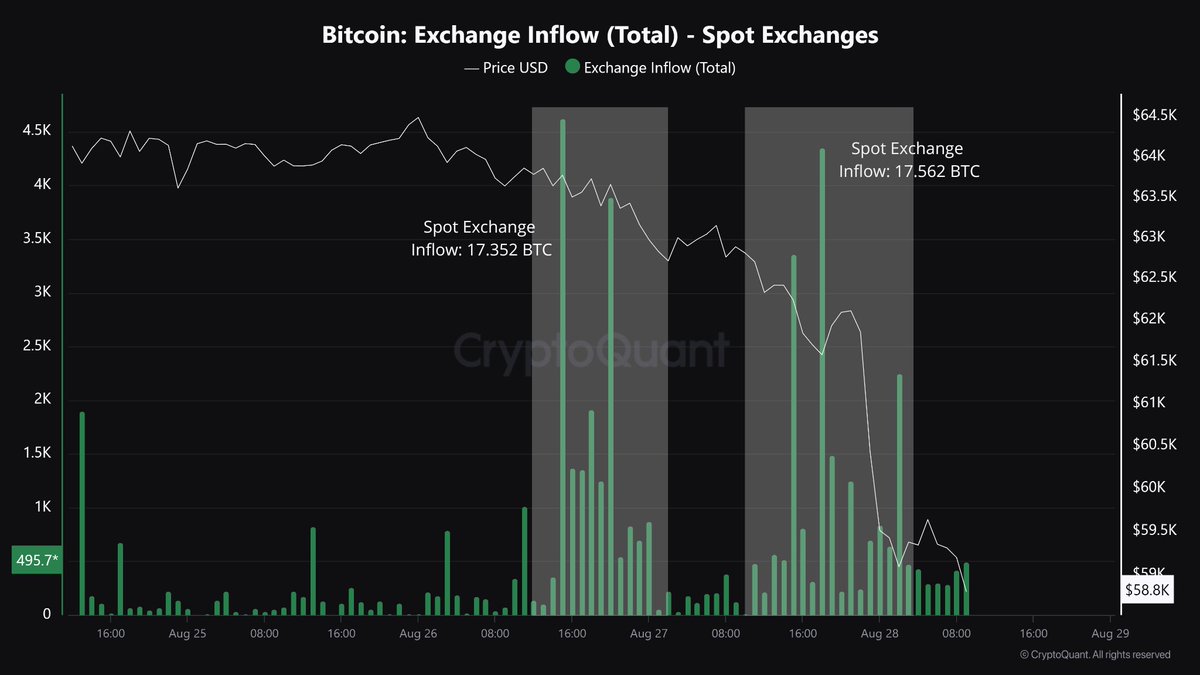

The document additionally notes an building up in spot inflows all through the fee decline, suggesting that enormous holders have been transferring their Bitcoin onto exchanges, doubtlessly to promote. This added promoting power exacerbated the delicate prerequisites within the futures marketplace.

CryptoQuant disclosed that as the fee persevered to drop, lengthy positions in each Bitcoin and Ethereum have been liquidated at top ranges—$90 million for Bitcoin and $55 million for Ethereum.

Those liquidations, the very best since August fifth, decreased open passion by way of $2.2 billion, additional destabilizing the marketplace.

CryptoQuant concluded by way of noting:

That’s what took place with the new value drop. For now, the marketplace wishes a while to stabilize, and we will have to track the on-chain information within the coming days.

In the meantime, the previous 24 hours haven’t been any other from the decline noticed the times prior. In particular, over this era, Bitcoin has persevered to drop, lately down by way of 3.2% and with a present buying and selling value of $59,841 on the time of writing.

Featured symbol created with DALL-E, Chart from TradingView