Symbol supply: Getty Pictures

I’m a large fan of the use of dividend shares so as to earn further revenue. However now not all dividend-paying firms are dependable. Vodafone disenchanted me not too long ago by way of slashing its 10% yield in part, prompting me to promote my stake within the corporate.

Now I’m extra cautious concerning the revenue shares I spend money on. Recently, my best 3 choices are Phoenix Team (LSE: PHNX), British American Tobacco (LSE: BATS) and Felony & Basic (LSE: LGEN).

Right here’s why I feel they’re value buyers bearing in mind.

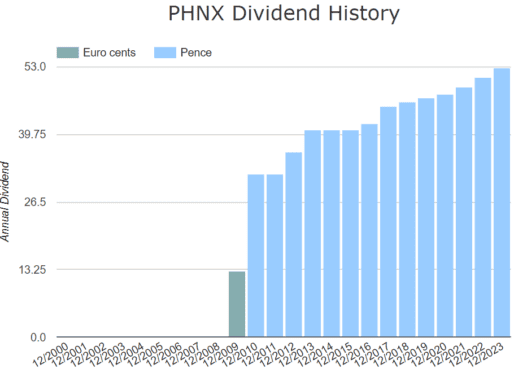

Phoenix Team

Phoenix Team’s 9.5% yield may just quickly be the very best at the FTSE 100 after Vodafone drops down to five.2%. The insurer hasn’t been paying dividends for terribly lengthy however has larger them yearly for the previous six years.

As probably the most UK’s greatest insurance coverage corporations, it faces stiff festival from Felony & Basic and Prudential. Sadly, there’s one obtrusive factor, it’s recently unprofitable. Years of low income have driven up its debt too, which is now nearly double its fairness.

That doesn’t sound very promising.

However a contemporary spice up in income’s helped push the corporate again against profitability. It’s more likely to change into successful once more subsequent 12 months, with income probably achieving £280m by way of the tip of 2025.

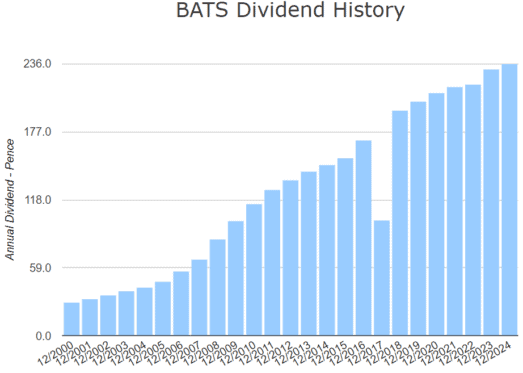

British American Tobacco

With an 8.5% yield, British American Tobacco may just quickly be the fourth-highest FTSE 100 yield after Burberry lower its dividend. Barring a temporary relief in 2017, it’s been paying a competent and extending dividend for over two decades.

Recently, it’s unprofitable however forecast income enlargement offers it a ahead price-to-earnings (P/E) ratio of 8.3. And with long run money flows anticipated to extend, the stocks are estimated to be undervalued by way of nearly 60%.

However tobacco’s a death trade so it’s onerous to have an excessive amount of religion within the corporate’s long-term potentialities. To not point out the ethical implications.

Alternatively, British American Tobacco is concerned with moving against tobacco-free merchandise as tighter laws threaten its base line. Its Vuse product is the most well liked vaping emblem on this planet, consistent with the corporate. It’s actively legislating for stricter laws and bans on disposable vapes and child-appeal flavours to lend a hand scale back underage smoking.

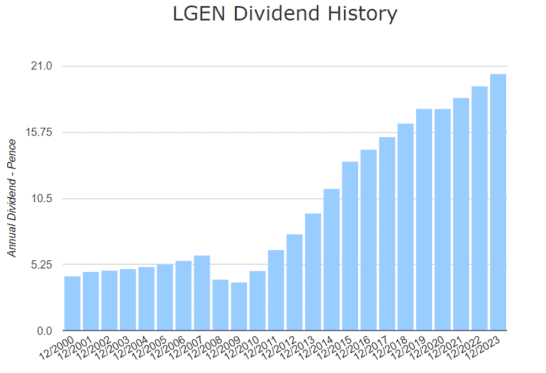

Felony & Basic

At 8.9%, Felony & Basic’s the 3rd very best yield at the FTSE 100, reasonably under fellow insurer M&G. However as a purely income-focused inventory, it doesn’t be offering a lot in the best way of charge enlargement. It’s handiest up 1.6% up to now 5 years.

Bills are super-reliable although, having larger constantly since 2009 with just a temporary pause in 2020. Its dividends boast a compound annual enlargement price (CAGR) of 13.3%, with the yield anticipated to succeed in 10% within the subsequent 3 years.

Like Phoenix, low income have driven its P/E ratio as much as 48 and left it with numerous debt. If forecasts are proper, advanced income may just convey it nearer to the trade reasonable of eleven. However with a debt load two times its market-cap, it’s an extended strategy to pass.

If it weren’t for the impressive observe file of paying dividends, I’d more than likely give it a leave out. However on this case, I feel the praise’s well worth the possibility.