Symbol supply: Getty Pictures

The FTSE 100 index is well-liked by traders in search of scorching dividend shares. It’s full of corporations whose robust stability sheets and mature operations supply a sustainable, huge, or even rising dividend through the years. However the FTSE 250 could also be house to quite a lot of nice source of revenue stocks.

I’ve been in search of the most efficient dividend shares to shop for for my very own portfolio. And I’ve come around the following two dividend heroes from the United Kingdom’s second-most-prestigious proportion index.

Right here’s why I’ll in moderation believe including them to my Shares and Stocks ISA after I subsequent have money spare to take a position.

Wind system

Greencoat UK Wind (LSE:UKW) provides one of the most greatest ahead dividend yields at the FTSE 250 nowadays. In reality, at 7%, its yield is two times the dimensions of the wider index moderate.

Electrical energy turbines like this can also be highest choices for a strong source of revenue through the years. The facility they generate stays in prime call for irrespective of no matter financial, political or social crises come alongside. In order that they revel in dependable money flows that they are able to then dish out to their shareholders.

Those trade aren’t utterly with out possibility then again. One worry to me is that the price of development wind farms is emerging sharply. In fresh months, Denmark’s Ørsted has both not on time or scrapped 3 primary tasks in the USA because of spiralling bills.

That mentioned, the long-term upside of making an investment in renewable power shares like Greencoat UK Wind stays really extensive. With the local weather emergency accelerating, steps to spice up blank power capability is heading in the similar route.

This actual inventory — which owns 49 belongings the duration and breadth of Britain — will have to obtain a spice up from the greener insurance policies of the brand new UK executive. Labour has vowed to redesign making plans regulations to enable you construct onshore wind farms.

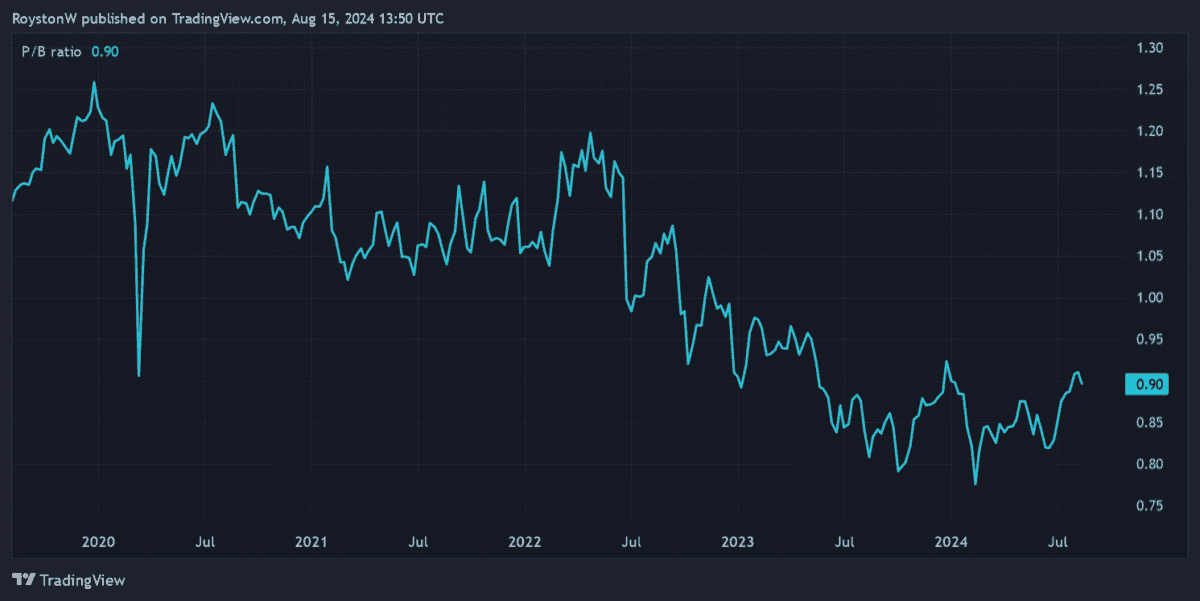

With the trade additionally buying and selling at a bargain to the worth of its belongings, I believe now is usually a nice time to take a position. Its price-to-book (P/B) ratio stands inside of price territory of underneath 1, at 0.9.

Healthcare massive

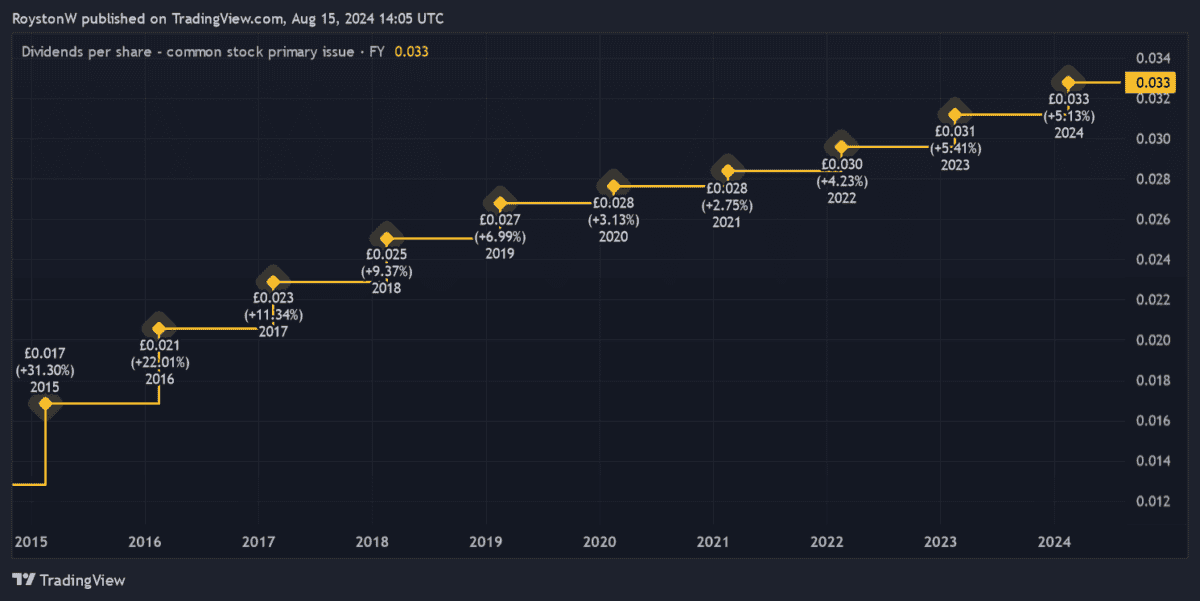

With a dividend yield of seven.9%, Assura‘s (LSE:AGR) every other proportion that agents be expecting to ship market-beating source of revenue this 12 months. Like Greencoat, it enjoys loyal source of revenue streams that translate right into a sustainable dividend.

This actual trade owns and we could out number one healthcare houses like GP surgical procedures throughout the United Kingdom and Eire. It is a extremely defensive a part of the true property marketplace. And what’s extra, the rents it receives are necessarily assured by means of native government, which means it doesn’t have to fret about overlooked bills.

I additionally like Assura on account of its more moderen transfer into the personal health center sector. Its acquire of 14 houses from Northwest Healthcare Houses for £500m will permit it to capitalise on booming call for for personal healthcare in Britain.

Assura has an ideal document of secure dividend enlargement, as proven within the chart above. Income might endure if the Financial institution of England fails to seriously slash rates of interest. However, on stability, I believe this stays a most sensible dividend inventory to believe purchasing.