Knowledge presentations the alternate inflows of Tether (USDT) and USD Coin (USDC) have spiked not too long ago. Right here’s why this may well be related for Bitcoin.

Stablecoins Are Watching Upper Than Same old Inflows Proper Now

As defined through CryptoQuant writer Axel Adler Jr in a brand new submit on X, the per month moderate alternate influx of the highest two stablecoins, USDT and USDC, has long past up not too long ago.

The “alternate influx” right here refers to an on-chain indicator that assists in keeping observe of the whole quantity of a given asset being deposited into the wallets related to centralized exchanges.

When the price of this metric is prime, it way the exchanges are receiving a considerable amount of deposits at this time. Any such development suggests there may be call for a number of the holders to industry away cryptocurrency.

However, the low indicator implies traders are probably opting for to carry onto their cash, as they aren’t making many transfers to the exchanges.

What both of those developments might suggest for the marketplace, despite the fact that, will depend on the kind of asset the only in query is. Buyers making deposits for risky belongings like Bitcoin generally is a bearish signal for the associated fee, as they’ll make the transfers for promoting.

With regards to stablecoins like USDT and USDC, whilst deposits too can imply traders need to promote those tokens, such promoting would now not have an effect on their costs, as they’re, through nature, solid in price. That mentioned, they do have relevance for the broader marketplace.

Buyers normally retailer their capital in stablecoins to steer clear of the volatility of Bitcoin and others. Then again, traders who retailer capital like this normally plan to delve again into the risky facet.

Thus, alternate inflows of USDT and different stablecoins can suggest that those traders ready at the sidelines are able to spend money on BTC and the corporate. This switch can naturally have a bullish impact at the costs of those risky tokens.

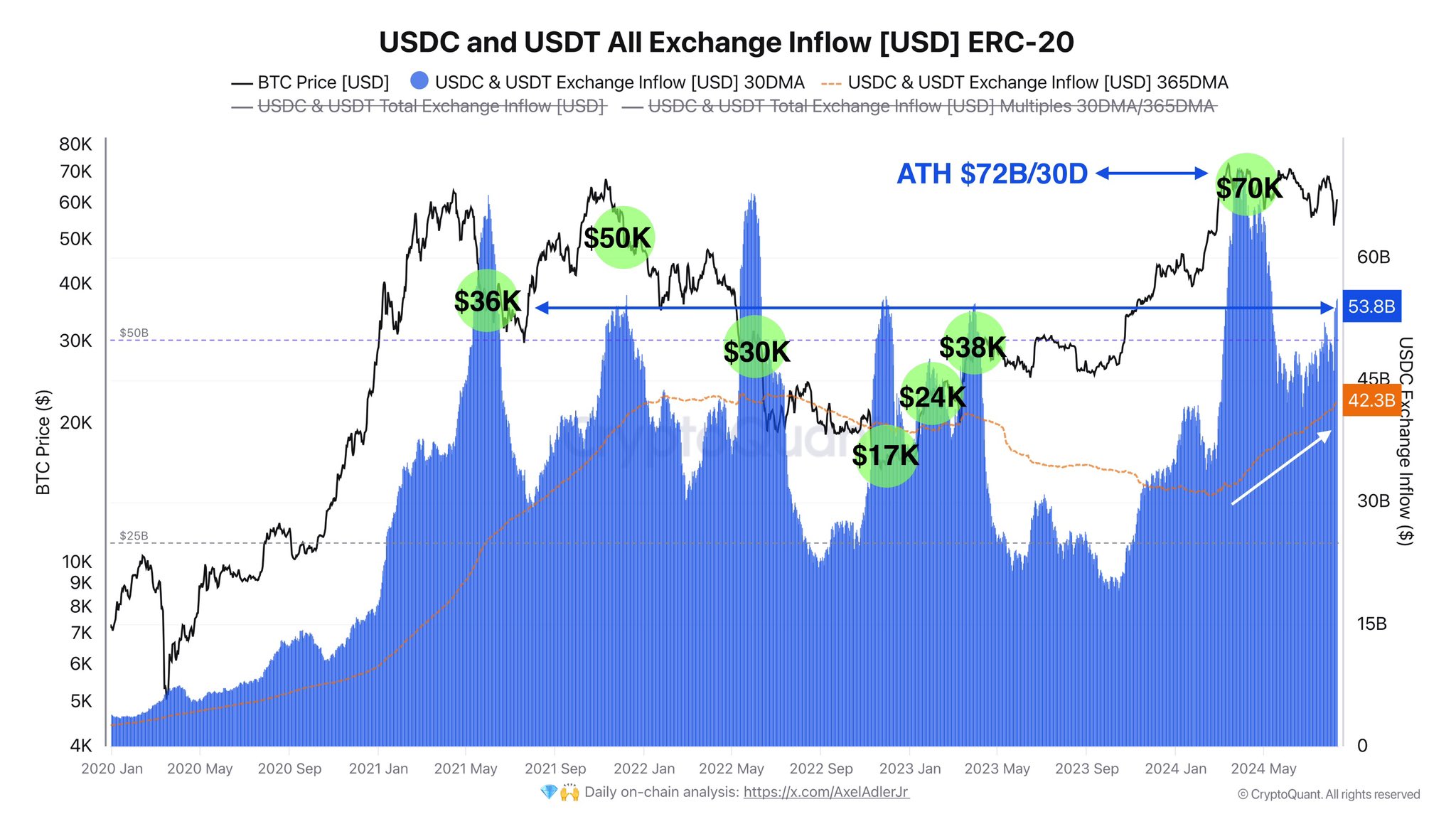

Now, here’s a chart that presentations the fad within the 30-day and 365-day shifting averages (MAs) for the blended alternate influx of USDT and USDC during the last few years:

The worth of the metric seems to were heading up in contemporary days | Supply: @AxelAdlerJr on X

Because the above graph presentations, the 30-day MA USDT and USDC alternate inflows spiked to beautiful prime ranges all the way through the Bitcoin rally against the brand new all-time prime (ATH), suggesting call for for purchasing the asset used to be really extensive.

Right through this surge, the indicator had set a brand new document of $72 billion in day by day deposits. Within the downturn that adopted, despite the fact that, the metric had observed a substantial cooldown, however not too long ago, it’s been on its long ago up.

To this point, it has reached the $53.8 billion according to day mark, which is moderately notable. If those recent stablecoin deposits are certainly taking place for purchasing into the risky facet, Bitcoin and others can see a bullish impact.

BTC Worth

Bitcoin had observed a retrace under $58,000 previous within the day, however the asset seems to have jumped again up because it has crossed the $60,000 stage.

Looks as if the cost of the coin has general been shifting sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured symbol from Dall-E, CryptoQuant.com, chart from TradingView.com