Symbol supply: Getty Photographs

In hindsight, we all know that the Rolls-Royce proportion charge between 2020 and 2022 used to be a inventory marketplace discount. So, it stands to explanation why that there are possibly different golden FTSE 100 alternatives staring us proper within the face.

May BT Crew (LSE: BT.A) inventory be one? Let’s have a look.

A price entice

I first regarded as BT stocks a couple of years in the past and I’m now happy that I didn’t make investments. They’ve fallen 62% throughout a decade and 15% in 5 years.

BT has lengthy been a worth entice. That is the place a inventory seems like a glittery discount as a result of its charge is low. However as an alternative of rebounding, it traps buyers through staying caught within the discount bin or falling even additional.

This may well be for any choice of causes, equivalent to deficient possibilities, underlying problems, or repeated cuts to the dividend (which undermines investor self belief). I’d say BT ticks all the ones packing containers.

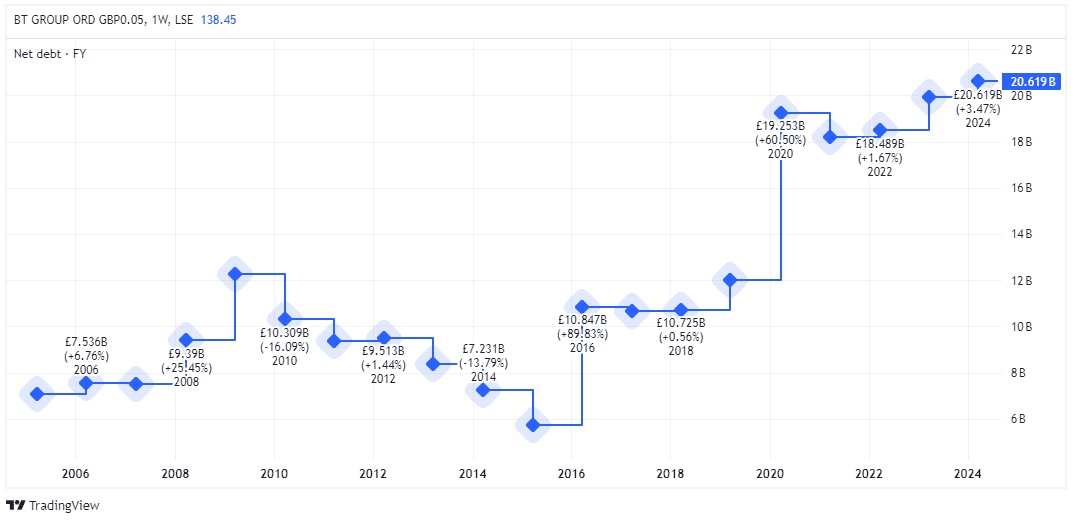

First, it’s working in a mature telecoms trade with low expansion possibilities. There’s additionally lengthy been a large underlying debt factor, whilst its long-term document of rising the dividend is just dreadful.

BT dividend in step with proportion (2005-2023)

Sensible buyers see worth

Since I ultimate regarded as BT stocks in April, they’ve soared through 32%. And so they jumped 6.2% to 138p nowadays (12 August) after it used to be introduced that Indian billionaire Sunil Bharti Mittal’s conglomerate would purchase a 24.5% stake from BT’s biggest shareholder.

Commenting at the funding, Bharti stated: “BT has a powerful portfolio of marketplace main manufacturers, high quality belongings and an skilled control workforce…BT is enjoying an important position to increase get entry to to full-fibre broadband infrastructure for hundreds of thousands of other people throughout the United Kingdom.”

This stake, valued at about £3.2bn, is clearly a favorable construction for shareholders. Curiously, the Bharti conglomerate hasn’t requested for a seat at the BT board, which is a vote of self belief within the turnaround underway through new CEO Allison Kirkby.

In June, Carlos Narrow, the Mexican telecoms billionaire, one after the other paid £400m for a three% stake in BT. So more than one trade veterans see nice worth right here. I’m now questioning whether or not I will have to get onboard too.

A FTSE 100 discount?

Having a look at BT’s earnings, the only factor it’s important to admit is that it’s remarkably constant.

| Monetary yr (finishing March) | Annual earnings |

| FY26 (forecast) | £20.9bn |

| FY25 (forecast) | £20.8bn |

| FY24 | £20.6bn |

| FY23 | £20.7bn |

| FY22 | £20.8bn |

In spite of this loss of top-line expansion, the inventory may nonetheless be a cast funding. That’s as a result of BT’s unfastened money go with the flow is predicted to support now that its huge investments in increasing full-fibre broadband have most likely peaked.

Certainly, the crowd sees normalised unfastened money go with the flow achieving £3bn through 2030, up from £1.3bn ultimate yr. That is necessary as a result of BT nonetheless has a large internet debt place of roughly £20bn.

In addition to paying down debt, this money may additionally toughen a emerging dividend. The ahead yield is these days 6% and looks well-covered.

In the meantime, the forward-looking price-to-earnings (P/E) more than one is round 7.5. That’s inexpensive than each the broader FTSE 100 and BT’s peer crew. So I will be able to see why sector buyers are licking their chops at a possible discount right here.

On the other hand, I will be able to’t forget about BT’s debt pile when this exceeds its £13.8bn marketplace capitalisation. It stays a large worry, as does stagnant earnings expansion and emerging pageant.

All issues regarded as, I reckon there are higher alternatives somewhere else for my cash.