On-chain knowledge presentations Bitcoin HODLers are nonetheless ready to promote at a cash in whilst the susceptible palms are going thru a big capitulation tournament.

Bitcoin Diamond Arms Nonetheless Very easily Promoting At A Benefit

As identified via CryptoQuant Head of Analysis Julio Moreno in a brand new submit on X, the BTC non permanent holders have capitulated right through this newest downturn available in the market.

The “non permanent holders” (STHs) make up for one of the most two major divisions of the Bitcoin userbase completed at the foundation of conserving time, with the opposite staff being known as the “long-term holders” (LTHs).

The cutoff between the 2 teams is 155 days, with traders who’ve been conserving since not up to this time falling into the STHs and the ones with extra qualifying as LTHs.

Statistically, the longer an investor holds onto their cash, the fewer most probably they turn into to promote or switch them at any level. As such, the STHs constitute the weak-minded facet of the marketplace, whilst the LTHs come with the HODLers.

All the way through the most recent crash, either one of those cohorts have proven a response, however this response has been very other between the 2. To exhibit this distinction, Moreno has made use of the “Spent Output Benefit Ratio” (SOPR) indicator.

The SOPR principally tells us about whether or not a given staff is promoting Bitcoin at a cash in or loss at this time. The metric being above 1 implies participants of the crowd are understanding income, whilst it being beneath suggests loss-taking is the dominant mode of marketing.

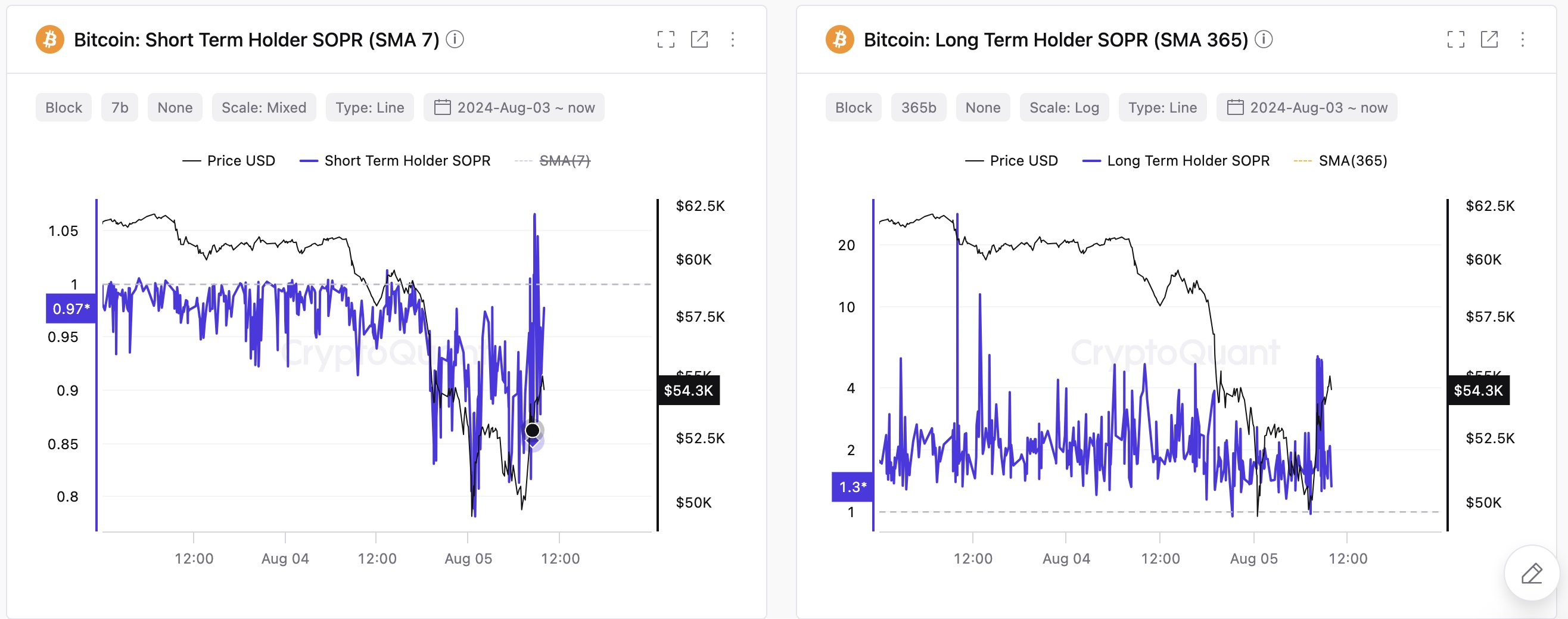

Now, here’s a chart that presentations the hot development within the Bitcoin SOPR for the STH and LTH cohorts:

The variation between the conduct of the STHs and LTHs | Supply: @jjcmoreno on X

As displayed within the graph, the Bitcoin STH SOPR has been most commonly at ranges beneath 1 right through the most recent drawdown in the associated fee, implying that those traders were promoting at a loss.

At its worst, the indicator had even fallen beneath the 0.8 mark, suggesting that the cohort have been taking a lack of greater than 20%. Obviously, those fickle-minded palms had been thrown into slightly a panic via the crash.

Whilst the STHs were capitulating, the LTHs are nonetheless collaborating in web profit-taking, because the SOPR for them has remained sturdy above the 1 degree. The indicator even reached a notable degree right through the rebound BTC noticed following its lows, suggesting that those diamond palms had offered for important beneficial properties.

Some STHs, too, had controlled to take income on this restoration, however as is visual within the chart, the metric had simplest somewhat breached the 1 mark and that too simply in brief, that means that the cash in realization hadn’t been the rest important and had lasted for just a second.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $55,000, down greater than 17% over the last week.

Seems like the cost of the coin has been sliding down just lately | Supply: BTCUSD on TradingView

Featured symbol from Dall-E, CryptoQuant.com, chart from TradingView.com