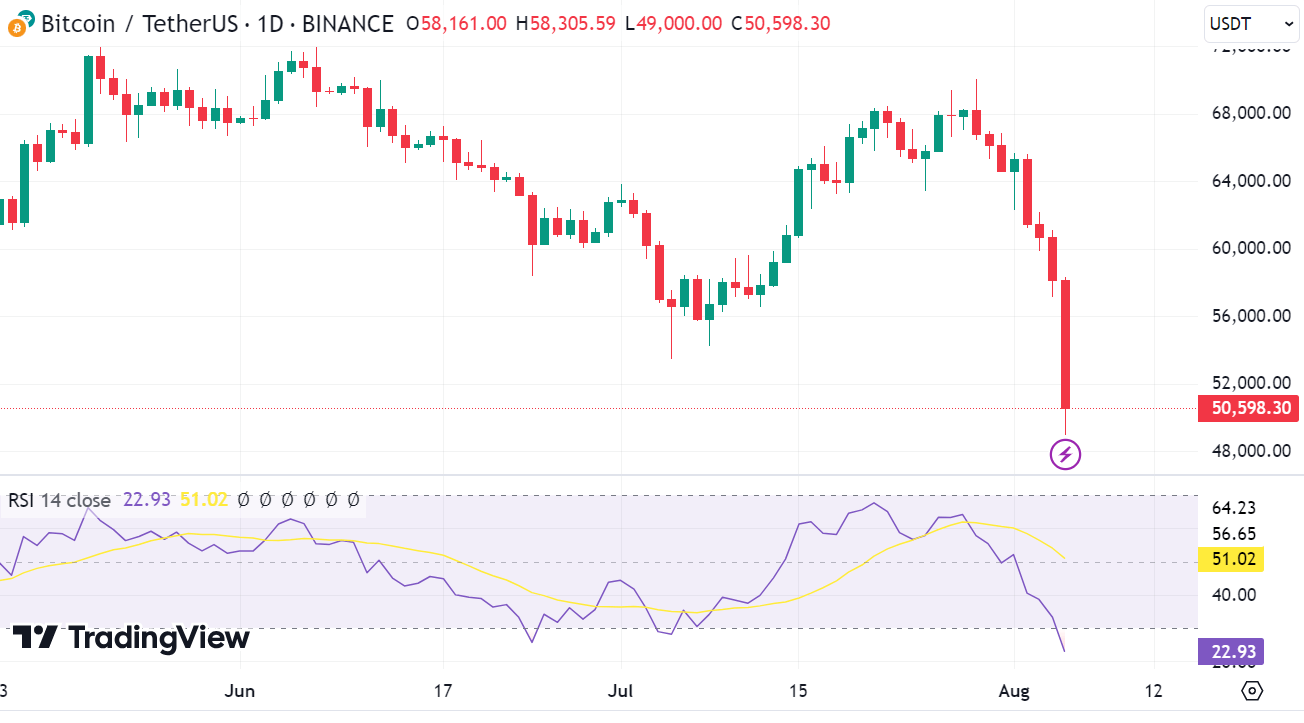

- Bitcoin in short assessments $49k ahead of rebounding to $51k amid a $270 billion crypto marketplace selloff.

- Considerations over the United States recession and Japan’s charge hike cause marketplace turmoil.

- FBI warns of emerging crypto scams right through greater marketplace volatility.

The cryptocurrency marketplace has skilled an important downturn nowadays, losing roughly $270 billion in price over 24 hours in keeping with CoinGecko information. Main this decline, Bitcoin plummeted by way of nearly 20%, achieving $49,121, its lowest degree since February at $53,091.

Ether additionally suffered a considerable drop of 21%, falling to $2,300, erasing its positive factors for the 12 months. Different cryptocurrencies like Binance’s BNB and Solana have additionally suffered vital losses.

Financial institution of Japa hikes its benchmark rate of interest

This dramatic downturn within the crypto marketplace coincided with a broader selloff in equities, in particular in Asia-Pacific markets, exacerbated by way of Japan’s Nikkei 225 falling by way of up to 7%.

The Financial institution of Japan’s determination to hike its benchmark rate of interest to the very best degree in 16 years caused this selloff, sending shockwaves thru monetary markets.

The pointy upward push within the JPY/USD is inflicting a large unwind of Yen elevate industry positions and contributing to the pointy decline in US shares. For individuals who don’t know how this works, a temporary rationalization

1) Many investors have been borrowing Eastern Yen (JPY) at low rates of interest,… %.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

The USA Nasdaq additionally slid into correction territory, marking its worst three-week stretch since September 2022, additional contributing to the decline in dangerous property, together with cryptocurrencies.

The marketplace’s response used to be influenced by way of Japan’s financial tightening and the United States Federal Reserve’s fresh movements.

Even if the Fed opted to carry its benchmark charge secure, it didn’t point out a charge minimize in September, which many marketplace professionals had expected.

This uncertainty added to the marketplace’s anxiousness, inflicting investors to worth in a 100% likelihood of decrease US base charges in September.

Considerations of a possible US recession

The selloff displays rising considerations a few attainable US recession, caused by way of softer financial information and emerging geopolitical tensions.

Tony Sycamore, a marketplace analyst at IG, highlighted that Bitcoin and different cryptocurrencies are chance property and are extremely vulnerable to marketplace volatility. He famous that Bitcoin is recently trying out the most important enhance ranges and will have to cling the $53,000 mark to stop additional declines.

Alternatively, at press time Bitcoin used to be buying and selling at $51,657, smartly underneath this enhance degree, in spite of coming round again from round $49k.

FBI problems caution

The cryptocurrency marketplace’s volatility has additionally heightened safety considerations. The FBI has issued a caution about scammers exploiting the marketplace crash to scouse borrow customers’ budget.

The FBI recommended customers to be wary of unsolicited messages or calls indicating account issues and instructed them to ensure any problems thru respectable channels. The company’s caution comes amid an important building up in crypto-related fraud and hacking incidents.

Within the first part of 2024, hackers stole just about $1.4 billion value of crypto, greater than double the quantity stolen in the similar length in 2023.

This building up is attributed to the emerging price of more than a few tokens, together with Bitcoin, Ethereum, and Solana. Ari Redbord, world head of coverage at TRM Labs, famous that whilst the protection of the cryptocurrency ecosystem has now not essentially modified, the upper price of tokens has made them extra sexy goals for criminals.

As Bitcoin and different cryptocurrencies navigate those turbulent instances, traders and customers will have to stay vigilant about marketplace stipulations and attainable safety threats.