Symbol supply: Getty Photographs

One in every of my maximum unsettling investments lately has been style store boohoo (LSE: BOO). Once I purchased into the corporate a few years in the past, it used to be nonetheless winning and I preferred its industry fashion. However the boohoo percentage worth has slumped. It’s 85% not up to 5 years in the past and sells for pennies.

Even hitting £1 would imply nearly tripling from as of late’s dismal percentage worth.

I don’t have any plans to shop for new stocks, however ought I to carry onto those I personal within the hope of a restoration?

Dangerous to worse

Earlier than making an allowance for what may just occur in long term, it’s useful to recap on why the proportion worth has crashed.

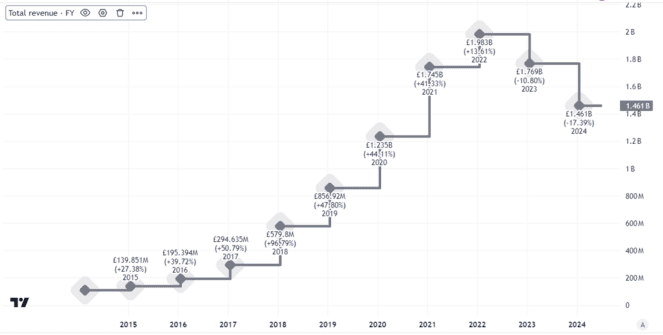

First, gross sales had been falling. What used to be as soon as a robust expansion tale has observed revenues back off.

Created the use of TradingView

Now not simplest is that regarding with regards to what it suggests concerning the corporate’s attraction to its audience, it additionally raises alarm bells about profitability. In spite of everything, rapid style is mainly a ‘pile ‘em prime, promote ‘em affordable’ industry. Boohoo has been piling gross sales much less prime than prior to, that means its mounted prices are unfold much less thinly.

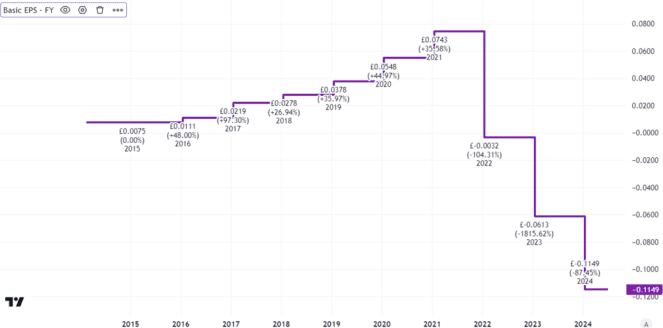

That in part explains declining profitability. In 2021, fundamental profits in step with percentage have been round a 5th of as of late’s percentage worth. Speedy ahead to closing 12 months, although, and the image used to be some distance worse.

Created the use of TradingView

The corporate, as soon as flush with money, now has nearly £100m of web debt. If it continues to lose cash, there’s a possibility it will factor extra stocks to boost budget, diluting present shareholders within the procedure.

Some grounds for optimism

And but and but. There are nonetheless some issues to love right here.

Whilst boohoo gross sales have declined, they continue to be considerable. It has a big buyer base and well-developed provide chain. In an financial system the place we’re seeing rising indicators of weakening client spending energy, I believe the inexpensive and cheerful style service provider may just receive advantages.

The industry noticed gross benefit margins build up fairly closing 12 months, to 51.8%. Running prices fell sharply.

A strategic center of attention on its 5 large manufacturers may just imply boohoo gross sales proceed to say no fairly or keep flat, however the profitability image improves. It’s concentrated on gross sales expansion and expects to generate loose money float this 12 months.

So much nonetheless to end up

The proportion worth has fallen to this point that the corporate now has a marketplace capitalisation of below part one billion kilos.

If it might probably generate loose money float this 12 months I believe that can cheer the Town. A go back to profitability may just power the proportion worth up considerably. To get again to £1 although, I believe would take greater than only a go back to profitability.

boohoo control’s popularity has been weakened by means of deficient industry efficiency lately. Whilst I’m upbeat about its potentialities, seeing the proportion worth nearly triple from right here would take robust evidence that the brand new technique is handing over on a sustained foundation.

I believe that might but occur, however see it as a long-term venture. I’d be shocked to peer boohoo stocks buying and selling even with regards to £1 this 12 months, or subsequent 12 months for that topic.