Symbol supply: Getty Pictures

Now’s a good time to head looking for affordable UK shares to shop for. Each the FTSE 100 and FTSE 250 indices are filled with best stocks that, following years of underperformance, are possibly too affordable to omit.

I’ve searched the Footsie for one of the crucial perfect bargains and feature get a hold of two outstanding choices: HSBC Holdings (LSE:HSBA) and Phoenix Staff Holdings (LSE:PHNX).

Either one of those blue-chip stocks have gigantic dividend yields north of 9%. That is important right through instances of marketplace volatility like these days, because the passive source of revenue they’ll supply may just make me a good go back even supposing their proportion costs fail to upward thrust.

Right here’s why I’d purchase them these days if I had spare money to take a position.

Discount financial institution

At 671p according to proportion, I feel HSBC can be a contender for the FTSE 100’s largest price proportion. It trades on a ahead price-to-earnings (P/E) ratio of 6.9 instances. In the meantime, its price-to-earnings enlargement (PEG) more than one stands at 0.8.

Any studying underneath 1 suggests {that a} proportion is undervalued relative to predicted revenue.

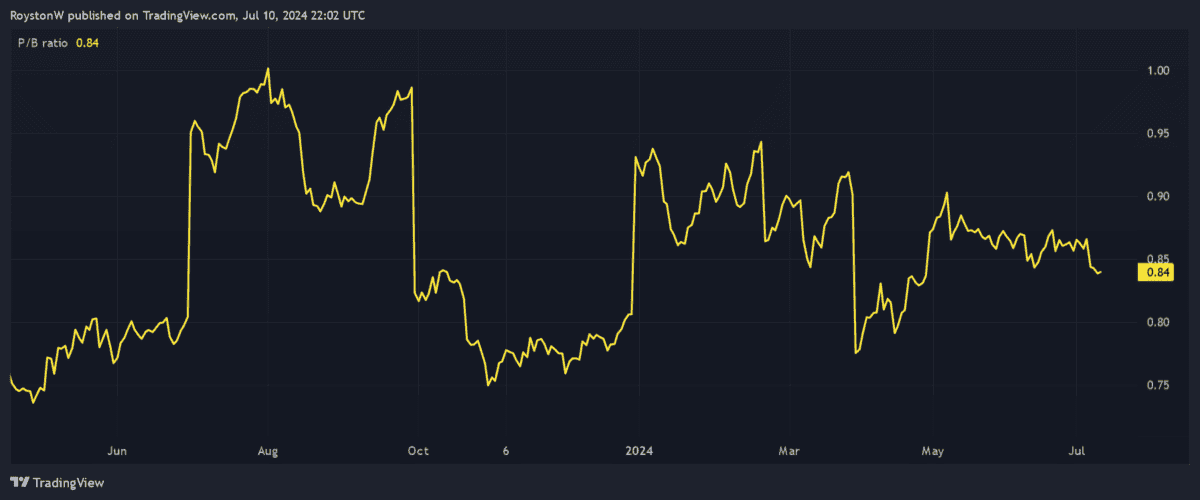

On best of this, the financial institution’s price-to-book (P/B) ratio stands at round the similar stage, suggesting it’s buying and selling at a bargain to the worth of its property. That is proven underneath.

In the end, the dividend yield on HSBC stocks stands at 9.2%. If dealer forecasts are right kind, the financial institution appears to be like more likely to be one of the crucial FTSE 100’s best 5 greatest dividend payers this yr.

I’d purchase the financial institution to money in on Asia’s emerging wealth and booming populations. HSBC is pivoting extra intently to those rising markets and it’s no wonder. Round 60% of the continent’s other people stay ‘unbanked’, offering monetary products and services corporations there with important enlargement alternatives.

At the problem, present turbulence in China’s financial system poses a danger to revenue. But HSBC’s cast steadiness sheet will have to nonetheless give it scope to stay paying massive dividends within the close to time period.

Its CET1 capital ratio rose to fifteen.2% as of March.

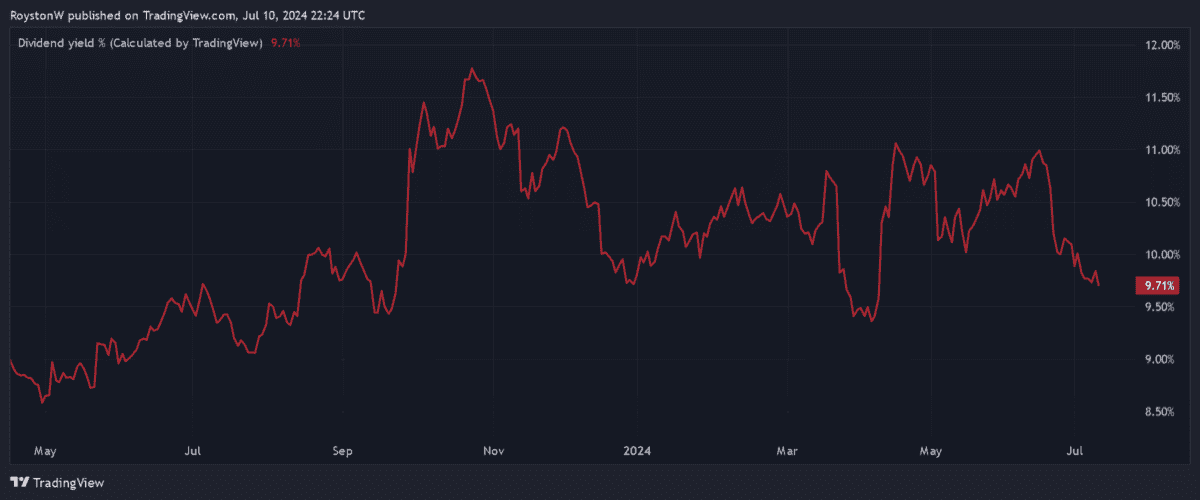

9.7% dividend yield

Phoenix Staff’s additionally predicted to be an impressive dividend supplier in 2024. Actually its yield for this yr falls simply fractionally wanting 10%, because the chart underneath displays.

The monetary products and services massive additionally looks as if very good price in the case of predicted revenue. Its PEG ratio is solely 0.2, in response to a present proportion fee of 543p.

Like HSBC, Phoenix has the chance to faucet right into a hastily rising business, albeit person who’s nearer to house. It supplies pensions, existence insurance coverage and financial savings merchandise to round 12m in the United Kingdom. This quantity has the prospective to surge as the rustic’s older inhabitants hastily expands.

I’m additionally a fan on account of the corporate’s shocking money era (this stood at a forecast-topping £2bn in 2023). This provides it the ammunition to take a position closely for enlargement in addition to proceed paying huge dividends.

Phoenix operates in a extremely aggressive business and this can be a possibility. But I nonetheless assume it’s a best price inventory to believe these days.