A well-liked crypto analyst has defined how the Bitcoin worth may well be susceptible to additional problem according to the present distribution of BTC provide round the fee.

This Bitcoin Worth Vary Holds A Essential Provide Barrier

In a contemporary publish at the X platform, outstanding crypto pundit Ali Martinez mentioned how the cost of Bitcoin may undergo extra decline. The explanation in the back of this bearish projection revolves across the moderate price foundation of a number of BTC buyers.

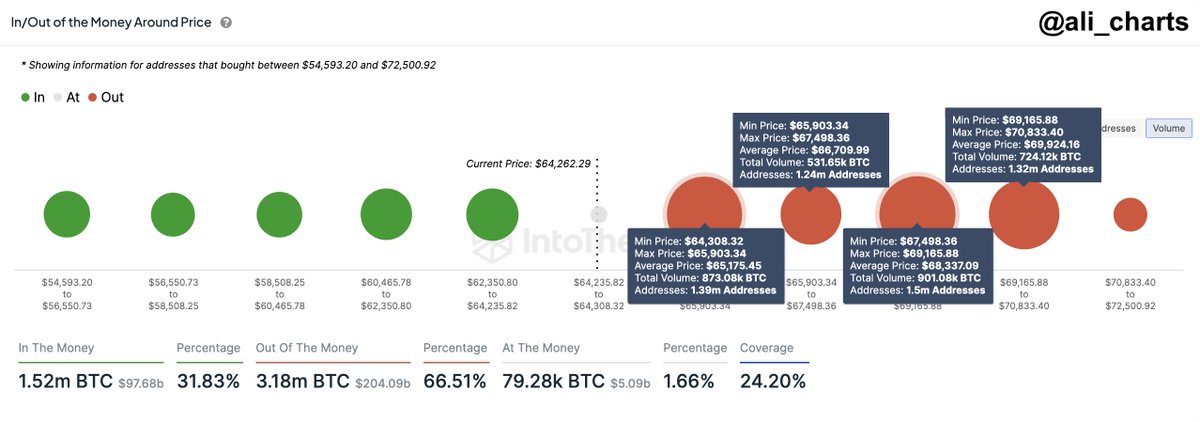

Information from IntoTheBlock displays that round 5.45 million addresses bought roughly 3.03 million BTC inside of the fee vary of $64,300 and $70,800. As highlighted by means of Martinez, this has resulted in the formation of a a very powerful provide barrier inside of this worth bracket.

For context, a provide barrier refers to a cost vary the place a considerable amount of cryptocurrency used to be received. From the scale of the dots within the graph under, it seems that that Bitcoin these days has an important provide barrier above it.

A graph appearing the distribution of BTC provide round quite a lot of worth levels | Supply: Ali_charts/X

This worth vary turns into particularly related when the Bitcoin worth falls under this stage, as BTC holders inside the provide barrier may get started promoting so as to lower their losses. This may result in intensified promoting force and probably steeper worth correction for the premier cryptocurrency.

Moreover, a large-scale offloading and steady worth decline may negatively affect the marketplace sentiment, triggering panic promoting among different buyers. If the marketing force is essential, this might upload to the downward force on the cost of BTC.

As of this writing, the Bitcoin worth stands round $64,460, reflecting an insignificant 0.2% building up previously 24 hours.

Bitcoin Miners Are Capitulating

Conventional buyers is probably not the one magnificence of individuals contributing to the marketing force going through the Bitcoin worth this present day. The most recent on-chain revelation displays that the Bitcoin miners have additionally been lively out there in contemporary weeks.

In keeping with information from IntoTheBlock, Bitcoin miners have offloaded greater than 30,000 BTC (valued at roughly $2 billion since June). This represents the quickest price of decline in BTC miners’ reserves in over a yr.

The blockchain analytics pegged this sell-off to the diminished profitability of the miners following the new halving tournament. The fourth halving tournament, which came about in April 2024, noticed the miner’s praise fall from 6.25 BTC to three.125 BTC.

The cost of Bitcoin makes an attempt to pass $65,000 at the day-to-day time-frame | Supply: BTCUSDT chart on TradingView

Featured symbol from iStock, chart from TradingView