Symbol supply: Getty Photographs

Raspberry Pi (LSE:RPI) stocks proved to be a candy addition to the London Inventory Trade in remaining week’s preliminary public providing (IPO).

Contemporary UK inventory marketplace listings have slumped to a 10-year low, however this tech corporate has attracted important investor hobby. In its first day of buying and selling, the Raspberry Pi proportion payment skyrocketed up to 40%.

So, must buyers imagine grabbing a slice of this new inventory lately?

Right here’s my take.

New child at the block

Regardless of the identify, Raspberry Pi has not anything to do with fit to be eaten treats.

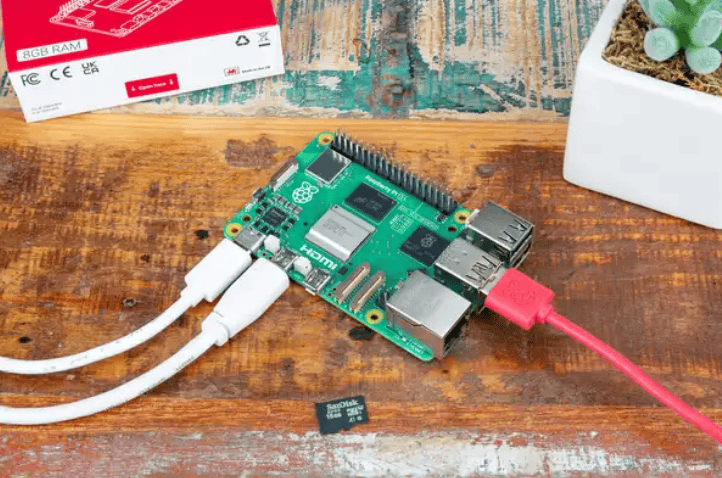

The Cambridge-based trade began lifestyles as the economic arm of a charity to advertise laptop science schooling. It’s now best-known for designing and production miniature single-board computer systems with costs beginning at simply $35.

Since its inception, Raspberry Pi’s bought an outstanding 60m gadgets. As of late, commercial consumers account for 72% of gross sales. The rest come from tech fanatics and educators.

Industrial packages for its computer systems come with sensible house units, seismometers, synthesisers, cardiology instrument screens, and a lot more.

Enlargement credentials

Strangely for a tech startup, Raspberry Pi’s already a winning undertaking with 0 debt. Closing 12 months, pre-tax cash in rose 90% to succeed in $38.2m.

It’s additionally subsidized by means of main gamers, together with the likes of Sony and ARM. Those strategic partnerships are the most important for the fledgling corporate and upload weight to the funding case.

As well as, the gang already has a fantastic stage of geographic diversification. Europe’s the most important marketplace, representing 38% of shipped gadgets, adopted by means of North The us (29%), and Asia (26%). The remainder of the sector accounts for 7%.

So as to add a cherry on most sensible, the possible marketplace alternative is massive and rising. These days, Raspberry Pi estimates its blended audience is value round $21bn.

All just right thus far, then.

Issues may just flip bitter

Then again, I’ve some considerations about making an investment within the stocks. 3 main dangers come to mind, even supposing it’s a ways from an exhaustive checklist.

First, the valuation. As I write, Raspberry Pi stocks business at a price-to-earnings (P/E) ratio round 29. The corporate has a £720m marketplace cap.

Whilst it’s no longer bizarre for tech shares to draw upper multiples, that places the company in the similar ballpark as Alphabet, Apple, and Meta.

Whether or not a inventory marketplace minnow with masses to turn out merits to business for the same P/E ratio as established US tech titans is a moot level. In brief, it doesn’t appear to be a in particular reasonable purchase to me.

2d, there are notable festival dangers. Raspberry Pi doesn’t seem to have a large moat. Arguably, there’s little preventing different corporations from consuming into its marketplace proportion with decrease costs or higher merchandise.

3rd, whilst the trade has admirable non-profit roots, I’m involved that its unswerving neighborhood of fanatics could also be dismayed by means of the verdict to head public. Balancing shareholder pursuits with an ethically-conscious fanbase received’t be simple.

An extraordinary probability to get wealthy?

Total, I believe Raspberry Pi is an interesting corporate and I am hoping it does neatly. That stated, I’ve too many doubts concerning the demanding situations it faces to speculate lately.

I believe there are higher alternatives to put money into wealth-creating shares in different places, however courageous buyers who disagree with me could be handsomely rewarded for taking at the dangers.