Symbol supply: Getty Photographs

Nationwide Grid (LSE:NG.) is continuously described as probably the most solid stocks that one can purchase for a long-term portfolio. The corporate’s popularity took a battering in Would possibly, regardless that, because it introduced a mammoth £7bn rights factor, at the side of a rebasement of the dividend, to assist it reach its inexperienced expansion technique.

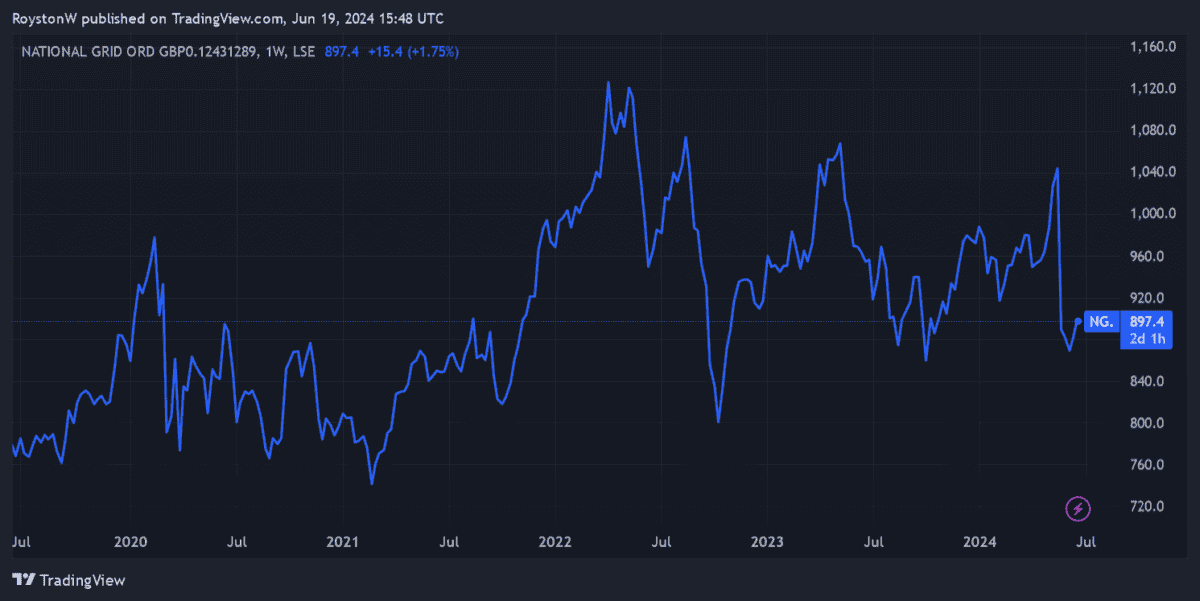

Nationwide Grid’s percentage payment plummeted 16% consequently. And it stays anchored round fresh lows as investor self assurance within the inventory has dropped.

I imagine the FTSE 100 industry is now price severe attention via percentage pickers. Listed below are 3 the reason why.

Explanation why 1: ideally suited steadiness

It’s comprehensible why Nationwide Grid stocks have slumped so badly. Percentage dilution has a tendency to be critically frowned upon via buyers.

However this isn’t all. The transmission industry is most well liked with its buyers because of its credentials as a dividend inventory. With the cost lowered, its popularity as a most sensible dividend inventory has gained a hammerblow.

But on steadiness, I imagine Nationwide Grid stays an outstanding S.W.A.N. (or Sleep Smartly At Evening) inventory. Its very important purposes imply it could possibly financial institution on stable income and powerful money flows in any respect issues of the commercial cycle.

What’s extra, below present Ofgem rules it has a monopoly on what it does. This is without doubt one of the largest financial moats (as Warren Buffett places it) {that a} industry could have to shield income.

Mixed, those qualities make Nationwide Grid stocks a good way for buyers to control chance.

Explanation why 2: going inexperienced

As that introduced rights factor displays, development infrastructure for the golf green revolution is vastly pricey. Underneath present plans, Nationwide Grid will spend £60bn all through the 5 years to March 2029. That is round double what it spent within the earlier part decade.

There’s at all times a chance that prices may just overrun, too, leading to additional rights problems or a pointy upward push in debt. On the other hand, the prospective spice up to long-term income is also impressive as call for for renewable power alternatives up.

Nationwide Grid expects its asset base to enlarge at a compound annual expansion fee (CAGR) of 10% between 2024 and 2029. With electrical energy intake in the United Kingdom tipped to double between now and 2050, this technique might be regarded as a no brainer.

Explanation why 3: surprising worth

The slumping Nationwide Grid percentage payment method the industry appears to be like ultra-cheap at this time.

At 897.4p consistent with percentage, they business on a trailing price-to-earnings (P/E) ratio of 12.8 instances. That is a ways beneath the five-year moderate, which is available in at round 19 instances.

On most sensible of this, the grid operator continues to provide a market-dividend yield, regardless of the ones plans to trim shareholder payouts. For this monetary yr (to March 2025) the yield stands at 5.4%.

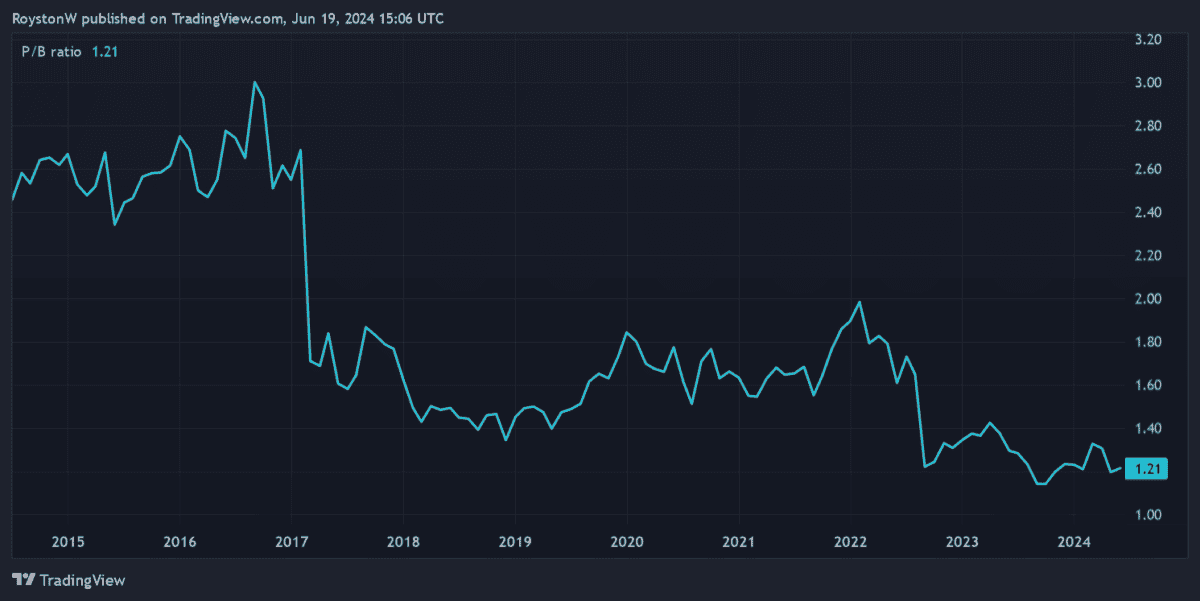

And in the end, Nationwide Grid’s price-to-book (P/B) ratio has tumbled again against overdue 2023’s troughs, as proven within the chart above. At 1.2 instances, it now fails to replicate qualities such because the company’s massive asset portfolio, regulated operations, and solid income and money flows.

Whilst it isn’t with out chance, I believe Nationwide Grid stocks are price an in depth take a look at as of late’s costs.