On-chain knowledge displays that the Bitcoin taker purchase/promote ratio has skilled an important surge on a specific crypto trade. Right here’s how it would have an effect on the cost of the premier cryptocurrency.

Bitcoin Buyers Purchasing The Dip On This Alternate

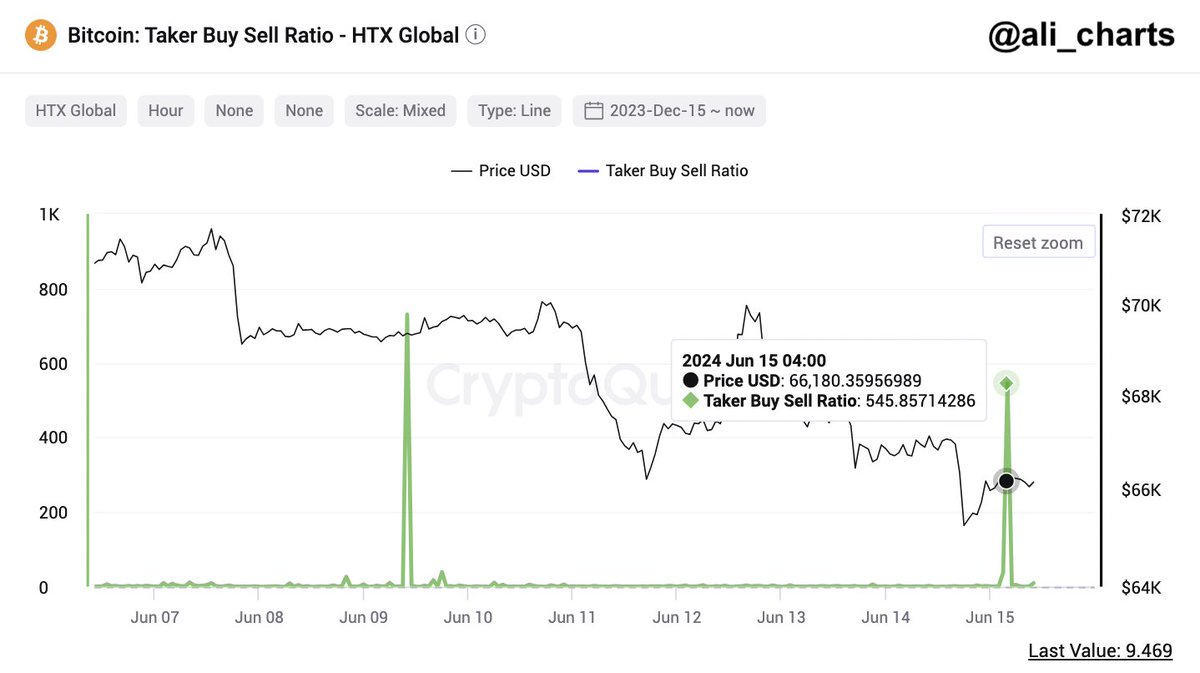

Outstanding crypto pundit Ali Martinez took to the X platform to expose that buyers on a specific trade were making the most of the new fall in Bitcoin value. The related indicator this is the taker purchase/promote ratio, which measures the ratio between the taker purchase volumes and the taker promote volumes.

Normally, when the price of this metric is bigger than 1, it signifies that the taker purchase quantity is upper than the taker promote quantity at the trade in query. On this case, extra buyers are prepared to shop for cash at a better value at the buying and selling platform.

Conversely, when the taker purchase/promote ratio is beneath 1, it implies that extra dealers are prepared to promote cash at a lower cost, indicating that the promote quantity is bigger than the purchase quantity.

Bitcoin taker purchase/promote ratio | Supply: Ali_charts/X

Consistent with knowledge from CryptoQuant, the Bitcoin taker purchase/promote ratio at the HTX Alternate (previously referred to as Huobi) lately skyrocketed to above 545 on Saturday. This implies an important build up in purchasing drive and a shift in investor sentiment.

Martinez famous in his put up on X that this spike in bullish drive can be a sign of imminent upward value motion for Bitcoin. Those top purchase volumes at the HTX trade come at the again of BTC’s fresh fall to $65,000.

Then again, it’s value noting that the common Bitcoin taker purchase/promote ratio throughout all exchanges remains to be beneath 1. On the time of writing, the price of this metric stands round 0.8.

BTC’s Moderate Mining Value Surges Above $86,500

The newest knowledge displays Bitcoin’s reasonable mining price has soared to $86,668. This determine displays the cumulative bills related to generating one BTC, together with electrical energy, {hardware}, and operational prices.

As highlighted via Ali Martinez in a put up on X, each and every important build up in BTC’s reasonable mining price is normally adopted via a corresponding build up within the coin’s marketplace price. With this ancient context, the most recent build up within the reasonable mining price suggests {that a} value build up may well be at the horizon for Bitcoin.

#Bitcoin‘s reasonable mining price is lately at $86,668.

And wager what? Traditionally, $BTC all the time surges above its reasonable mining price! %.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

As of this writing, the cost of Bitcoin continues to hover across the $66,000 mark, and not using a important alternate prior to now day. Consistent with CoinGecko knowledge, the premier cryptocurrency is down via just about 5% prior to now week.

The cost of BTC at the day by day time frame | Supply: BTCUSDT chart on TradingView

Featured symbol from Barron’s, chart from TradingView