Contemporary analyses recommend that a good portion of the capital drift into Bitcoin exchange-traded price range (ETFs) is pushed by way of arbitrage methods fairly than direct funding from retail investors.

Specifically, Raoul Good friend, CEO of Actual Imaginative and prescient, has highlighted this pattern in keeping with knowledge relating to those price range’ possession and buying and selling patterns.

Institutional Involvement And Marketplace Actions

Actual Imaginative and prescient CEO Raoul Good friend highlighted the predominance of arbitrage actions within the present Bitcoin spot ETF surroundings. His observations are sponsored by way of analyses indicating that round two-thirds of the web inflows may also be attributed to arbitrage buying and selling, in particular some of the most sensible institutional holders of those price range.

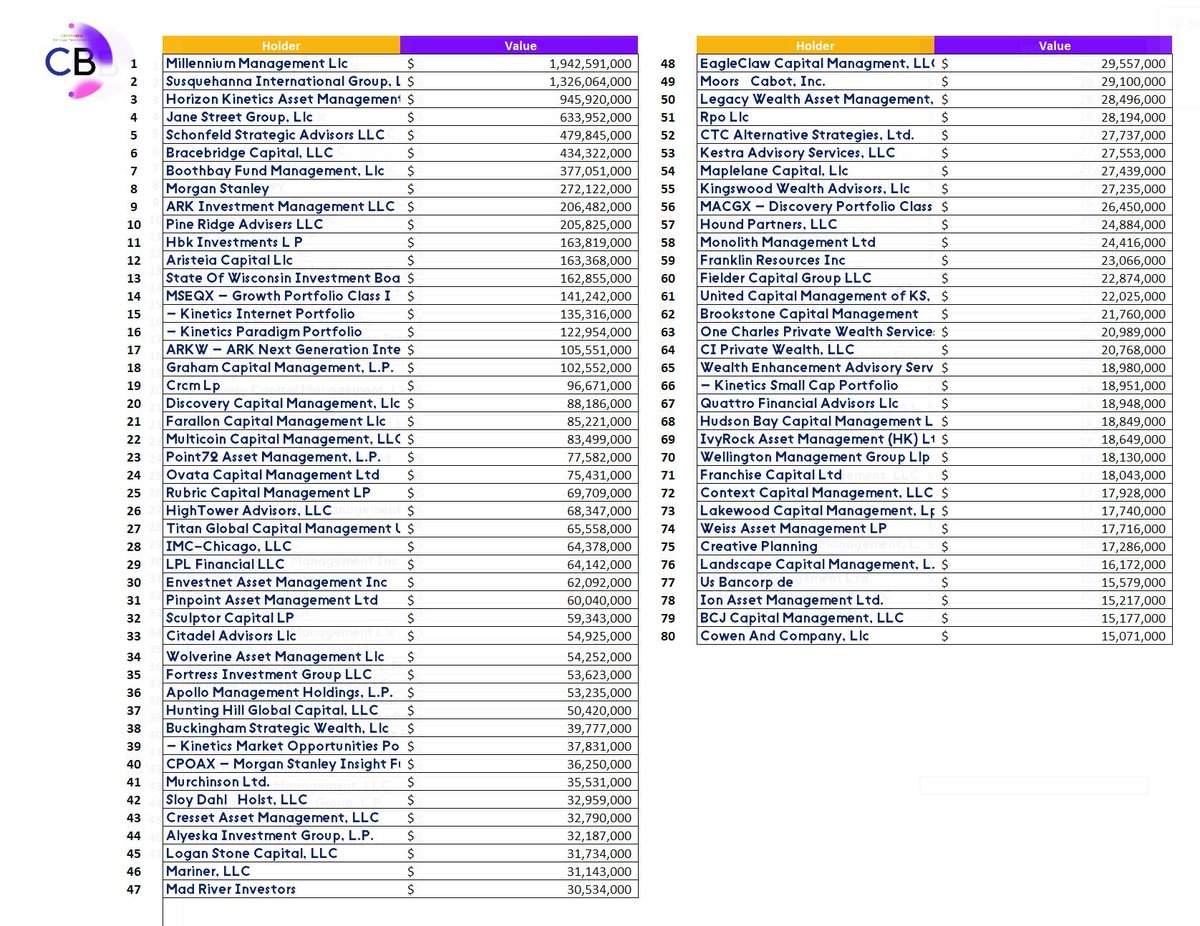

Upon analyzing the behaviors of the biggest holders of Bitcoin spot ETFs in america, it’s transparent that hedge price range and big institutional traders play a pivotal position.

Information shared by way of Tom Dauvley, a managing spouse at MV Capital, displays that the highest 80 holders, essentially hedge price range, arrange property amounting to roughly $10.26 billion of the overall $15.42 billion in web inflows, representing an important focus of marketplace energy.

Millennium Control is the biggest unmarried holder, with investments unfold throughout a couple of ETF issuers, together with outstanding names like Bitwise, Grayscale, Constancy, BlackRock, ARK, and 21Shares.

Consistent with Good friend, the character of those inflows issues predominantly against arbitrage. Arbitrage in ETFs comes to capitalizing at the worth discrepancies between the ETF’s web asset price and the underlying Bitcoin worth.

Regardless of those observations, there may be debate about how arbitrage influences general ETF flows. Some marketplace individuals, like Joseph B., a crypto dealer, argue that arbitrage would possibly represent lower than 15% of overall flows when taking into consideration the wider spectrum of US Bitcoin ETFs, which jointly arrange over $42 billion in property.

Hmmmm don’t essentially agree. Excl GBTC, there may be 605,000 BTC ($42 Billion)in ETFs

Quick pastime at the CME (The one position establishments can be doing their foundation business?) has about 91,000 in BTC ($6 Billion) shorts.

The hot inflows may indubitably be attributed to the…

— Joseph B (@Packin_Sats) June 11, 2024

Arbitrage Dominates Bitcoin ETF Panorama

These days, BTC is priced at $69,523, having higher by way of 3.5% within the remaining 24 hours after a up to date CPI document indicating a slowing down in inflation in the United States. Significantly, this efficiency from BTC marks a restoration from a week-long decline in price.

Earlier than this worth transfer, US spot Bitcoin ETFs noticed vital web outflows, with a complete of $200 million withdrawn on Tuesday, proceeding a trend from previous this week that halted a streak of web inflows.

Grayscale’s Bitcoin Accept as true with (GBTC) skilled the absolute best withdrawals of kind of $121 million, whilst Ark Make investments’s ARKB reported $56 million in web outflows.

Information from SoSoValue additionally displays that Bitwise’s BTC ETF (BITB) noticed a $12 million go out, and each Constancy and VanEck famous smaller outflows within the unmarried digits. In the meantime, BlackRock’s IBIT didn’t document any web flows that day.

Up to now, the streak of continuing web inflows into the 11 U.S. spot Bitcoin ETFs concluded on Monday after 19 days, leading to outflows of just about $65 million. From their inception in January, those ETFs have cumulatively gathered web inflows totaling $15.42 billion.

Featured symbol created with DALL-E, Chart from TradingView