Symbol supply: Getty Photographs

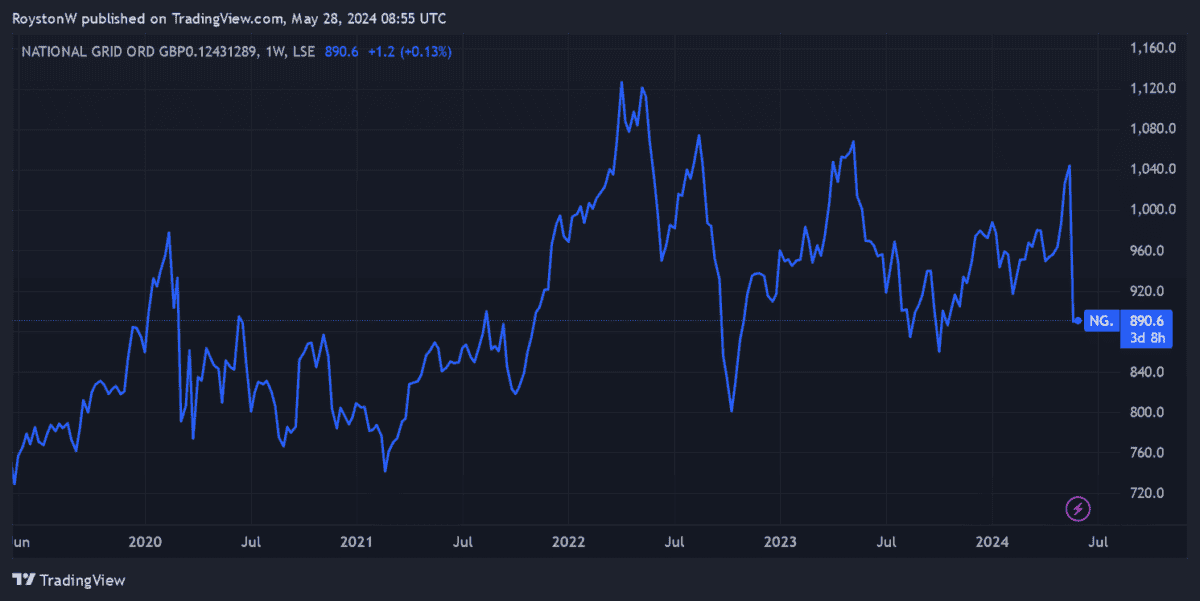

Nationwide Grid‘s (LSE:NG.) stocks were on a wild journey in fresh days. Information of a £7bn rights factor on Thursday (23 Might) began a hunch that persevered within the run-up to the Financial institution Vacation weekend.

Call for for the FTSE 100 application’s stocks have stabilised as of late. Certainly, it’s recently the second-most bought proportion amongst Hargreaves Lansdown buyers, reflecting wholesome pastime from dip consumers.

I’m taking an in depth have a look at Nationwide Grid following its proportion fee cave in. And I’m asking: is now the time to load up in this beaten-down blue chip?

Double whammy

Nationwide Grid is a sufferer of its recognition as a in large part drama-free funding. This went up in flames remaining week following information of a £7bn rights factor that may building up the proportion rely by way of kind of 29%.

Underneath the plans, present shareholders will have the ability to purchase seven stocks for each and every 24 they already personal. At 645p, those new stocks will probably be made to be had at a vital bargain to the corporate’s pre-update fee.

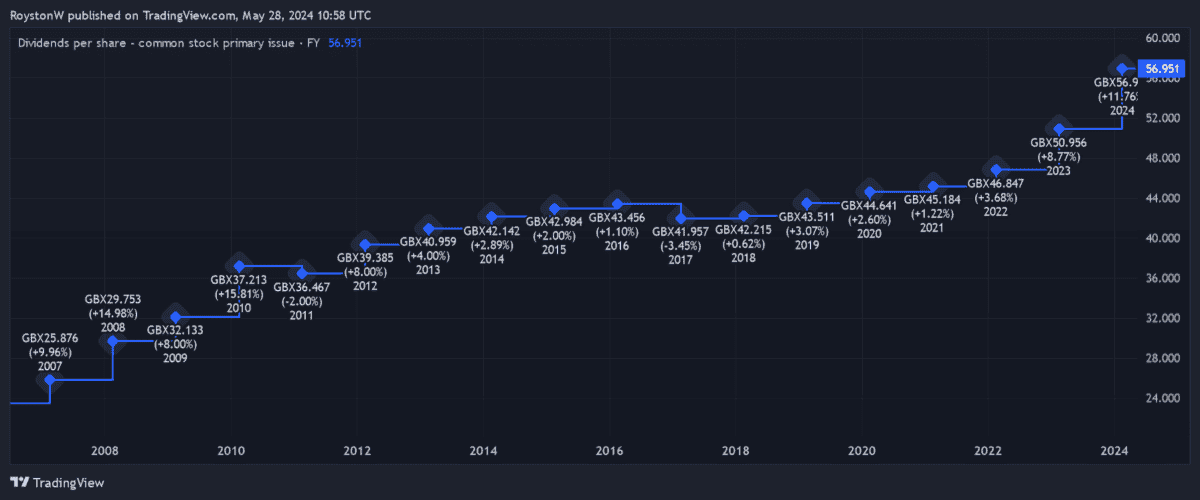

The putting can even have implications at the company’s dividends, Nationwide Grid mentioned. Whilst vowing to proceed its innovative payout coverage, the dividend for remaining yr (to March 2024) will probably be rebased to mirror the issuance of the ones new stocks.

The putting will lend a hand the industry reach upper expansion within the coming years, it mentioned. The industry plans to spend £60bn on infrastructure thru to monetary 2029 to facilitate the power transition in the United Kingdom and US.

Dear industry

Making an investment within the inexperienced transition is greatly dear industry, as the corporate’s new spending plans display. In truth, holding the United Kingdom’s pylons, substations, and different vital {hardware} in operating order is normally extraordinarily pricey.

It will have large implications for annual revenue, and leads to the industry having prime debt ranges. It additionally raises the possibility of additional proportion issuances afterward down the road.

Taking a look longer term

However Nationwide Grid additionally has monumental long-term revenue possible because the decarbonisation of the facility grid rolls alongside. And that is extremely sexy to me.

Underneath its 2024-2029 funding plan, the corporate intends to develop its asset base at a compound annual fee of 10%. It’s assured that underlying revenue according to proportion will upward push between 6% and eight% once a year consequently.

This would give you the bedrock for Nationwide Grid to proceed paying a big and extending dividend to its shareholders. The corporate already has a powerful report of long-term dividend expansion, because the chart under displays.

Right here’s what I’m doing

Nationwide Grid’s new plans have larger execution chance and created uncertainty over near-term returns. On the other hand, in addition they have the possible to seriously spice up shareholder returns all over the following decade and past.

And as of late is usually a just right time for buyers to shop for into this tale. It undoubtedly provides sexy price for cash following that aforementioned fee hunch.

Nationwide Grid’s ahead price-to-earnings (P/E) ratio of eleven.2 instances is now neatly under its five-year moderate of 16.2 instances.

At present costs of 885p, I feel the utilities large is price critical attention from price buyers like me.