On-chain knowledge presentations that the Ethereum replace internet flows were extremely certain not too long ago, an indication that promoting is also happening out there.

Ethereum Trade Netflows Have Noticed A Spike Not too long ago

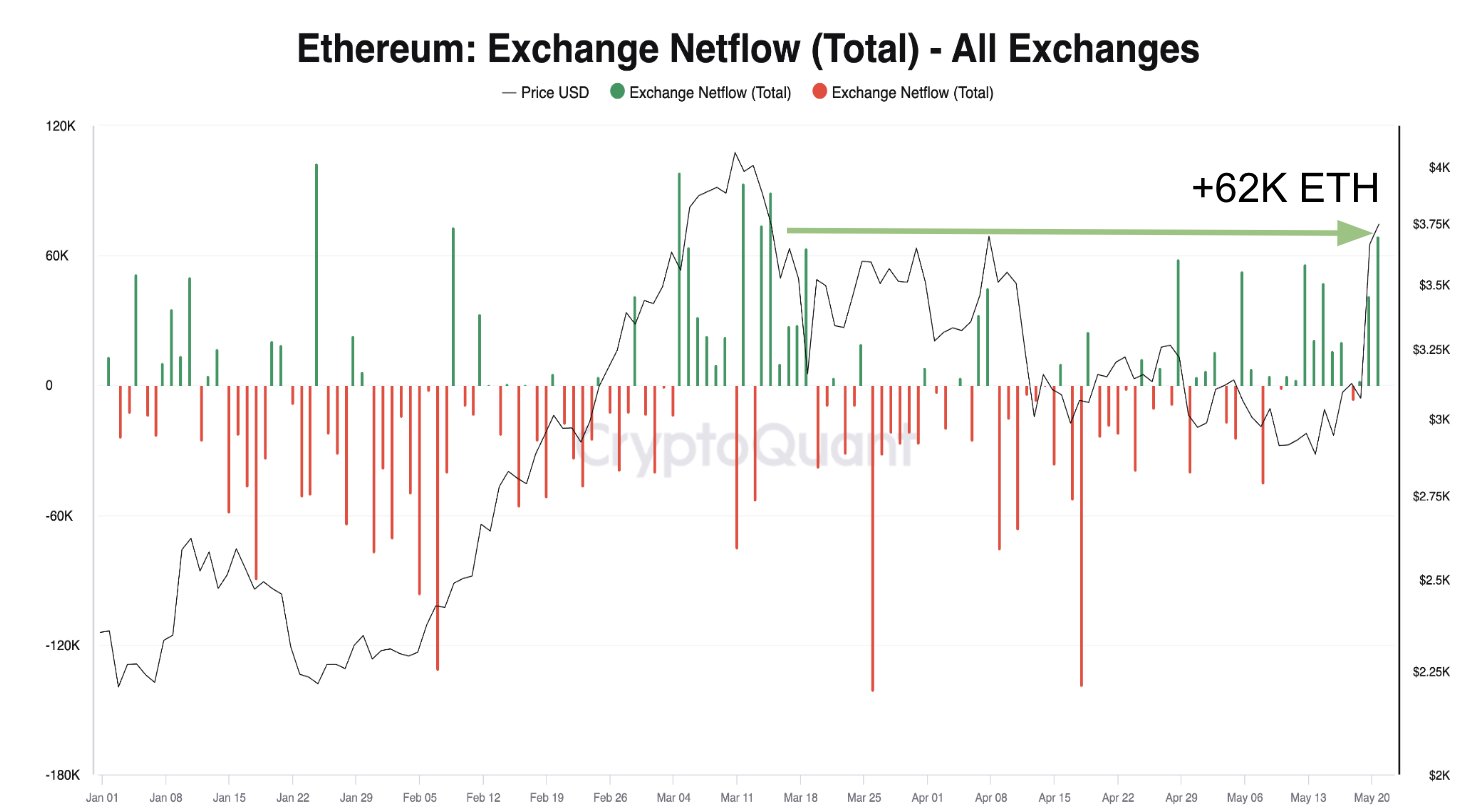

In a brand new put up on X, CryptoQuant head of analysis Julio Moreno mentioned the newest pattern in Ethereum’s replace netflow. The “replace netflow” right here refers to an on-chain metric that assists in keeping observe of the web quantity of ETH transferring into or out of the wallets of all centralized exchanges.

When this metric’s price is certain, it signifies that those platforms are receiving a internet choice of cash presently. As probably the most major causes holders may deposit cash to exchanges is for selling-related functions, this pattern can doubtlessly bearish penalties for the asset’s value.

However, the indicator’s unfavorable studying means that exchange-associated wallets are staring at internet withdrawals recently. Traders is also transferring their cash clear of the custody of those central entities for long-term maintaining, so the sort of pattern would possibly end up to be bullish for the cryptocurrency.

Now, here’s a chart that presentations the fad within the Ethereum replace netflow over the previous couple of months:

The price of the metric seems to were moderately top in fresh days | Supply: @jjcmoreno on X

The above graph presentations that the Ethereum replace netflow has registered some massive certain spikes not too long ago. Those internet deposits were of a scale best noticed in March. In step with Moreno, those deposits have most commonly been headed in opposition to Binance and Bybit.

As discussed earlier than, internet replace inflows can point out that promoting is happening out there, even though this doesn’t essentially must be the case. Occasionally, massive deposits use probably the most different services and products those platforms supply, like derivatives contracts.

Regardless of the case, although, volatility does have a tendency to upward thrust following massive deposits. The chart presentations that the rally best again in March noticed the indicator think top values as buyers participated in profit-taking.

Not too long ago, Ethereum has noticed a pointy surge, fueled via certain information surrounding the spot exchange-traded price range (ETFs). Given this rally, it’s imaginable that profit-taking would possibly as soon as once more be the objective in the back of the certain internet flows.

To this point, although, ETH has controlled to stave off this attainable selloff, as its value has remained fairly top. It’s unsure, alternatively, how lengthy call for can proceed to take in the imaginable promoting drive if deposits proceed to go with the flow into those platforms within the coming days.

ETH Value

Ethereum began a transfer up all the way through the previous day as its value breached the $3,950 mark. The upward push best lasted in brief, although, because the asset returned beneath the $3,800 degree.

Seems like the cost of the asset has noticed a surge over the previous couple of days | Supply: ETHUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com