Information reveals a mass quantity of quick contracts have seen liquidation in crypto derivatives through the previous day following Bitcoin’s rally above $66,000.

Bitcoin Restoration Has Triggered Giant Derivatives-Associated Liquidations

In line with knowledge from CoinGlass, the cryptocurrency market as an entire has noticed a considerable amount of liquidations on the derivatives aspect over the past 24 hours.

“Liquidation” right here naturally refers back to the course of that any contract undergoes after accumulating losses of a sure diploma, the place its platform has to shut it up forcibly. Under is a desk that reveals the overall quantity of liquidation over the previous day.

Appears to be like like a considerable amount of contracts have been flushed throughout this era | Supply: CoinGlass

As is seen, greater than $135 million in cryptocurrency derivatives contracts belonging to over 52,000 merchants had been liquidated throughout this window.

This derivatives flush has disproportionately affected the quick holders, as $93 million of their contracts had been caught in it. In additional concrete phrases, 68.4% of the liquidations concerned the shorts. That is pure as a result of Bitcoin and different property have seen inexperienced returns up to now day.

Greater than $42 million longs nonetheless managed to get liquidated regardless of the optimistic efficiency, suggesting that speculators jumped on with overleveraged positions when the surge befell. Nonetheless, they arrived too late and located liquidation when the preliminary leg-up cooled off.

As is normally the case, Bitcoin-related contracts contributed probably the most to this liquidation occasion, because the heatmap under suggests.

The breakdown of the liquidations by image | Supply: CoinGlass

BTC’s $47 million liquidations considerably outweighed Ethereum’s this time, whose $16 million determine is extra much like Solana’s $12 million share. This may recommend the urge for food for hypothesis round ETH has been unusually low not too long ago.

A mass liquidation occasion like at the moment’s is popularly often called a “squeeze.” Throughout a squeeze, a pointy swing within the value triggers a lot of liquidations, which solely feed again into the worth transfer, thus unleashing a cascade of liquidations.

The shorts noticed probably the most liquidations the previous day, so the occasion can be known as a brief squeeze. Traditionally, such giant liquidations haven’t precisely been uncommon within the cryptocurrency market.

It is because most cash will be fairly unstable, and hypothesis is rife. Overleveraged positions will be fairly dangerous on this market, so it’s not shocking that when volatility like at the moment’s emerges, many merchants get caught off guard.

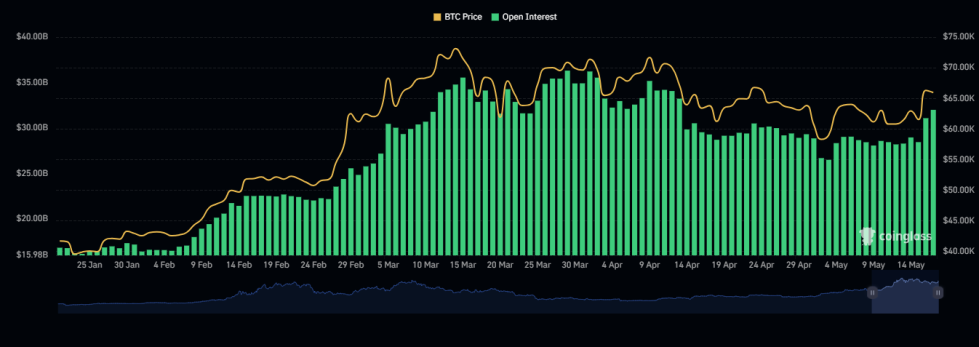

The warning indicators that liquidations would pop up had already appeared when the surge started yesterday, because the Bitcoin futures Open Curiosity, a measure of the overall quantity of open positions, had proven an increase.

The worth of the metric seems to have gone up over the previous couple of days | Supply: CoinGlass

The chart reveals that Open Curiosity continues to be excessive even after the surge, suggesting that the squeeze hasn’t been capable of delay the speculators.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $66,000, up 8% over the previous seven days.

The value of the coin appears to have shot up over the past day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CoinGlass.com, chart from TradingView.com