Information suggests the hype across the new Bitcoin Runes has severely dropped, one thing that’s not a superb signal for miner revenues.

Bitcoin Halving Impact Settles In On Miner Income As Runes Curiosity Drops

Just a few days again, the much-anticipated Bitcoin Halving went by. Halvings are periodic occasions coded into the blockchain by which the BTC block rewards are lower precisely in half. They happen each 4 years, and the latest one was the fourth such occasion.

The block rewards, which the Halvings drastically have an effect on, are one of many two principal methods miners make revenue. Miners obtain these rewards as compensation for fixing blocks, which have traditionally additionally been their dominant income supply.

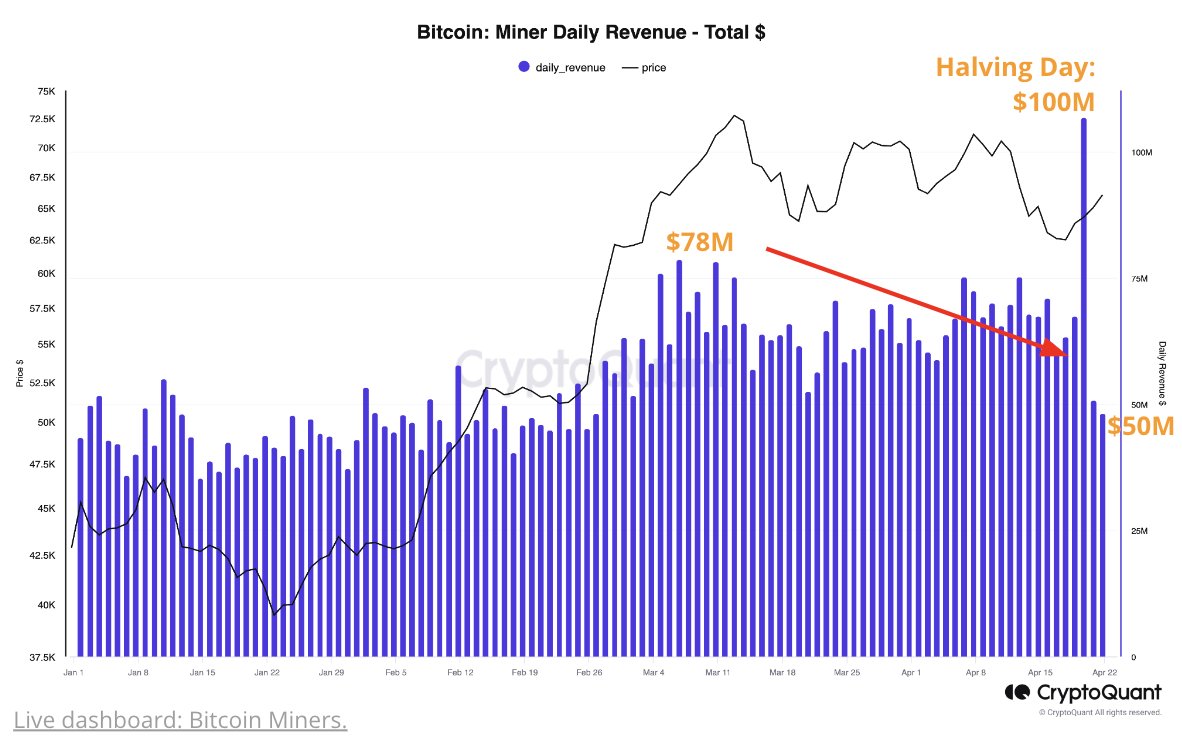

As such, the Halvings might be troublesome for this group’s financials, as their income undergoes a major drop following them. Nevertheless, shortly after the most recent Halving, miner revenues spiked to a file $100 million.

The block rewards had been lower in half with the occasion, however on the identical time, their second revenue stream, the transaction charges, noticed an explosion, serving to whole income go up reasonably than down as might usually be anticipated.

This spike in charges is because of one other main improvement on the community on Halving Day: the discharge of the Runes protocol. This protocol offers a strategy to mint fungible tokens on the Bitcoin blockchain.

Fungible tokens are indistinguishable from one another, similar to how particular person BTC satoshis (sats) are additionally usually precisely the identical. Alternatively, distinctive tokens are often known as non-fungible tokens (NFTs).

The Runes immediately discovered reputation amongst customers, and community utilization sharply elevated. The transaction charge is often tied to community exercise, so it additionally went up when this new protocol dropped.

That is naturally as a result of in instances of excessive visitors, transfers can get caught in ready because of the community’s restricted capability to deal with them, so customers don’t have any alternative however to pay a excessive charge if they need their strikes by faster.

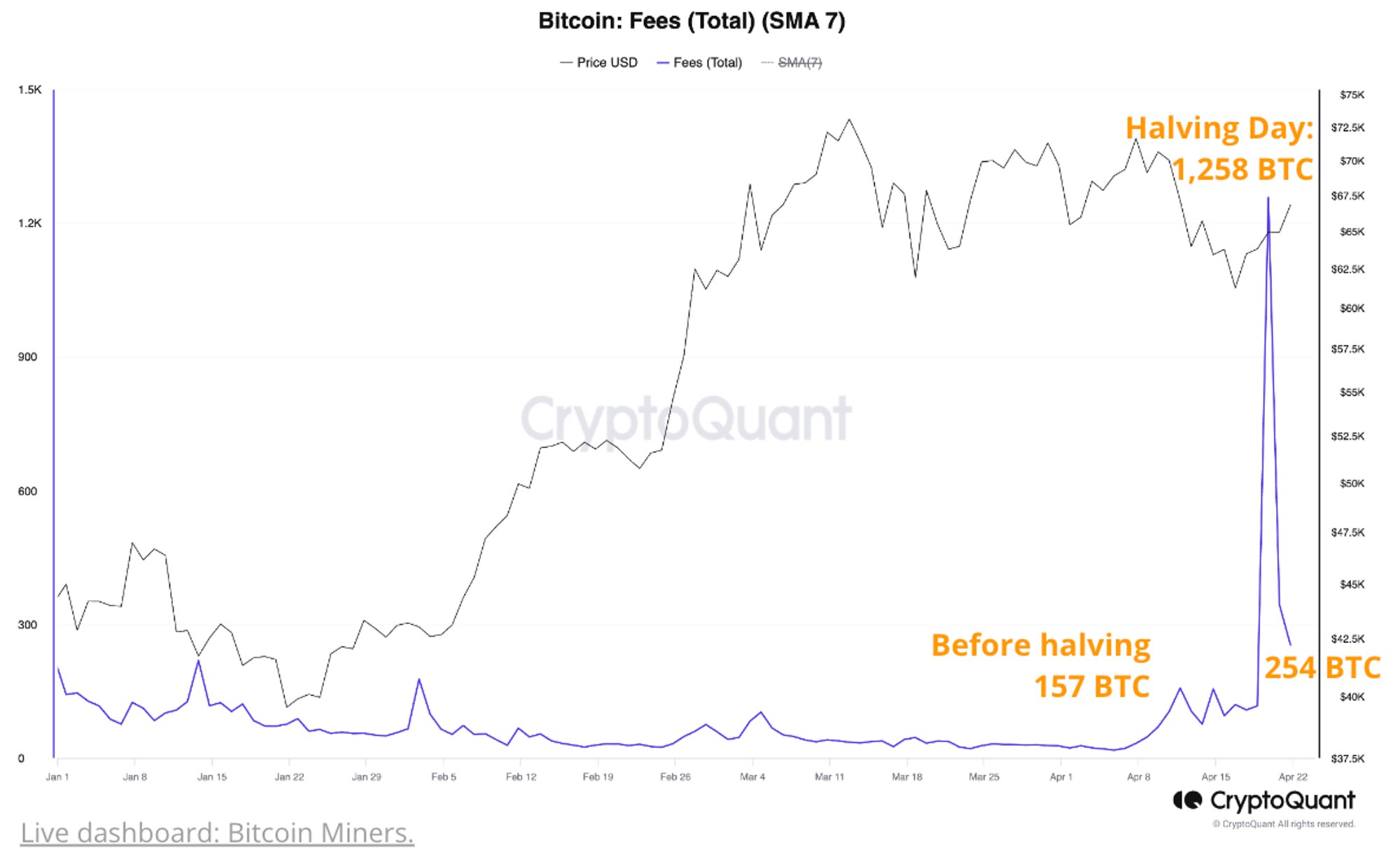

Information shared by the on-chain analytics agency CryptoQuant exhibits that the overall transaction charges exploded because of the excessive curiosity the Runes obtained upon launch.

The worth of the metric appears to have been fairly excessive in current days | Supply: CryptoQuant on X

The chart additionally exhibits that the indicator has cooled off since this extraordinary peak. Thus, whereas the Runes had been fairly widespread at launch, curiosity in them has already waned.

Consequently, Bitcoin mining revenues, which had been extraordinarily excessive post-Halving, have additionally fallen.

Seems just like the miner income has taken a deep hit up to now few days | Supply: CryptoQuant on X

Bitcoin miner income is now right down to $50 million, half of the $100 million peak from earlier. Subsequently, whereas the Runes had quickly positioned miners in a snug place, that line of help is now gone, and these chain validators are beginning to come beneath stress.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $63,900, down over 1% up to now seven days.

The value of the asset seems to have plunged over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, CryptoQuant.com, chart from TradingView.com