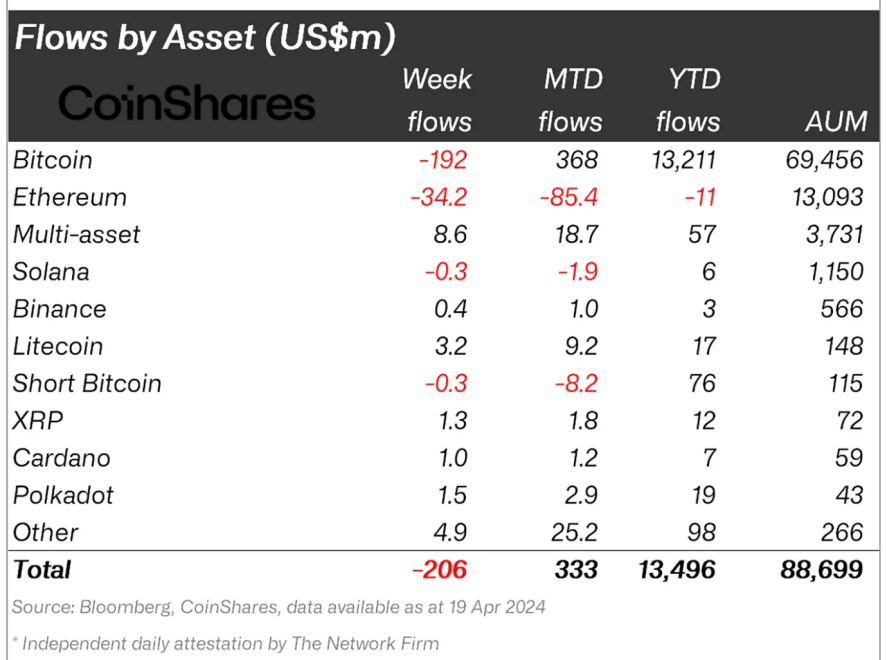

International crypto funding merchandise noticed a web outflow of $206 million final week, reflecting investor considerations over the “potential impacts of Federal Reserve coverage selections on rates of interest,” as reported by Coinshares.

International Affect Of Crypto Outflows On Bitcoin ETFs And Market Quantity

CoinShares revealed that the recorded web outflow of $206 million marks the second consecutive week of outflows, pushed by expectations that the Federal Reserve will preserve excessive rates of interest for an prolonged interval.

The outflows had been notably notable in crypto funding merchandise provided by asset managers reminiscent of Ark Make investments, Bitwise, Constancy, Grayscale, ProShares, and 21Shares.

CoinShares Head of Analysis James Butterfill famous:

The info suggests urge for food from ETP/ETF buyers continues to wane, possible off the again of expectations that the FED is more likely to hold rates of interest at these excessive ranges for longer than anticipated.

Curiously, world exchange-traded merchandise noticed a slight decline in buying and selling quantity final week, totaling $18 billion, which accounted for 28% of the overall Bitcoin buying and selling quantity. This determine marks a lower from the 55% noticed a month in the past.

The online outflows within the US spot Bitcoin ETFs considerably contributed to the worldwide weekly outflow, reaching $204.3 million.

Nevertheless, amidst this pattern, BlackRock’s IBIT emerged as the only real spot for Bitcoin ETFs to maintain weekly inflows. It garnered $165.4 million in inflows, prolonging its streak to 69 consecutive days earlier than the Bitcoin Halving.

Waking up on 4/20 to see $IBIT took in money for the 69th straight day, which was additionally the halving. It’s somewhat too excellent https://t.co/7Z8W3t9L7h

— Eric Balchunas (@EricBalchunas) April 20, 2024

Area-Based mostly Crypto Fund Flows And Market Tendencies

In line with the coinshares report, including crypto futures merchandise in the US led to whole web outflows of $244 million final week.

Conversely, Canada and Switzerland-based funds noticed web inflows of $30 million and $8 million, respectively. International Bitcoin funds accounted for $192 million of the overall web weekly outflows.

Notably, short-Bitcoin merchandise skilled minimal outflows of $300,000 regardless of the outflows, indicating that few buyers noticed this as a chance to brief, in line with Butterfill.

Moreover, Ethereum-based funding autos carried on with their outflow streak for the sixth consecutive week, with $34 million in outflow. Then again, Litecoin and Chainlink merchandise noticed inflows of $3.2 million and $1.7 million, respectively.

In the meantime, blockchain equities confronted an eleventh consecutive week of outflows totaling $9 million. James Butterfill states that is so “as buyers proceed to fret over the implications of the halving on mining corporations.”

Amidst these fund flows, the general crypto market has proven a slight uptick prior to now 24 hours. Bitcoin, the most important crypto by market capitalization, recorded a 1.2% improve, whereas Ethereum, the second-largest, noticed practically 1% progress over the identical interval.

This value motion coincided with Bitcoin’s fourth halving on April 20, lowering miners’ block subsidy rewards from 6.25 BTC to three.125 BTC.

Featured picture from Unsplash, Chart from TradingView