Symbol supply: Getty Pictures

Hundreds of thousands of Britons make investments for a 2nd source of revenue. We make investments, preferably thru a Shares and Stocks ISA, over a protracted time period with the purpose of establishing a portfolio that’s big enough to sustainably generate an source of revenue. It doesn’t occur in a single day, however after all, it’s price it.

So, why £27,500? Smartly, in keeping with information from the Annual Survey for Hours and Profits (ASHE) by means of the Place of work for Nationwide Statistics (ONS), the online moderate per month income (that is after tax) are £2,297 (or £27,573) in the United Kingdom.

Right here’s the way it may well be completed by means of making an investment.

Enjoying the lengthy sport

In an effort to generate £27,500 a yr from a Shares and Stocks ISA, any individual wishes £550,000 invested and to reach a 5% annualised dividend yield. Now, this would possibly sound a like a troublesome ask, particularly if we’re ranging from not anything. However I guarantee you, it’s solely possible.

There are many hypothetical or mathematical techniques of having to £550,000. Alternatively, all of those equations require traders to make constant contributions and to reinvest the proceeds of capital good points and dividends.

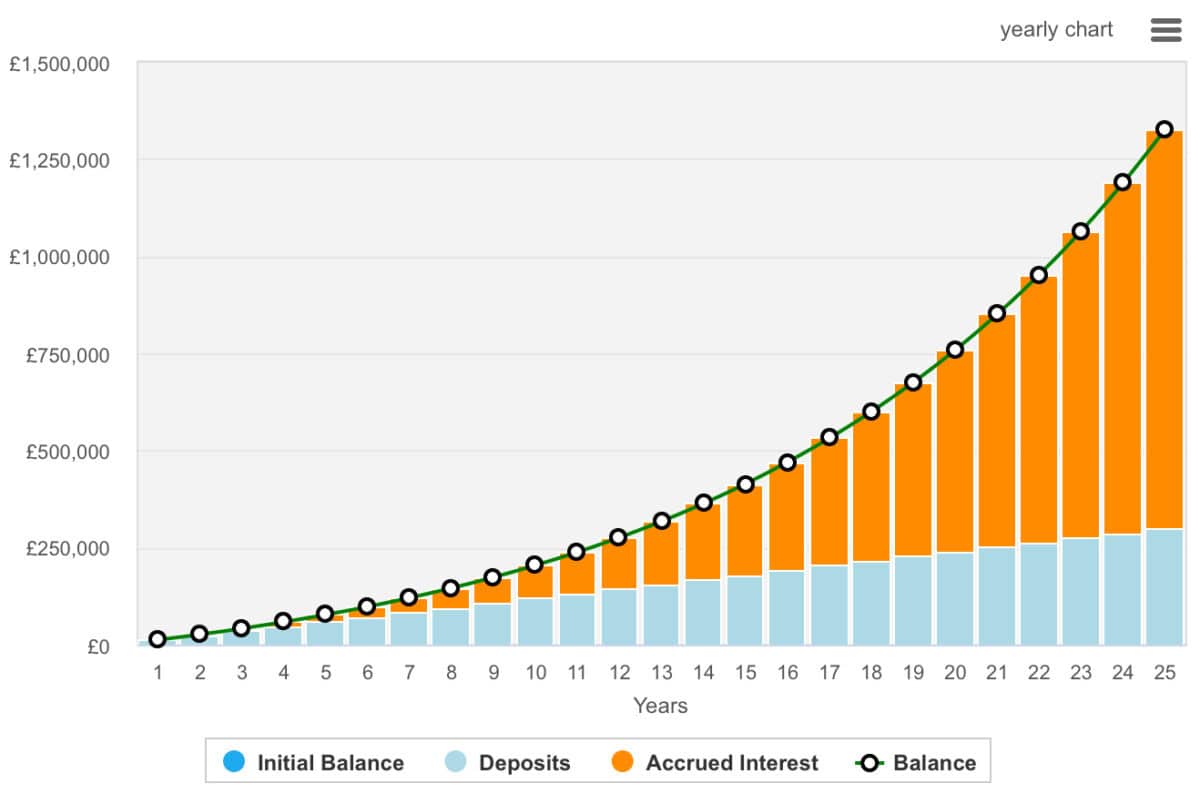

On this instance, a £550,000 portfolio may well be completed by means of making an investment £1,000 monthly whilst reaching an annualised go back of 10% over 17.5 years. At this level, an investor may just transfer to a dividend-focused portfolio, or bonds, to be able to take a tax-free 2nd source of revenue.

Alternatively, we must take into account the ability of compounding. If an investor continues with the tactic for an extended time period, the speed of enlargement would enlarge.

Please be aware that tax remedy depends upon the person cases of each and every shopper and is also topic to switch in long run. The content material on this article is supplied for info functions simplest. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for sporting out their very own due diligence and for acquiring skilled recommendation ahead of making any funding selections.

Investments to believe

In fact, there’s a caveat. Make investments poorly and folks will lose cash. With this in thoughts, newbie traders are generally urged to take a varied way. This regularly method making an investment in an index tracker — a fund that targets to copy the efficiency of an index.

Alternatively, some actively controlled budget or trusts may just give traders a greater probability of thrashing the marketplace. One way to believe may well be Berkshire Hathaway (NYSE:BRK.B). It’s neither a fund nor agree with, however a conglomerate with companies in railroads and insurance coverage, and inventory holdings in corporations like Apple, American Categorical, and Visa. Briefly, it invests within the spine of the American economic system.

Whilst we’re lately seeing turmoil in US markets amid Trumpian uncertainty and recession fears, Berkshire Hathaway inventory hasn’t been offered off. That would possibly sound odd for an organization that’s so tightly connected to the United States economic system. However there’s a excellent explanation why. The industry has been slowly promoting positions in its holdings over the last 18 months. Amazingly, it now has $334bn in money.

Buyers were wondering why the Warren Buffett-controlled corporate has been turning to money. Alternatively, with a recession turning into much more likely and because of an enormous selloff in US shares, Buffett is also smartly situated to make strategic acquisitions or begin new positions in shares.

In fact, there’s a chance with Berkshire, as there may be with each and every funding. The danger is that Berkshire’s portfolio is amazingly focused on the United States economic system. Throughout Buffett’s occupation, the United States economic system has outperformed, however there’s no be sure that will proceed endlessly. Nevertheless, I’ve not too long ago transform a Berkshire shareholder myself.