- Cboe has submitted a 19b-4 submitting to be allowed to checklist and business choices on spot Ethereum ETFs.

- The proposal follows top call for for Ethereum ETFs.

- NYSE American has made a identical proposal regardless that it’s but to obtain SEC approval.

The Cboe BZX Trade has formally submitted a 19b-4 submitting to america Securities and Trade Fee (SEC), in quest of approval to checklist and business choices on spot Ethereum exchange-traded budget (ETFs).

This transfer indicates a pivotal step for Cboe against increasing investor get entry to to Ethereum, mirroring the rising call for inside the cryptocurrency marketplace.

Cboe seeks to increase its funding gear

Cboe’s proposal goals to develop the spectrum of funding gear to be had to marketplace individuals. Via permitting choices buying and selling on Ethereum ETFs, buyers would acquire an obtainable manner to interact with Ethereum’s worth actions.

The 19b-4 submitting contains budget corresponding to the ones controlled by way of Bitwise and Grayscale, particularly the Grayscale Ethereum Agree with and Grayscale Ethereum Mini Agree with, which grasp Ethereum as their number one asset.

The change posits that those choices will serve no longer handiest as every other road for buyers to achieve publicity to Ethereum but additionally as a an important hedging tool in opposition to the inherent volatility of the cryptocurrency marketplace.

Particularly, Cboe’s filling follows at the heels of a identical proposal by way of NYSE American, which has but to obtain SEC approval, with the regulator mentioning considerations over marketplace manipulation, investor coverage, and making sure an even buying and selling surroundings.

The SEC’s hesitance is rooted in Phase 6(b)(5) of the Securities Trade Act of 1934, which emphasizes the security of buyers and the upkeep of honest and orderly markets.

Regardless of those demanding situations, Cboe’s proposal is framed as a aggressive reaction to NYSE’s initiative, suggesting a possible marketplace eagerness to peer those monetary merchandise come to fruition.

Cboe’s method within the submitting underscores that Ethereum ETF choices could be ruled by way of the similar stringent regulations as different fund proportion choices on its platform, together with record necessities, margin regulations, and buying and selling halts. This regulatory alignment goals to reassure the SEC of the proposal’s adherence to current frameworks, very similar to the ones carried out to Bitcoin ETF choices, which have been authorized below identical regulatory scrutiny.

The surge in investor pastime in Ethereum ETFs

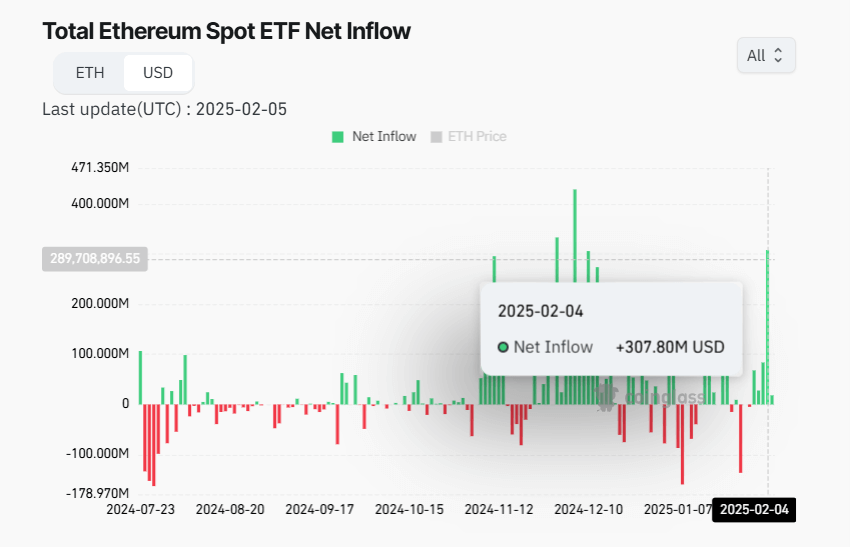

The timing of the Cboe submitting coincides with a surge in investor pastime in Ethereum ETFs. Not too long ago, those budget have noticed extraordinary buying and selling volumes and web inflows.

For example, on February 4, 2025, Ethereum ETFs recorded web inflows of $307.77 million, the best single-day influx of the yr, demonstrating tough investor self assurance.

This efficiency no longer handiest helps the explanation in the back of introducing choices buying and selling but additionally highlights the marketplace’s readiness for such monetary inventions.

The advent of choices on Ethereum ETFs may just doubtlessly stabilize Ethereum’s worth by way of bettering marketplace liquidity.

Choices supply refined possibility control gear for institutional buyers, permitting them to hedge in opposition to worth fluctuations. Retail investors would possibly leverage those choices for speculative beneficial properties.

This would result in a extra mature and solid marketplace surroundings for Ethereum, fostering better institutional adoption and contributing to the cryptocurrency’s mainstream monetary integration.

Trade mavens, like Nate Geraci from The ETF Retailer, have indicated that the approval procedure would possibly practice a timeline very similar to that of spot Bitcoin ETFs, which took about 8-9 months from release to choices buying and selling approval.

If this precedent holds, we would possibly see choices on Ethereum ETFs turning into a fact within the close to long term, doubtlessly once subsequent month, assuming regulatory hurdles are cleared.