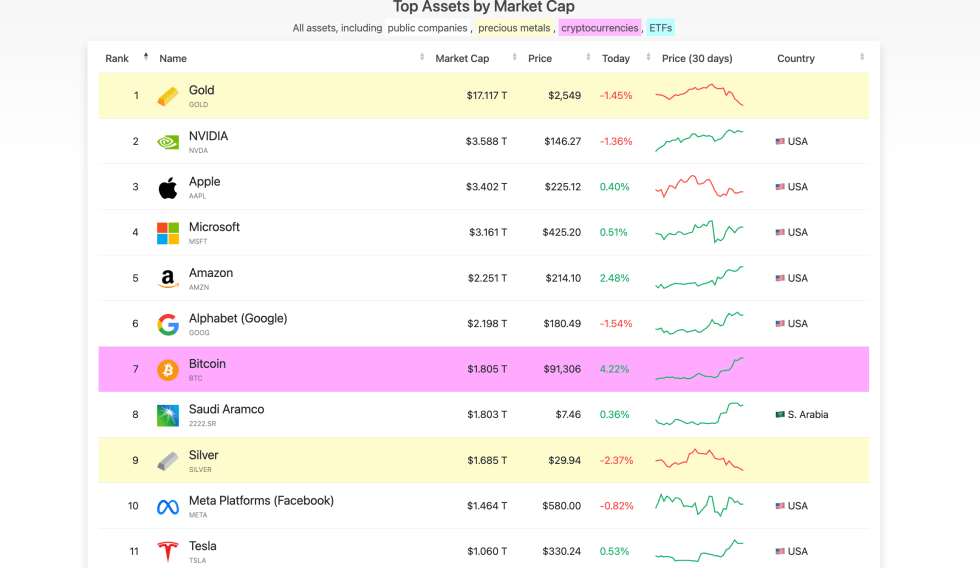

Bitcoin has entered an explosive bullish rally, breaking all-time highs seven instances during the last 8 days. This sustained surge has set new value information and driven its marketplace cap above $1.809 trillion, striking it forward of Saudi Aramco, the oil large valued at $1.79 trillion.

Now located as the sector’s seventh biggest asset by way of marketplace cap, BTC’s climb is shooting consideration because it demanding situations conventional giants of worldwide finance and commodities.

This milestone fuels hypothesis: may just BTC at some point overtake gold, which holds the highest asset place with an estimated $17 trillion marketplace cap? Whilst BTC’s upward thrust has been pushed by way of institutional adoption, provide shortage, and rising acceptance as “virtual gold,” it will have to multiply a number of instances to check gold’s marketplace dominance.

The trail is unsure, however Bitcoin’s trajectory suggests a long run the place it continues to upward thrust instead retailer of price. This rally may just start an extraordinary shift in how international wealth is saved, shifting capital from conventional property to virtual possible choices. On this unfolding state of affairs, BTC is proving that it’s greater than only a cryptocurrency—it’s changing into an impressive asset elegance with international have an effect on.

Bitcoin Turning into A World Asset

Bitcoin is unexpectedly evolving into an international asset, more and more identified as a shop of price and a tradable asset by way of establishments and people alike. As extra organizations undertake BTC, its enchantment is now not restricted to the cryptocurrency neighborhood however expands throughout conventional finance and past.

Key knowledge from Firms Marketplace Cap highlights this evolution, revealing that Bitcoin’s marketplace cap now stands at $1.809 trillion, making it the seventh biggest asset globally. This milestone surpasses well-established firms like Saudi Aramco, Meta, and Tesla and commodities like silver, underscoring Bitcoin’s rising stature within the monetary international.

With 106 million customers international, BTC continues to be within the early phases of its adoption curve, suggesting important enlargement attainable within the coming years. If BTC continues gaining traction as a reserve asset and international industry device, it will transfer up the asset ratings additional.

Whilst overtaking gold turns out like a far off problem—Bitcoin’s marketplace cap is these days greater than 10 instances smaller than gold’s estimated $13 trillion—there may be attainable for a shift. A upward thrust in international adoption, particularly if cryptocurrencies transform a mainstream mode of industry, may just push Bitcoin’s marketplace cap to $17 trillion, a possible goal given its fast enlargement.

The tempo at which BTC is increasing solidifies its standing as one of the most fastest-growing property in historical past, surroundings the level for additional leaps within the subsequent decade.

Bitcoin Value Emerging Speedy

Bitcoin is buying and selling at $90,700 after achieving a brand new all-time prime of $93,483 the previous day. The cryptocurrency has surged greater than 15% since the USA election, and its momentum displays no fast indicators of slowing down. Competitive purchasing force has fueled this sturdy rally, marking over 8 consecutive days of value will increase.

Alternatively, given the fast ascent, there’s a rising chance of a correction or consolidation under the $93,000 stage. Some analysts be expecting a pullback to seek out toughen round $85,000, permitting the marketplace to ascertain a brand new equilibrium earlier than proceeding upper.

In spite of this chance, Bitcoin’s value motion stays extraordinarily bullish, and not using a indicators of weak spot at the chart. The overall sentiment is that the present surge is best the start of a bigger upward pattern.

As BTC trades close to its file highs, the following few days might be the most important to decide whether or not a temporary consolidation happens or if the bullish momentum continues unabated. Whilst non permanent pullbacks are imaginable, Bitcoin’s general trajectory stays sturdy, and its long-term outlook favors additional value appreciation.

Featured symbol from Dall-E, chart from TradingView