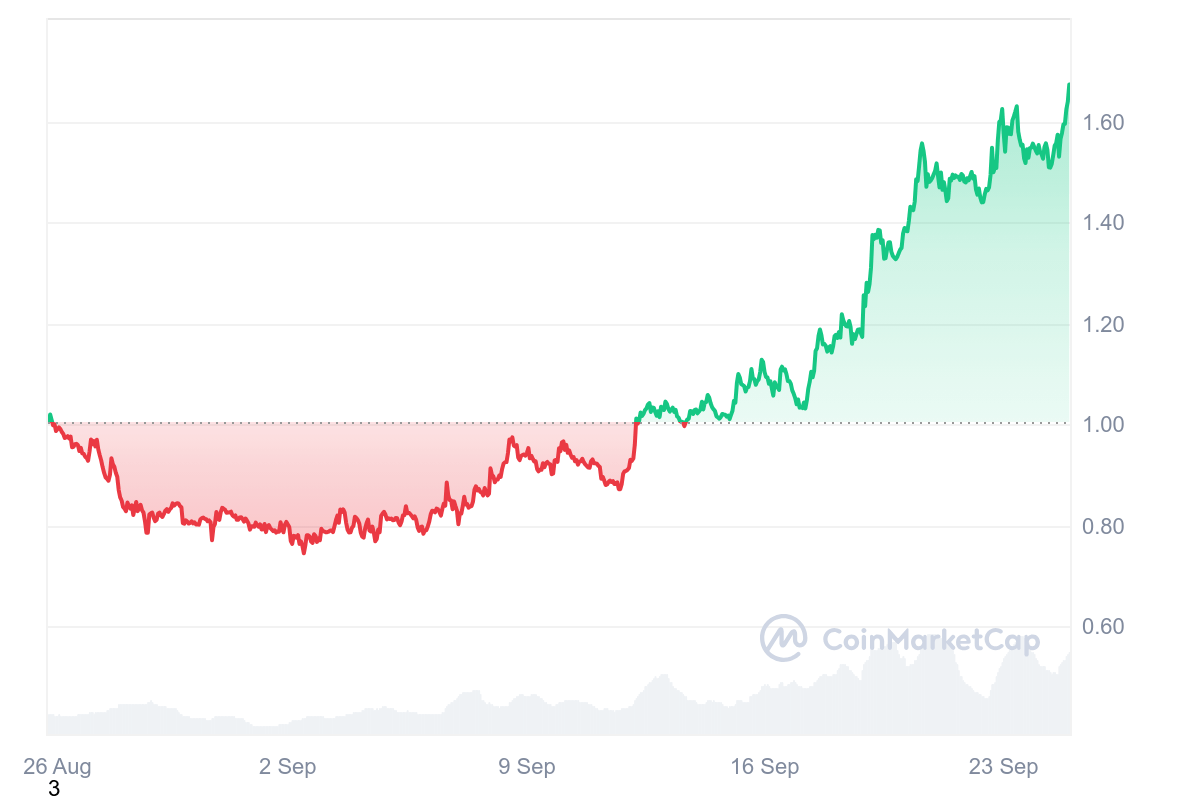

- Sui has noticed a greater than 44% spike in value prior to now week and 65% in 30 days.

- Features come after the Grayscale Sui Agree with opened for authorised traders.

- The SUI community’s overall price locked has surpassed $1.34 billion.

SUI value has surged via greater than 44% prior to now week to business above $1.67. The positive factors come with a greater than 65% spike prior to now 30 days. This sees the local token of the layer 1 blockchain platform succeed in highs closing noticed in early April.

What catalyzed SUI value surge?

Sui has skilled a notable surge in quantity after Grayscale introduced its Sui Agree with used to be now open to authorised traders.

Day by day quantity for SUI skyrocketed after the scoop, and worth adopted, hitting ranges above $1.

Sui’s value rally to above $1.67 has additionally coincided with a pointy build up in overall price locked in more than a few decentralized finance protocols within the Sui ecosystem. OKX Ventures pointed to the Grayscale Sui Agree with’s spice up to SUI marketplace credibility as institutional passion emerged.

Sui TVL hits $1.3 billion

The bullish sentiment round this outlook is appearing within the on-chain process that has the TVL hitting $1.34 billion.

In step with DeFiLlama, Sui’s TVL rose from about $250 million at first of 2024 to move $1 billion in Might. Then again, it dropped to $462 million on Aug. 5 amid the cryptocurrency marketplace crash that driven Bitcoin value beneath $50k.

Notable although is the spike again to $1 billion and acceleration to $1.34 billion in lower than a month. It manner a greater than 377% spike year-to-date and 47% month-to-date.

Sui’s rising DeFi ecosystem that’s at the back of this surge come with greater adoption for protocols throughout lending, decentralized exchanges, real-world property, derivatives and yield.

Navi Protocol has noticed its TVL build up 34% month-to-date to over $449 million.

Lending protocols Scallop and Suilend have respective TVL readings of $246 million and $203 million. It represents a 34% and 100% MTD spike respectively.