On-chain information displays that Bitcoin buyers have just lately been taking part in accumulation at a price 5 occasions that of miners’ manufacturing.

Bitcoin Traders Have Been Doing Vital Web Accumulation Just lately

In a brand new put up, analyst James Van Straten mentioned how the call for amongst Bitcoin buyers lately compares towards the per 30 days issuance at the community.

The “per 30 days issuance” right here refers back to the quantity of Bitcoin miners have “issued” at the community right through the previous month. Miners produce new BTC after they mine new blocks and obtain block subsidies as reimbursement.

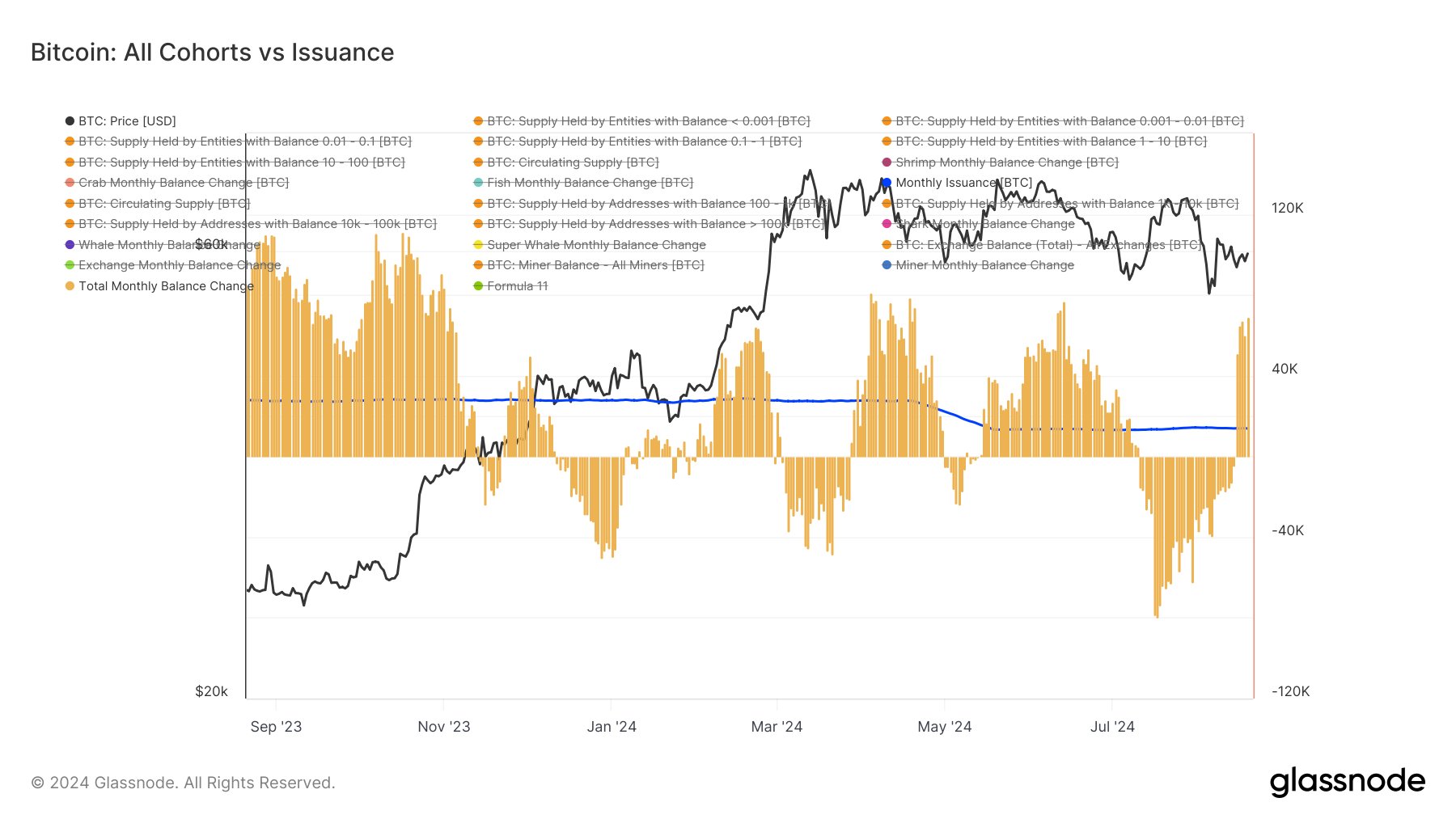

The chart beneath displays how the Bitcoin per 30 days issuance has stacked towards the per 30 days stability adjustments of all BTC investor cohorts during the last 12 months.

Seems like the stability adjustments of the buyers had been fairly sure in fresh days | Supply: @jvs_btc on X

The investor cohorts right here come with all varieties of holders, starting from the measly shrimps to the humongous whales. The chart displays that the stability alternate of the mixed marketplace had grew to become extremely unfavourable ultimate month, but it surely steadily larger in worth and has now flipped into sure territory with a pointy spike.

Traders didn’t wish to purchase Bitcoin on the ranges it used to be buying and selling at in July, as they’d as a substitute most popular to promote, however the development shift suggests the new value ranges had been a lot more engaging.

Because the chart displays, this sturdy accumulation has considerably outweighed the issuance. The per 30 days issuance stands at 14,000 BTC, whilst the buyers have added a internet 70,000 BTC to their wallets during the last month, that means that they’ve purchased 5 occasions up to miners have minted.

As for a way the buyers can acquire greater than what the miners are generating, the solution is inconspicuous: the cohorts right here exclude exchange-related wallets.

Reserves of centralized exchanges constitute the promoting drive provide out there, so when buyers shift cash to those platforms, the stability alternate of all cohorts displays a internet unfavourable worth.

The hot sturdy accumulation from the Bitcoin buyers is of course a favorable signal, because it suggests the cohorts are pulling a internet quantity of provide out of the wallets of those central entities.

Alternatively, it continues to be observed how lengthy the marketplace is still in accumulation mode, because it has handiest been a couple of days for the reason that metric flipped sure.

BTC Value

Bitcoin had made every other foray above the $61,000 mark previous within the day, however it sort of feels just like the asset has discovered rejection yet again because it has retraced all the way down to $60,600. The chart beneath displays the new trajectory of cryptocurrency.

The cost of the coin seems to have long gone up during the last day | Supply: BTCUSD on TradingView

Featured symbol from Dall-E, Glassnode.com, chart from TradingView.com