Symbol supply: Getty Pictures

From a buyer’s viewpoint, financial institution charges may also be very anxious. From a shareholder’s, although, they is also much less anxious in the event that they lend a hand a financial institution earn income and ship dividends. Take HSBC (LSE: HSBA) for instance — the dividend yield is recently a juicy 7%, and the lender is producing important extra capital regardless of investment that.

May issues get even higher from right here – and ought I to take a position?

Spectacular dividend payout

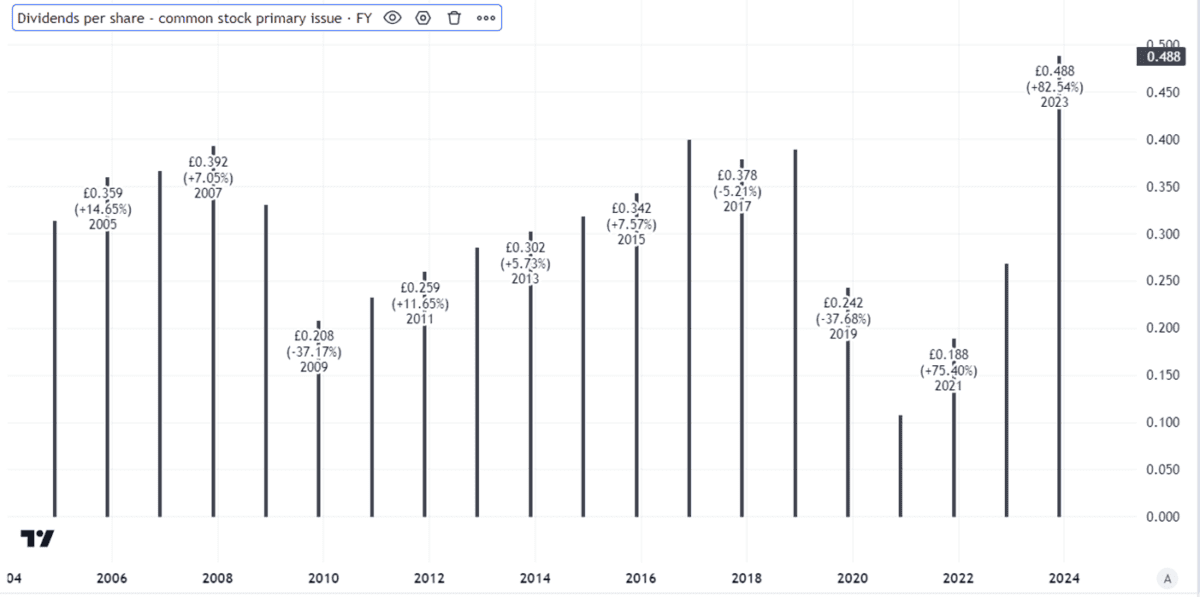

To start, we will have to put the present dividend in context. The top yield is in line with the payout closing yr. However that used to be surprisingly massive.

Created the usage of TradingView

Dividends are by no means assured – and the HSBC payout is a superb representation of this.

Because the chart above presentations, the dividend has been lower two times during the last couple of a long time, as soon as after the monetary disaster and once more throughout the pandemic. On each events, it took a few years for it to get again to the place it have been prior to the lower.

That could be a commonplace possibility with banks, together with HSBC. When the financial system does smartly, it’s more uncomplicated for them to earn a living. But if financial typhoon clouds accumulate, that may harm income – and dividends may also be lower rapid.

On this sense, HSBC’s higher publicity to Asia because of strikes like eliminating Canadian and French companies signifies that any financial downturn in Asia might hit the financial institution extra in comparison to higher varied competitors.

Forged efficiency

Nonetheless, having a look at its meantime effects launched lately (31 July), the financial institution appears to be appearing smartly.

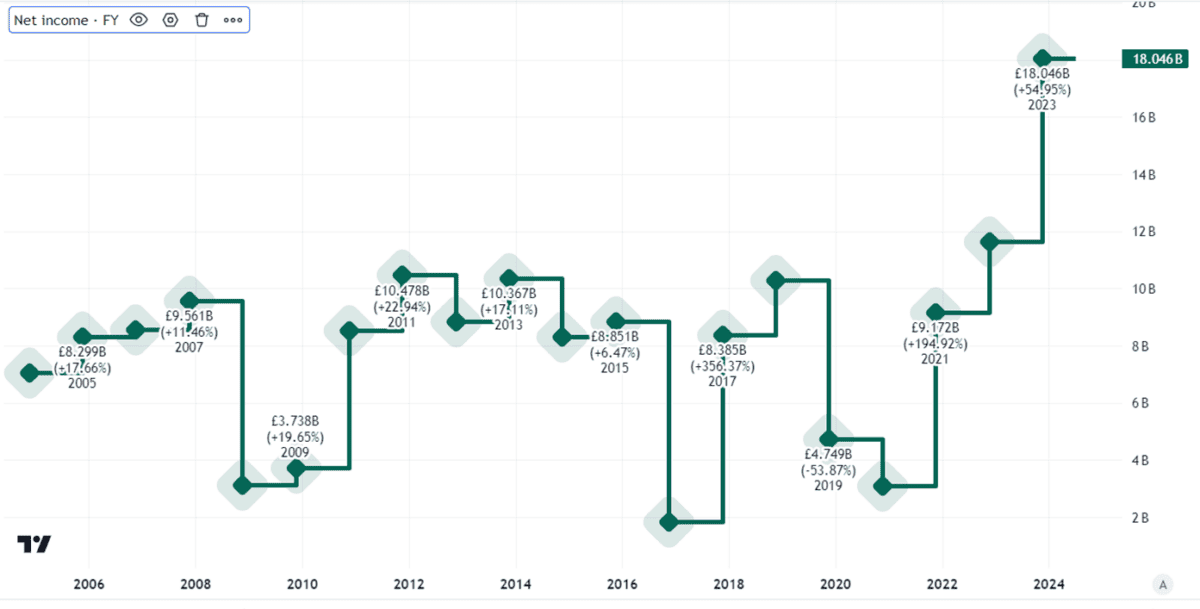

For the primary part of the yr, earnings fell quite in comparison to the similar duration closing yr. So too did income after tax. That fall used to be most effective round 2%, although, and income after tax nonetheless got here in at a whopping £13.7bn. That continues the robust efficiency observed closing yr.

Fresh income after tax were some distance above ancient ranges, so there’s a possibility we’re in a increase time for HSBC that won’t closing. Alternatively, bulls may argue that the financial institution’s strategic center of attention and cost-cutting in recent times have put it in higher form than prior to and the robust fresh effects reveal that.

Created the usage of TradingView

Certainly, the corporate generated such a lot extra money that it introduced plans to shop for again as much as round £2.3bn of its stocks over the following 3 months.

Nonetheless, whilst there used to be a distinct dividend within the first part, the 2 abnormal dividends declared for the six-month duration had been the similar as closing yr.

I’m now not purchasing

HSBC stocks are up simply 9% in 5 years, so the dividend yield is a key a part of the funding case these days personally.

Robust money era, as steered through the proportion buyback, is comforting.

However the flat abnormal dividend mixed with traditionally top benefit ranges during the last 18 months imply that I concern the dividend may well be lower when there’s any other banking downturn. For now I don’t have any plans to take a position.