Symbol supply: Getty Photographs

The Rolls-Royce (LSE:RR.) proportion charge has been the standout performer amongst FTSE 100 shares during the last two years, emerging just about 400%. What a outstanding turnaround it’s been since Covid-19 just about destroyed the trade.

So, what elements underpin the aerospace and defence inventory’s improbable efficiency? And will the expansion trajectory proceed?

Right here’s what the charts say!

Increasing margins

CEO Tufan Erginbilgiç’s tenure has been characterized through strategic tasks and a value potency pressure. Quickly after taking the activity at the beginning of 2023, he derided the company as a “burning platform” that was once underperforming competition.

Since the ones feedback, the corporate’s passed through successive rounds of activity cuts and followed a extra streamlined trade fashion. Those adjustments have paid off handsomely.

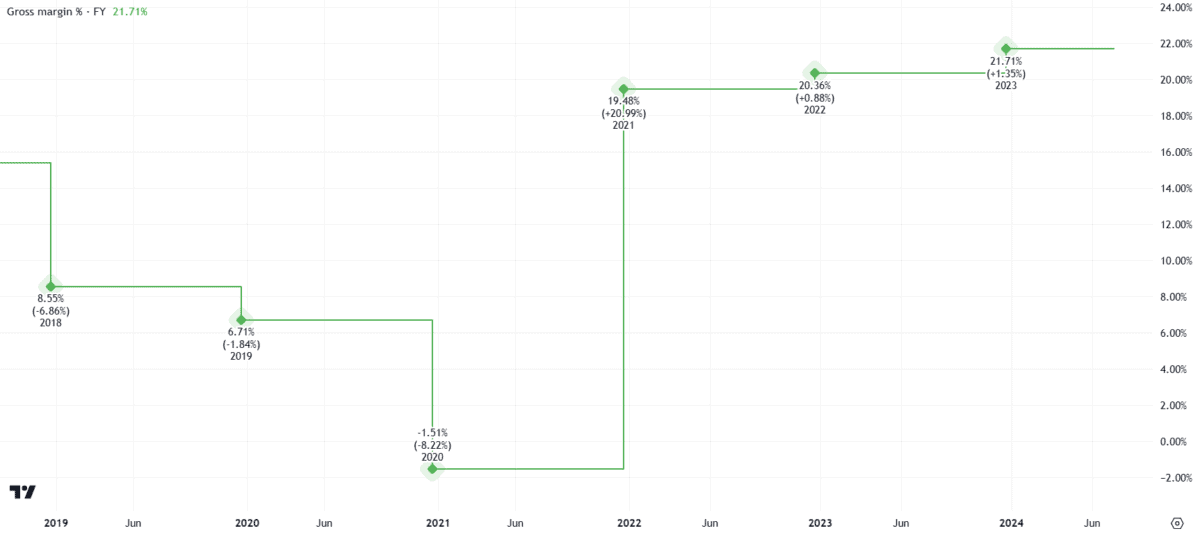

Rolls-Royce’s underlying running margin greater than doubled in FY23 to ten.3%. Additionally, the gross margin of 21.7% is at a five-year prime.

Those figures are a window into the monetary well being of the trade, with implications for pricing methods, potency, and expansion doable.

There’s no doubt a powerful margins restoration has been a significant component within the Rolls-Royce proportion charge surge.

Debt aid

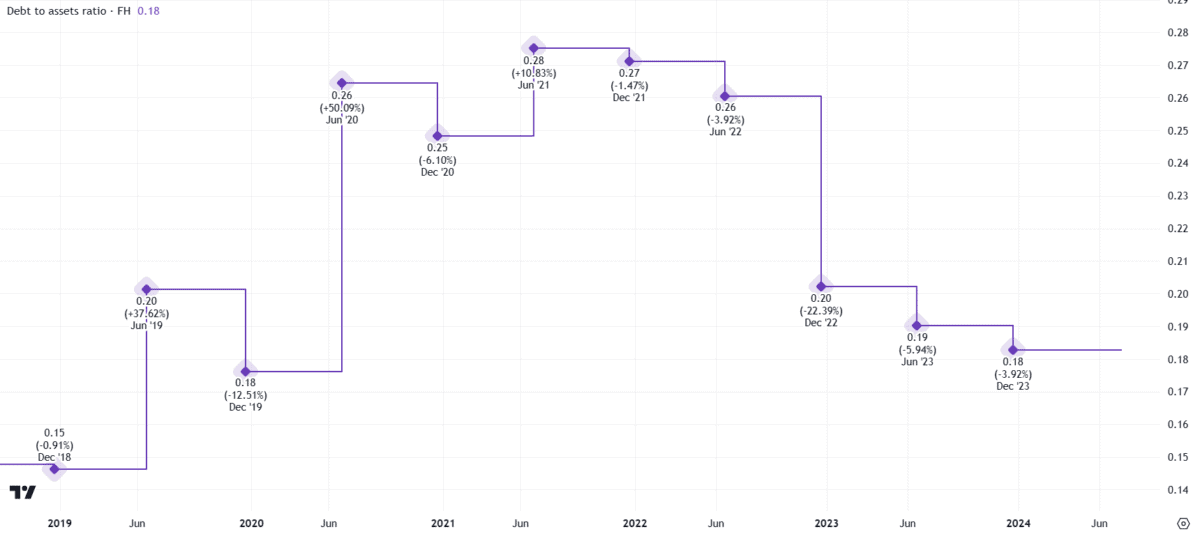

So too has the really extensive stability sheet growth.

For context, Rolls-Royce was once compelled to lift £7.3bn in debt and fairness on the peak of the pandemic. Presently, the trade was once burning via money to stick afloat whilst airplane fleets remained grounded.

The outlook’s modified dramatically. Rolls-Royce has regained an investment-grade credit standing from all main businesses. Web debt’s fallen to £2bn, down from £3.3bn on the finish of FY22.

Crucially, the debt-to-assets ratio has plummeted to only 0.18. As a result, the stability sheet appears to be like significantly more healthy lately.

Valuation

Then again, the corporate now has the next valuation.

Historically, a price-to-sales (P/S) ratio between one and two is fascinating from an investor’s standpoint. For Rolls-Royce, that more than one’s now eclipsed this higher restrict. The P/S ratio is recently 2.22.

This implies the Rolls-Royce proportion charge is not the cut price it was once throughout the pandemic. The next valuation poses dangers to long run returns.

I wouldn’t be stunned if the corporate’s inventory marketplace efficiency over the approaching years isn’t as stellar because it’s been in recent times.

Rolls-Royce stocks will have additional room to run if long run income are just right, however they’re most definitely nearer to being moderately valued than undervalued lately.

Long term goals

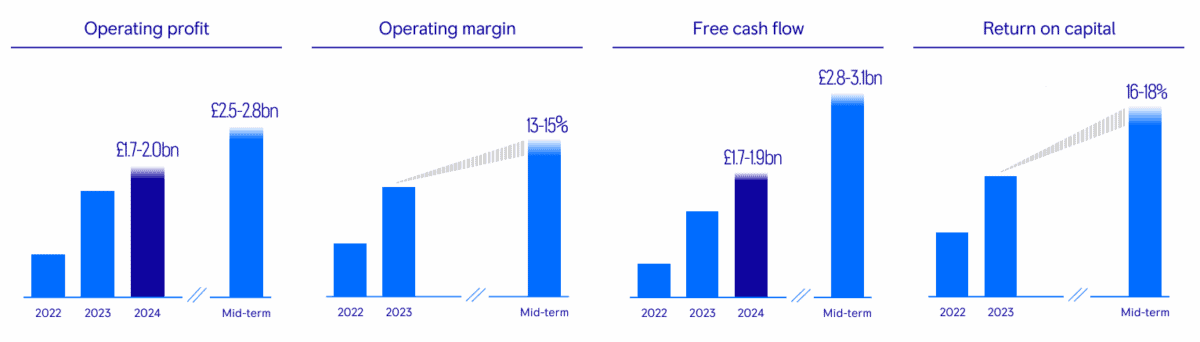

Nevertheless, Erginbilgiç doesn’t lack ambition. Mid-term goals spanning a variety of metrics counsel there’s doable for additional enhancements in step with a 2027 time frame.

The gang’s indicated those advances will likely be “modern, however no longer essentially linear“. Accordingly, buyers must watch for proportion charge volatility alongside the best way.

However, the large image’s widely encouraging. The Civil Aerospace department must proceed to have the benefit of an ongoing restoration in massive engine flying hours. Plus, the Defence arm has a number of doable expansion alternatives, such because the deployment of micro-reactor nuclear applied sciences in submarine fleets.

On stability, I feel the Rolls-Royce proportion charge expansion tale stays intact, however we’ve most definitely observed the lion’s proportion of the positive aspects already. I’ll proceed to carry my stocks for now.

Traders who’re willing to go into a place may believe pound-cost averaging their proportion purchases to capitalise on any doable dips over the approaching quarters.